On May 7, 2024, IAC Inc. (IAC, Financial) disclosed its first-quarter financial results through an 8-K filing, revealing a complex quarter marked by both challenges and strategic advancements. This period saw the company navigating through revenue declines while enhancing operational efficiency and engaging in significant strategic partnerships.

Company Overview

IAC is a leading internet media company with diversified business segments including Angi (33% of total revenue), Dotdash Meredith (39%), search (14%), and emerging and other (14%). The company has a history of spinning off successful entities, such as Match Group and Vimeo, and continues to adapt its business model in response to changing market dynamics.

Financial Performance

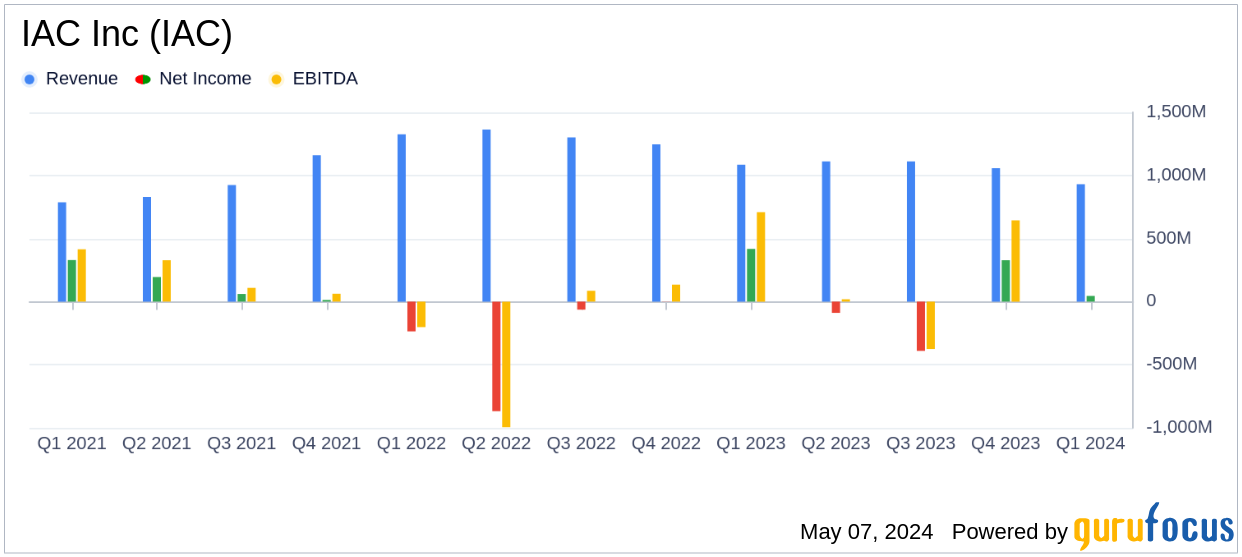

The first quarter of 2024 was challenging for IAC in terms of revenue, which saw a 14% decrease to $929.7 million from $1,084.3 million in the prior year. However, the company managed to significantly reduce its operating loss from $135.6 million in Q1 2023 to $59.2 million in Q1 2024, marking a 56% improvement. This was accompanied by a substantial increase in Adjusted EBITDA, which improved from $9.1 million to $43.0 million.

Strategic Developments and Segment Performance

One of the quarter's highlights was Dotdash Meredith's strategic partnership with OpenAI, aiming to enhance AI-driven advertising solutions. This segment achieved a 13% increase in digital revenue, totaling $209 million. Despite a 10% decline in print revenue, total Dotdash Meredith revenue grew slightly by 1% year-over-year.

Angi Inc., another significant segment, experienced a 14% decline in revenue, primarily in its Domestic business, offset partially by 18% growth internationally. Notably, Angi's operating income saw improvement, rising to $3 million from a loss previously, with Adjusted EBITDA increasing by 21% to $36 million.

The 'Emerging & Other' segment faced a 34% revenue decline, largely due to asset sales and reduced performance at Care.com. This segment's operating income turned to a loss of $8 million compared to a gain last year, with Adjusted EBITDA also turning negative.

Operational and Financial Metrics

Significant operational metrics included a decrease in service requests by Angi Inc. and a reduction in total sessions for Dotdash Meredith. Financially, the company reported a robust free cash flow of $48.3 million, a significant improvement from the $3.3 million recorded in the same quarter last year.

Investor Insights

Despite the revenue decline, IAC's strategic initiatives such as the OpenAI partnership and improved operational efficiencies across its segments provide a silver lining. The company's ability to manage costs effectively and drive EBITDA growth amidst revenue challenges highlights its resilience and adaptability in a dynamic digital market.

For detailed financial figures and future outlooks, stakeholders are encouraged to view the full earnings release and tune into the upcoming earnings call scheduled for May 8, 2024.

Contact Information

For further details, investors and interested parties may contact IAC/Angi Inc. Investor Relations at (212) 314-7400 or visit the IAC corporate website at iac.com.

This comprehensive analysis of IAC Inc.'s first-quarter earnings illustrates a period of transition and adjustment, with strategic maneuvers poised to potentially bolster future growth and stability.

Explore the complete 8-K earnings release (here) from IAC Inc for further details.