Value investors are perennially in search of stocks trading below their intrinsic value, and Carnival Corp (CCL, Financial) is one such company that has caught the eye of many. With a current price of $16.34 and a recent daily loss of 4.94%, along with a 3-month decline of 12.48%, the stock's valuation seems appealing. According to the GF Value, the fair valuation of Carnival (CCL) is $36.87, suggesting a significant discount. But is this discount a signal of an undervalued gem or a forewarning of a value trap?

Understanding the GF Value

The GF Value is an intrinsic value estimate derived from a proprietary method unique to GuruFocus. It is a benchmark for what the stock should be trading at, based on historical trading multiples, an adjustment factor reflecting past returns and growth, and future business performance estimates. While stocks tend to oscillate around the GF Value Line, those priced significantly above it are considered overvalued and may yield poor returns. Conversely, stocks priced well below this line could potentially offer higher returns.

However, a discerning investor should look beyond the surface. Carnival's low Altman Z-score of 0.75, combined with a five-year decline in revenue and Earnings Per Share (EPS), raises red flags. These indicators imply that despite the appearance of undervaluation, Carnival may be ensnared in the trappings of a value trap, necessitating a more meticulous investment analysis.

Decoding Financial Health Scores

Before examining Carnival's financials, it's crucial to understand the metrics that indicate fiscal health. The Altman Z-score, a predictor of bankruptcy risk, combines five financial ratios to produce a score. A score below 1.8 signals high financial distress risk, while above 3 suggests stability. These scores, alongside others like the Piotroski F-score and Beneish M-score, are vital tools for evaluating a company's fiscal strength and potential as an investment.

Carnival's Business Overview

Carnival, the largest global cruise company with a diverse portfolio of brands, has a history of attracting millions of guests annually. However, the company's recent financial performance has not mirrored its pre-COVID-19 success. A comparison between Carnival's stock price and the GF Value reveals a discrepancy that invites a deeper investigation into the company's value proposition.

Examining Carnival's Altman Z-Score

Delving into Carnival's financial ratios, the company's Retained Earnings to Total Assets ratio has shown a declining trend: 2022: 0.08, 2023: -0.01, 2024: 0.00. This pattern suggests a weakening ability to reinvest profits or manage debt, which negatively affects the Altman Z-Score and indicates potential financial distress.

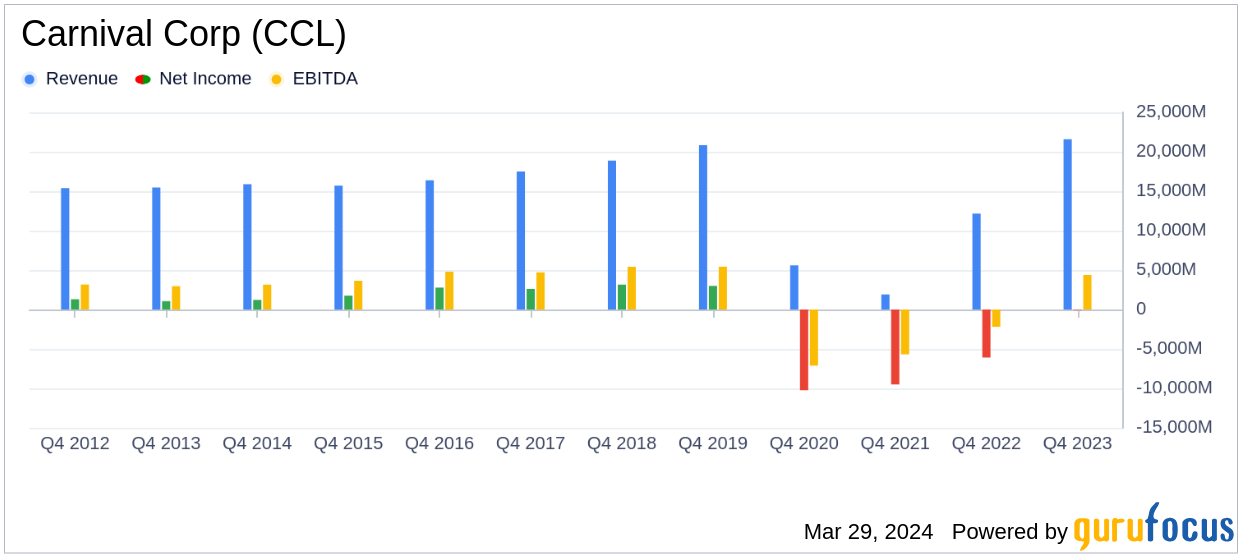

Warning Signs in Revenue and Earnings

Revenue per share is a critical indicator of a company's health. Carnival's revenue per share over the last five years has been tumbling: 2020: $30.38, 2021: $1.13, 2022: $3.09, 2023: $12.31, 2024: $17.35. Moreover, the 5-year revenue growth rate stands at a concerning -17.8%. These declining figures could be symptomatic of deeper issues, such as reduced demand or increased competition, which could significantly impact future performance.

The Earnings Growth Conundrum

Despite an attractive price-to-fair-value ratio, Carnival's sinking revenues and earnings overshadow its investment appeal. The low price relative to intrinsic value might seem like an opportunity, but deteriorating fundamentals suggest otherwise. Without a robust turnaround strategy, Carnival risks further performance decline, potentially rendering the low GF Value ratio a harbinger of a value trap rather than an opportunity.

Conclusion: Navigating the Investment Waters

Carnival's current financial indicators, such as the low Altman Z-Score and negative revenue and earnings trends, suggest that the company could be a value trap. Investors should proceed with caution, conducting thorough due diligence before considering an investment in Carnival. For those seeking more secure investment opportunities, GuruFocus Premium members have access to screens that filter for stocks with high Altman Z-Scores or good revenue and earnings growth, like the Walter Schloss Screen and the Peter Lynch Growth with Low Valuation Screener. In the volatile seas of the stock market, it's essential to distinguish between a fleeting bargain and a financial quagmire.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.