Recently, Powell Industries Inc (POWL, Financial) experienced a significant daily gain of 18.89%, contributing to a 3-month gain of 46.82%. This substantial increase raises questions about the stock's valuation, particularly in light of its Earnings Per Share (EPS) of 8.42. Is Powell Industries significantly overvalued? This article delves into the company's valuation to provide investors with a clearer picture.

Company Overview

Powell Industries Inc is a key player in the U.S. market, specializing in the development, design, manufacture, and service of equipment and systems for electrical energy distribution, control, and monitoring. The company's main products include integrated power control room substations and electrical houses, crucial for industries such as oil and gas refining, mining, and more. Despite its robust product line and market presence, a stark contrast exists between its current stock price of $170.01 and the GF Value of $51.91, suggesting a potential overvaluation.

Understanding GF Value

The GF Value is a proprietary measure reflecting the intrinsic value of a stock, based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. For Powell Industries, the GF Value suggests that the stock is significantly overvalued. This valuation is critical as it indicates that the stock's future return might be lower than its business growth potential.

Financial Strength and Stability

Investing in companies with robust financial health is crucial to avoid capital loss. Powell Industries boasts a cash-to-debt ratio of 291.74, ranking it higher than 92.43% of its peers. This strong financial position is reflected in its financial strength rating of 8 out of 10 from GuruFocus.

Profitability and Growth Prospects

Powell Industries has maintained profitability over the past decade, with an operating margin of 11.39%, which is notably higher than many of its industrial peers. The company's 3-year average annual revenue growth rate of 9.2% and an EBITDA growth rate of 30.3% further underscore its capacity for growth and value creation.

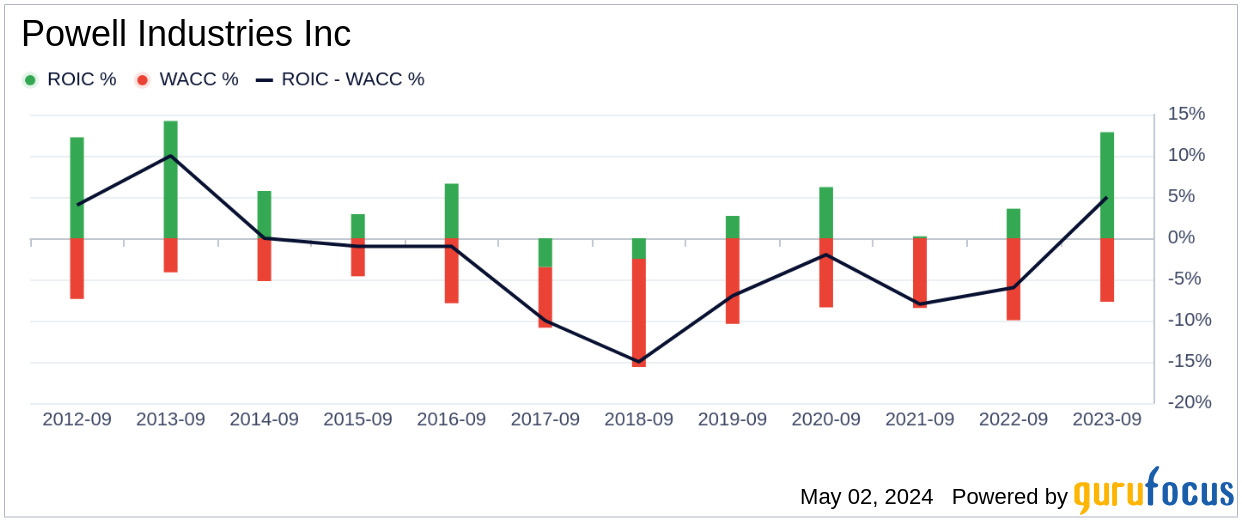

ROIC vs. WACC: A Measure of Value Creation

Comparing the Return on Invested Capital (ROIC) and the Weighted Average Cost of Capital (WACC) provides insights into how effectively a company is creating value. Powell Industries' ROIC of 16.76 significantly exceeds its WACC of 8.7, indicating efficient management and promising shareholder returns.

Conclusion

While Powell Industries (POWL, Financial) appears significantly overvalued based on its GF Value, the company's strong financials and growth prospects suggest it could still be a worthy investment for those looking at long-term gains. Investors should weigh these factors carefully to make informed decisions.

To explore more about high-quality companies that may deliver superior returns, visit the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.