Insights from Sands Capital Management's Latest Investment Decisions

Frank M. Sands, Jr., CFA, the CEO and CIO of Sands Capital Management, has a reputation for his keen investment strategies and a focus on long-term growth. With a rich history in the investment world, Sands Jr. has been instrumental in steering the firm towards identifying and investing in exceptional growth businesses globally. His investment philosophy is rooted in the belief that stock prices ultimately reflect the earnings growth of the companies they represent. Sands Capital Management, founded by his father in 1992, has become a beacon of success under his guidance, leveraging strategies like Select Growth and Global Growth to cater to their clients' investment needs.

Summary of New Buys

Frank Sands (Trades, Portfolio) introduced a new position in the fourth quarter of 2023, with the most significant addition being:

Key Position Increases

Frank Sands (Trades, Portfolio) also bolstered his stakes in 32 stocks, with the most notable increases being:

- Nu Holdings Ltd (NU, Financial), adding an additional 40,992,413 shares, bringing the total to 85,220,661 shares. This represents a substantial 92.68% increase in share count and a 1.04% impact on the current portfolio, with a total value of $709,888,110.

- Okta Inc (OKTA, Financial), with an additional 2,486,456 shares, bringing the total to 8,358,414. This adjustment signifies a 42.34% increase in share count, with a total value of $756,687,220.

Summary of Sold Out Positions

Exiting completely from two holdings in the fourth quarter of 2023, Frank Sands (Trades, Portfolio) made the following divestments:

- Chegg Inc (CHGG, Financial): All 4,782,211 shares were sold, impacting the portfolio by -0.15%.

- Zai Lab Ltd (ZLAB, Financial): The entire stake of 98 shares was liquidated, causing a negligible impact on the portfolio.

Key Position Reductions

Frank Sands (Trades, Portfolio) also trimmed positions in 35 stocks. The most significant reductions include:

- Aptiv PLC (APTV, Financial), with a reduction of 4,217,206 shares, resulting in a -99.8% decrease in shares and a -1.42% impact on the portfolio. The stock traded at an average price of $86.1 during the quarter and has seen a return of 6.15% over the past three months and -10.76% year-to-date.

- Sea Ltd (SE, Financial), with a reduction of 8,771,146 shares, leading to a -54.41% reduction in shares and a -1.31% impact on the portfolio. The stock's average trading price was $40.79 during the quarter, with a -7.48% return over the past three months and a 5.15% year-to-date return.

Portfolio Overview

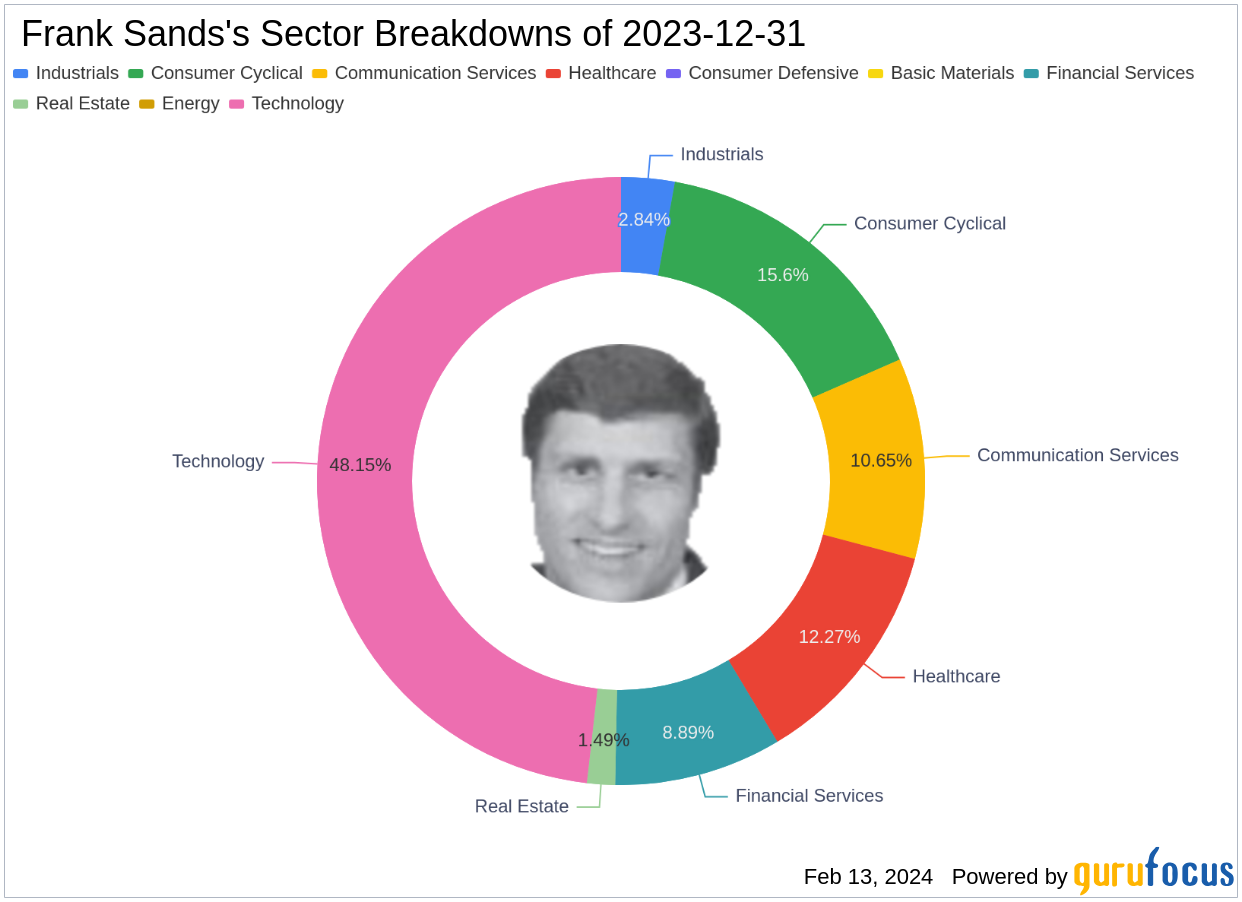

As of the fourth quarter of 2023, Frank Sands (Trades, Portfolio)'s portfolio comprised 74 stocks, with top holdings including 6.11% in Amazon.com Inc (AMZN, Financial), 5.68% in DexCom Inc (DXCM, Financial), 5.12% in Visa Inc (V, Financial), 4.66% in NVIDIA Corp (NVDA, Financial), and 4.4% in MercadoLibre Inc (MELI, Financial). The investments are primarily concentrated across seven industries: Technology, Consumer Cyclical, Healthcare, Communication Services, Financial Services, Industrials, and Real Estate.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.