With PDD Holdings Inc (PDD, Financial) experiencing a significant daily gain of 18.08% and a three-month gain of 72.11%, investors are closely monitoring its performance. The company's Earnings Per Share (EPS) is reported at 4.05. The critical question on investors' minds is whether PDD Holdings (PDD) is fairly valued at its current price. This article delves into a valuation analysis to provide insights into PDD Holdings' intrinsic value and market performance. Read on for a detailed examination of the company's financial health and growth prospects.

Company Introduction

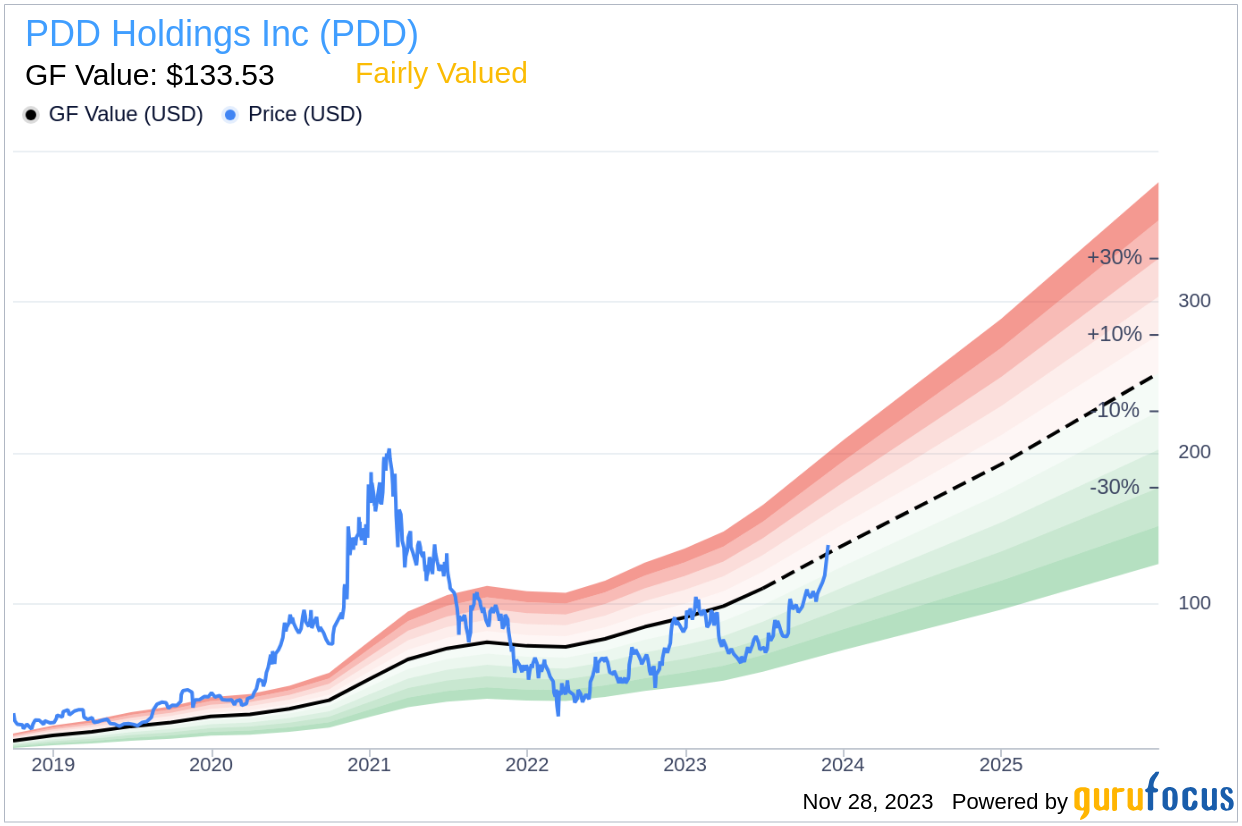

PDD Holdings Inc (PDD, Financial) is a dynamic multinational commerce group that has made significant strides in integrating businesses into the digital economy. This strategy has been pivotal in fostering the productivity of local communities and small businesses, opening up new opportunities. The company boasts an impressive network that supports its sourcing, logistics, and fulfillment capabilities. With a stock price of $139 and a GF Value of $133.53, PDD Holdings presents an intriguing case for valuation analysis. By comparing the stock price to the GF Value, we can begin to unravel the true worth of PDD Holdings in the market.

Summarize GF Value

The GF Value is a unique measure that reflects the intrinsic value of a stock, incorporating historical trading multiples, an adjustment factor based on past performance, and projections of future business growth. The GF Value Line offers a visual representation of the stock's fair trading value. When a stock's price significantly exceeds the GF Value Line, it may be considered overvalued, and conversely, if it is well below this line, it could indicate a higher future return potential.

According to the GuruFocus Value calculation, PDD Holdings (PDD, Financial) seems to be fairly valued. The current market cap of $184.70 billion, with a share price of $139, supports this assessment. Given its fair value, the long-term return on PDD Holdings' stock is expected to align closely with the company's business growth rate.

