Transportadora de Gas del Sur SA (TGS, Financial) recently experienced a notable daily gain of 24.57%, alongside a modest 3-month gain of 1.01%. However, with a reported Loss Per Share of $0.27, investors are faced with the critical question: is the stock significantly overvalued? This valuation analysis aims to shed light on the stock's current market position and invites readers to delve into the intricacies of its financial standing.

Company Introduction

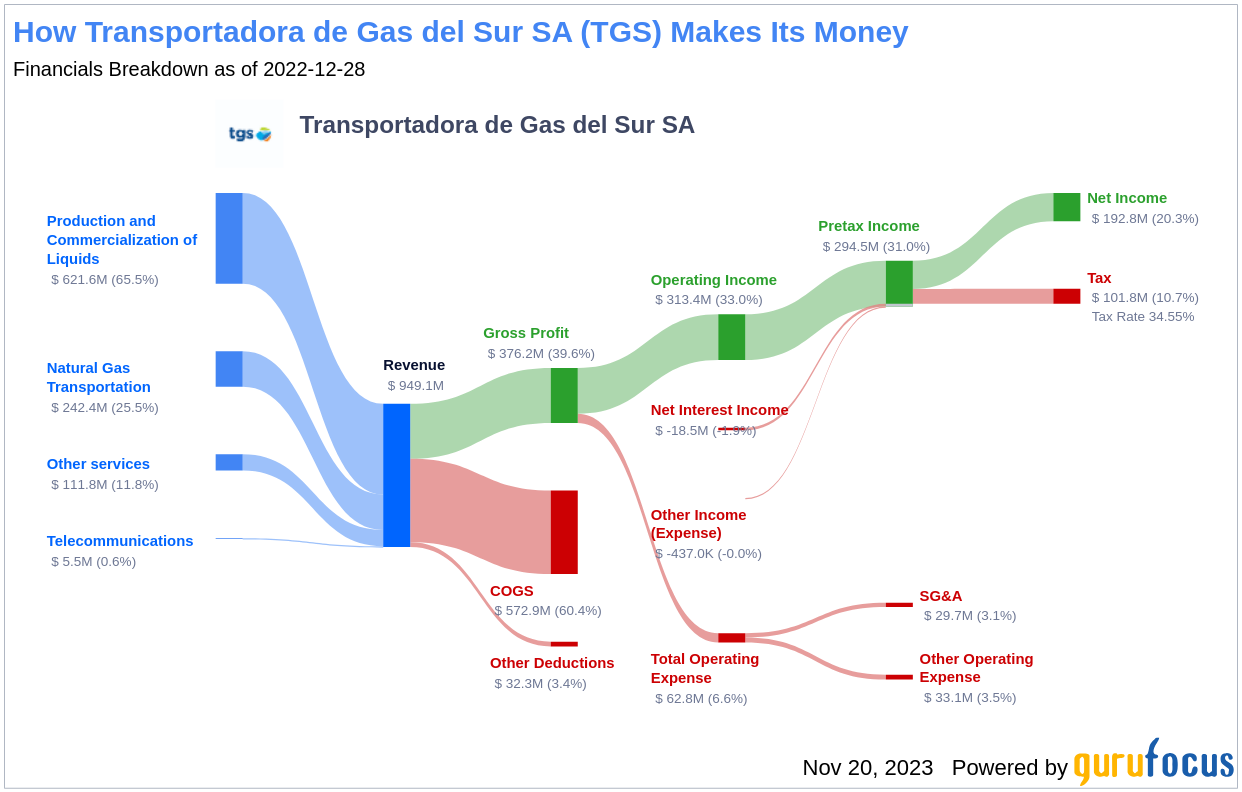

Transportadora de Gas del Sur SA operates as one of the largest natural gas transporters in Latin America, with a diverse portfolio including Natural Gas Transportation, Production and Commercialization of Liquids, and Telecommunications segments. The company's financial snapshot presents a stark contrast between the current stock price of $13.03 and the GuruFocus Fair Value (GF Value) of $0.93, hinting at a significant overvaluation. This discrepancy sets the stage for a deeper evaluation of Transportadora de Gas del Sur SA's intrinsic value.

