Wayfair Inc (W, Financial), a prominent player in the cyclical retail industry, has experienced a notable shift in its stock performance recently. With a market capitalization of $6.38 billion and a current price of $54.04, the company's stock has seen a 3.49% gain over the past week. However, the past three months have painted a different picture, with a 10.58% loss. According to GuruFocus's GF Value, Wayfair is currently considered modestly undervalued at $67.98, a significant change from its past GF Value of $115.32, which suggested a possible value trap.

Understanding Wayfair's Business

Wayfair Inc operates as an e-commerce giant, offering an extensive array of home goods and furniture. With a primary focus on the United States, which accounts for 86% of its 2022 sales, Wayfair also extends its reach to Canada, the United Kingdom, Germany, and Ireland. The company's product range is vast, featuring over 40 million items from more than 20,000 suppliers. Wayfair's brand portfolio includes Wayfair, Joss & Main, AllModern, Birch Lane, and Perigold, catering to a diverse customer base seeking furniture, decor, and housewares. Founded in 2002 and going public in 2014, Wayfair has established itself as a key figure in the online retail space.

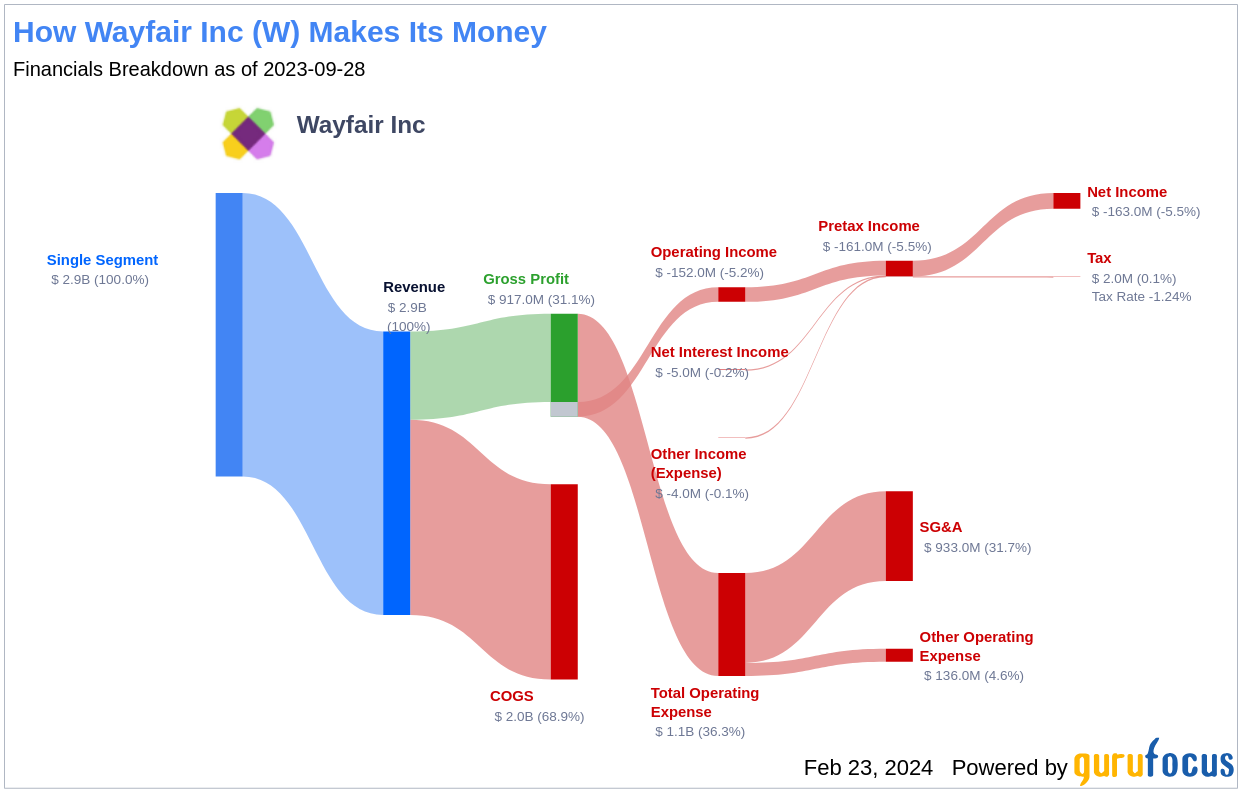

Profitability Insights

Wayfair's Profitability Rank stands at 4/10, reflecting challenges in maintaining consistent profitability. The company's operating margin is currently at -7.45%, which, while not ideal, is better than 15.29% of 1,105 companies in the same industry. Its Return on Assets (ROA) is at -26.62%, surpassing 5.75% of its peers, and the Return on Invested Capital (ROIC) is at -37.44%, outperforming 5.22% of competitors. Despite these figures, Wayfair has only managed to achieve profitability in one of the past ten years, indicating room for improvement in financial performance.

Growth Trajectory

Wayfair's Growth Rank is a robust 7/10, showcasing the company's strong expansion over time. The 3-Year Revenue Growth Rate per Share stands at 5.10%, better than 51.94% of 1,030 companies in the industry. The 5-Year Revenue Growth Rate per Share is even more impressive at 18.00%, surpassing 85.89% of 907 companies. Looking ahead, the Total Revenue Growth Rate (Future 3Y To 5Y Est) is projected at 1.34%, which is more favorable than 31% of 229 companies. The 3-Year EPS without NRI Growth Rate is at 1.30%, outperforming 35.85% of the industry. These growth metrics suggest that Wayfair is on a positive trajectory, despite recent stock price volatility.

Key Shareholders

Wayfair's shareholder landscape is marked by significant investments from notable entities. Baillie Gifford (Trades, Portfolio) holds 7,428,995 shares, representing a 6.3% share percentage. Jim Simons (Trades, Portfolio) follows with 1,929,769 shares, accounting for 1.64% of the company's shares. Steven Cohen (Trades, Portfolio) also has a stake in Wayfair, with 1,230,578 shares, equating to a 1.04% share percentage. The involvement of these prominent investors could signal confidence in Wayfair's market strategy and future prospects.

Competitive Analysis

When compared to its competitors, Wayfair holds its own in the market. Global E Online Ltd (GLBE, Financial) has a market cap of $5.32 billion, while Maplebear Inc (CART, Financial) and Etsy Inc (ETSY, Financial) have market caps of $8.38 billion and $8.46 billion, respectively. Wayfair's market cap situates it comfortably within this competitive landscape, suggesting that it is a significant contender within the e-commerce space for home goods and furniture.

Conclusion

In summary, Wayfair Inc's current market position is characterized by a recent uptick in stock price, a modest undervaluation according to GF Value, and a strong growth rank that indicates potential for future expansion. While profitability remains a concern, the company's growth rates and the backing of influential shareholders suggest a positive outlook. Wayfair's performance, when juxtaposed with its competitors, reveals a company that is holding its ground in a competitive industry. Investors and market watchers will continue to monitor Wayfair's financial health and market movements as it navigates the dynamic e-commerce landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.