Link: Discover companies that may deliver higher future returns at reduced risk.

Financial Strength

Assessing a company's financial strength is crucial before investing in its stock. PDD Holdings shines in this area with a cash-to-debt ratio of 9.83, surpassing 88.73% of its peers in the Retail - Cyclical industry. The company's robust financial strength is further evidenced by its impressive score of 9 out of 10. This financial fortitude suggests a lower risk of permanent loss for investors.

Profitability and Growth

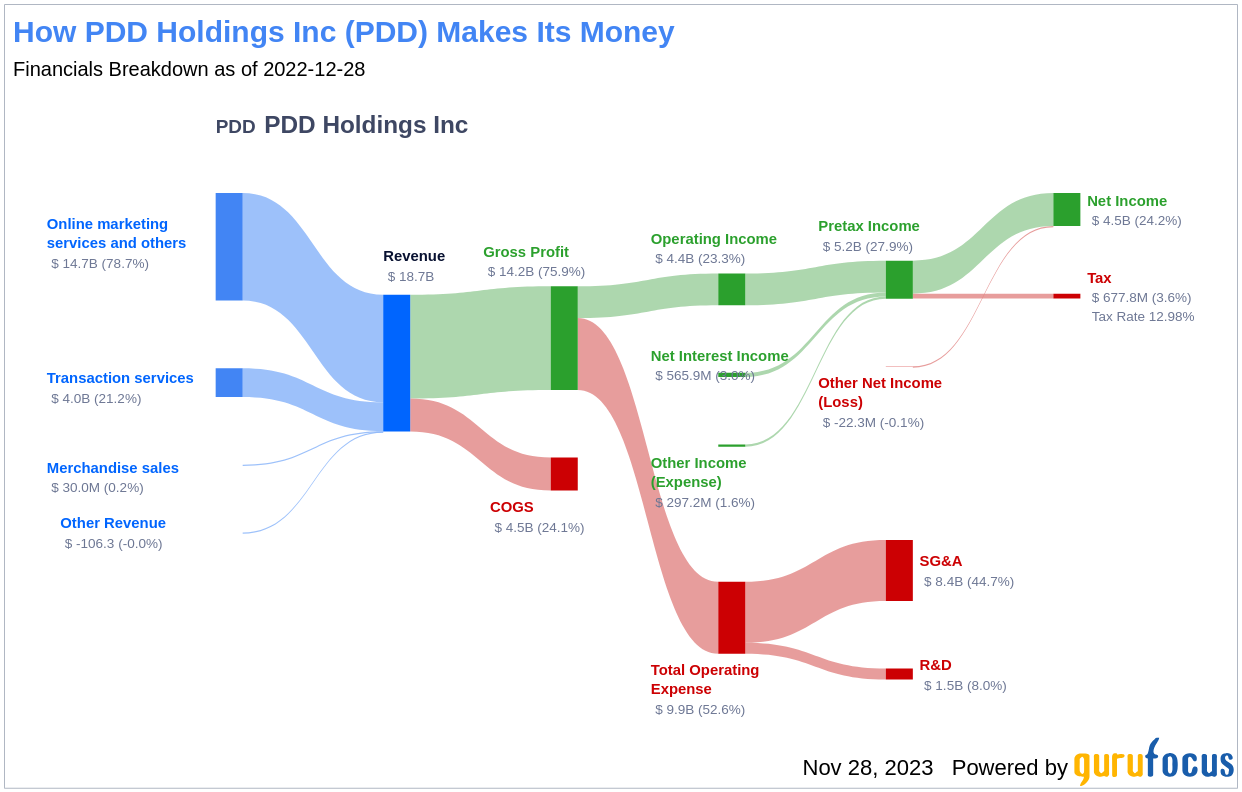

Investing in profitable companies, particularly those with a track record of consistent profitability, is generally less risky. PDD Holdings has maintained profitability for 2 out of the past 10 years. With a revenue of $23.50 billion and an operating margin of 23.69%, which ranks higher than 96.33% of its industry counterparts, the company demonstrates strong profitability. However, the overall profitability rank of 4 out of 10 indicates there is room for improvement.

The growth of a company is a vital indicator of its valuation. PDD Holdings boasts a 3-year average annual revenue growth rate of 51.8%, ranking it above 95.61% of companies in the Retail - Cyclical industry. However, the 3-year average EBITDA growth rate is 0%, which is less favorable when compared to industry peers.

ROIC vs WACC

A comparison of the Return on Invested Capital (ROIC) and the Weighted Average Cost of Capital (WACC) can provide insights into a company's profitability. PDD Holdings' ROIC of 68.44 significantly exceeds its WACC of 4.93, indicating the company is generating value for its shareholders. This relationship between ROIC and WACC is a strong indicator of PDD Holdings' effective capital allocation.

Conclusion

In summary, PDD Holdings (PDD, Financial) appears to be fairly valued. The company's strong financial condition and impressive profit margins are offset by its poor profitability rank and growth that trails behind industry benchmarks. For a more comprehensive understanding of PDD Holdings' financial performance, investors can explore its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.