Summarize GF Value

The GF Value is a calculated measure of a stock's intrinsic value, incorporating historical trading multiples, a GuruFocus adjustment factor for past performance, and future business estimates. This value serves as a benchmark for fair trading. When a stock trades above this line, it may indicate overvaluation and potentially lower future returns, whereas trading below suggests undervaluation with prospects for higher returns. Transportadora de Gas del Sur SA's stock, at its current price, is deemed significantly overvalued by our GF Value metric. This suggests that its long-term return potential may be less than the company's anticipated business growth.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength

Investing in companies with robust financial strength minimizes the risk of capital loss. Transportadora de Gas del Sur SA's cash-to-debt ratio of 0.82 ranks favorably within the industry, reflecting a fair financial standing. A closer look at the company's debt and cash over time provides insight into its fiscal health and resilience.

Profitability and Growth

Consistent profitability over time often correlates with lower investment risk. Transportadora de Gas del Sur SA has maintained profitability for 9 out of the past 10 years, with a solid operating margin that surpasses many in the industry. This enduring profitability is a testament to the company's robust financial core.

Growth is a pivotal valuation factor, with research showing a strong link to long-term stock performance. Transportadora de Gas del Sur SA's revenue growth outpaces a significant portion of its industry peers, indicating a promising trajectory for value creation.

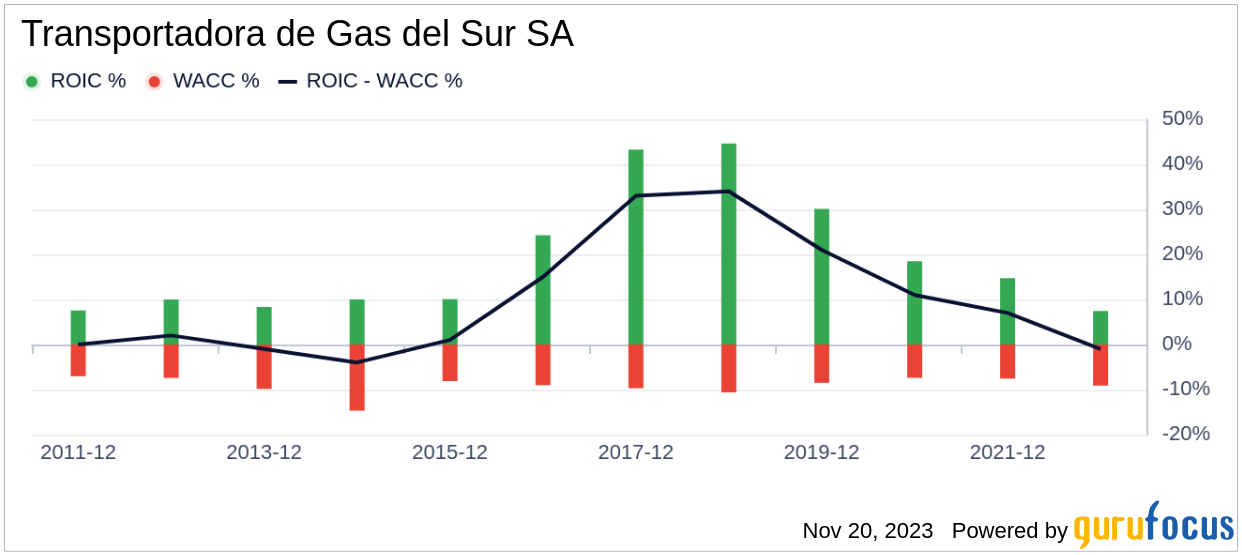

ROIC vs WACC

Comparing Return on Invested Capital (ROIC) with the Weighted Average Cost of Capital (WACC) reveals a company's efficiency in generating returns on investment. Transportadora de Gas del Sur SA's ROIC currently stands at 0.06, significantly below its WACC of 9.6, highlighting an area for potential improvement.

Conclusion

In conclusion, Transportadora de Gas del Sur SA (TGS, Financial) appears to be significantly overvalued in the current market. Despite this, the company exhibits fair financial health and strong profitability, with growth rates that are competitive within the Oil & Gas industry. For a more detailed exploration of Transportadora de Gas del Sur SA's financial landscape, interested parties are encouraged to review its 30-Year Financials here.

To discover high-quality companies that may offer above-average returns, please visit the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.