On May 7, 2024, Biote Corp (NASDAQ: BTMD), a leader in personalized hormone optimization and therapeutic wellness, released its first quarter financial results, showcasing a stable financial performance with significant strategic developments. The detailed earnings can be viewed in their recent 8-K filing.

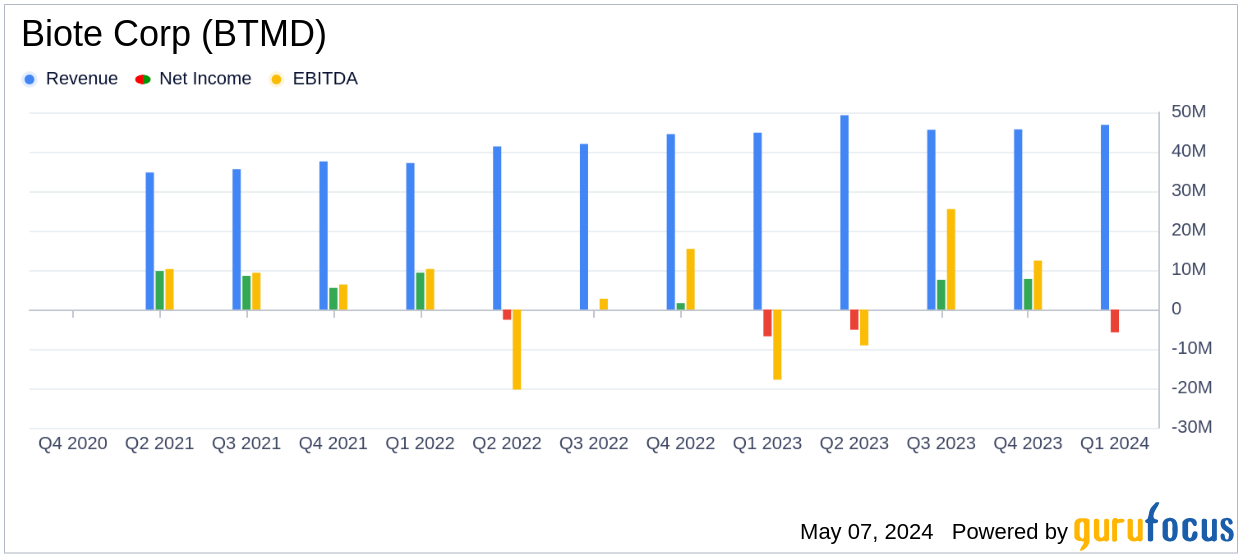

Biote Corp operates within the hormone optimization space, providing comprehensive solutions to enable practitioners to establish and grow their practices focusing on personalized patient care. This quarter, the company reported a revenue of $46.8 million, a 4.4% increase year-over-year, aligning closely with analyst expectations of $45.71 million. Despite a challenging economic environment, Biote has managed to sustain growth through strategic initiatives and operational efficiency.

Financial Highlights and Strategic Developments

Biote's CEO, Terry Weber, highlighted the 6.6% increase in procedure revenue, attributing it to the stable demand from established clinics. The company's recent acquisition of Asteria Health aims to strengthen its competitive position by achieving full vertical integration in pellet manufacturing. This strategic move is expected to enhance Biote's ability to develop innovative wellness therapies.

The company also reported a significant improvement in gross profit margin, which rose to 71.4% from 69.1% in the previous year, primarily due to effective cost management and favorable product mix. Operating income saw a notable increase to $10.4 million from $7.9 million. However, the net loss for the quarter stood at $5.8 million, an improvement from a net loss of $21.4 million in the first quarter of 2023, largely due to a decrease in the loss from the change in the fair value of the earnout liability.

Challenges and Adjusted EBITDA

Despite the positive revenue growth, Biote faced challenges, including a decline in dietary supplement revenue by 11.3%, mainly due to a major distributor exiting the nutraceutical business. Adjusted EBITDA for the quarter was $14.2 million, up from $13.1 million in the previous year, reflecting an Adjusted EBITDA margin of 30.2%.

Outlook and Forward Guidance

Looking ahead, Biote reaffirms its 2024 financial guidance, anticipating stronger revenue growth in the second half of the year. The company expects the integration of Asteria Health and the expansion of BioteRx to significantly contribute to its performance in the upcoming quarters.

Biote's management remains committed to enhancing shareholder value through strategic initiatives and operational excellence. The company is poised to leverage its innovative solutions and extensive network to capitalize on the growing demand for personalized healthcare solutions.

For a more detailed financial analysis and future updates, stakeholders and interested investors are encouraged to participate in the earnings conference call or access the webcast on Biote's Investor Relations website.

Biote Corp's strategic positioning and operational advancements underscore its resilience and potential for sustained growth in the dynamic healthcare market, making it a noteworthy consideration for value investors focused on long-term growth and stability in the healthcare sector.

Explore the complete 8-K earnings release (here) from Biote Corp for further details.