Amazon.com Inc (AMZN, Financial) has recently witnessed a notable uptick in its stock performance, with a market capitalization soaring to $1.76 trillion. The current stock price stands at $170.61, reflecting a 0.97% gain over the past week and a significant 16.26% gain over the past three months. According to GuruFocus's valuation metrics, Amazon is currently fairly valued with a GF Value of $158.79, a slight increase from the past GF Value of $162.11, which indicated the stock was modestly undervalued. This shift in valuation suggests a positive market adjustment aligning with the company's intrinsic value.

Amazon's E-Commerce and Cloud Computing Dominance

Amazon.com Inc, a titan in the retail-cyclical industry, has revolutionized e-commerce and cloud computing. With a staggering $386 billion in net sales and an estimated $578 billion in online gross merchandise volume in 2021, Amazon's revenue streams are diverse. Retail-related revenue accounts for roughly 80% of the total, complemented by Amazon Web Services (AWS) and advertising services. The company's international presence is also significant, with key markets in Germany, the United Kingdom, and Japan contributing to 25%-30% of non-AWS sales.

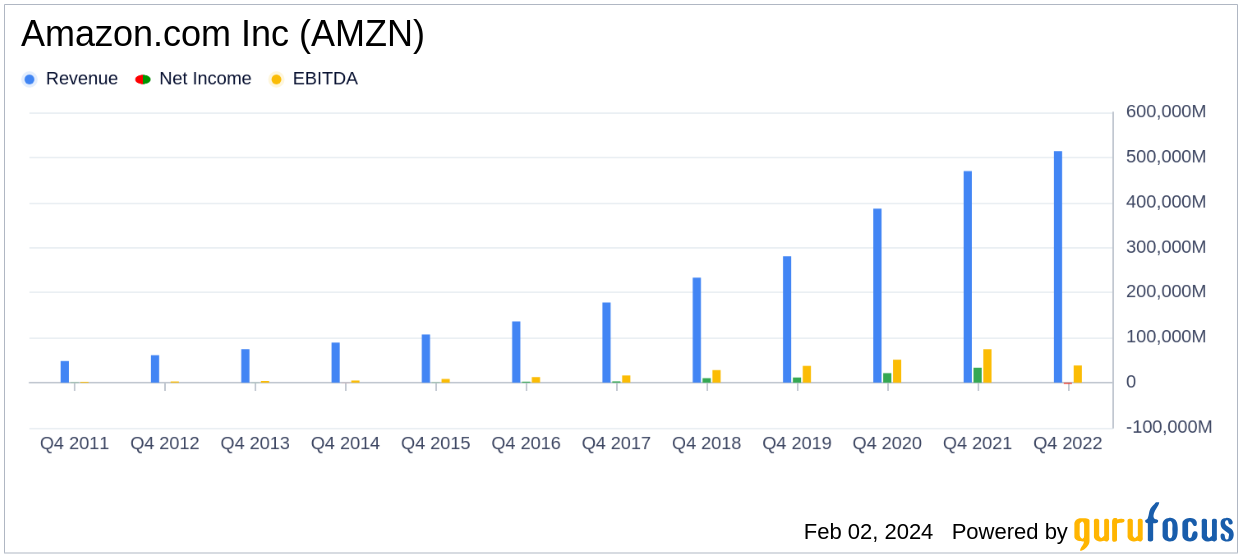

Assessing Amazon's Profitability

Amazon's Profitability Rank stands strong at 8/10, indicating robust financial health. The company's Operating Margin is 4.76%, surpassing 57.57% of 1,103 companies in the same industry. With an ROE of 12.71% and an ROA of 4.33%, Amazon outperforms a majority of its peers. The ROIC at 6.84% further demonstrates the company's effective cash flow generation relative to capital investment. Amazon has maintained profitability for 8 out of the past 10 years, showcasing its enduring financial stability.

Amazon's Growth Trajectory

The Growth Rank for Amazon is an impressive 10/10, reflecting its exceptional expansion in revenue and profitability. The company's 3-Year Revenue Growth Rate per Share is 21.90%, and its 5-Year Revenue Growth Rate per Share is 23.80%, both outpacing the majority of competitors. The estimated Total Revenue Growth Rate for the next 3 to 5 years is projected at 10.77%. Despite a -4.10% 3-Year EPS without NRI Growth Rate, the 5-Year EPS without NRI Growth Rate is a robust 27.20%. The future EPS Growth Rate is anticipated to be 16.00%, indicating a strong outlook for earnings.

Notable Shareholders in Amazon

Amazon's stock is held by prominent investors, with Ken Fisher (Trades, Portfolio) owning 41,353,218 shares, representing a 0.4% share percentage. Baillie Gifford (Trades, Portfolio) holds 40,667,179 shares, accounting for 0.39% of the company, while Dodge & Cox possesses 18,025,075 shares, equating to a 0.17% share percentage. These significant holdings by reputable investors underscore confidence in Amazon's market position and future potential.

Amazon Versus Its Competitors

In comparison to its competitors, Amazon maintains a dominant market position. PDD Holdings Inc (PDD, Financial) has a market cap of $164.72 billion, Alibaba Group Holding Ltd (BABA, Financial) is valued at $179.34 billion, and MercadoLibre Inc (MELI, Financial) stands at $89.58 billion. Amazon's market cap significantly surpasses these figures, reflecting its leading role in the industry.

Conclusion: Amazon's Market Resilience and Growth Prospects

In summary, Amazon.com Inc's stock performance and valuation have shown resilience and growth, with a recent 16.26% surge in stock price over the past three months. The company's profitability and growth metrics remain strong, with a high Profitability Rank and Growth Rank. Significant investments by major holders like Ken Fisher (Trades, Portfolio), Baillie Gifford (Trades, Portfolio), and Dodge & Cox further validate Amazon's robust market standing. When compared to its competitors, Amazon's market cap and growth prospects position it as a leader in the retail-cyclical industry, making it a compelling choice for value investors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.