BJ's Wholesale Club Holdings Inc (BJ, Financial) recently experienced a daily loss of 4.81%, adding to a 3-month decline of 6.15%. Despite these setbacks, the company maintains an Earnings Per Share (EPS) (EPS) of 3.72. This raises the question: Is the stock modestly undervalued? This article invites readers to delve into a valuation analysis to uncover the true worth of BJ's Wholesale Club Holdings.

Company Introduction

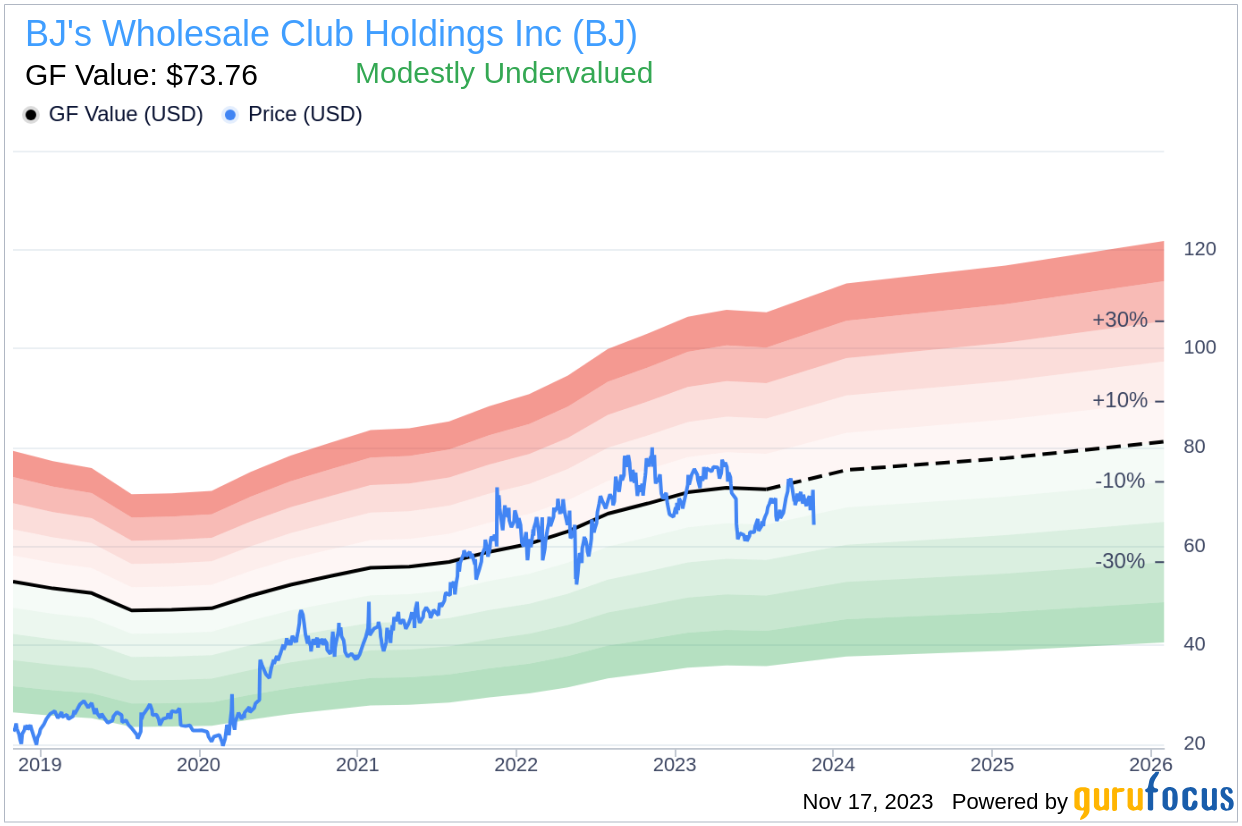

BJ's Wholesale Club Holdings Inc is a prominent operator of warehouse clubs and gas stations, offering a wide array of products ranging from electronics to food items. The company's financial performance is characterized by a market cap of $8.60 billion and sales amounting to $19.40 billion. A comparison between BJ's Wholesale Club Holdings' current stock price of $64.35 and the GF Value, an estimated fair value of $73.76, suggests that the stock may be trading at a discount. This initial assessment sets the stage for a deeper evaluation of the company's intrinsic value.

Summarizing the GF Value

The GF Value is a proprietary calculation that reflects the intrinsic value of a stock, integrating historical trading multiples, a GuruFocus adjustment factor based on the company's past performance, and projections of future business activity. BJ's Wholesale Club Holdings (BJ, Financial) appears modestly undervalued when applying this valuation method. The stock's current price suggests potential for higher future returns relative to its business growth, considering it trades below the GF Value Line.

Link: These companies may deliver higher future returns at reduced risk.Financial Strength Assessment

Assessing the financial strength of a company is crucial before investing. BJ's Wholesale Club Holdings' cash-to-debt ratio of 0.01 falls short in comparison to its industry peers, placing it in a less favorable position. However, the overall financial strength score of 6 out of 10 indicates that BJ's financial situation is fair, which is an essential factor for investors to consider.

Profitability and Growth Prospects

BJ's Wholesale Club Holdings has demonstrated consistent profitability, with an operating margin of 3.98% that surpasses over half of its industry competitors. The company's profitability rank of 7 out of 10 is indicative of its sound financial performance. Furthermore, BJ's impressive growth metrics, with a 3-year average annual revenue growth of 14.3%, position it advantageously within the Retail - Defensive industry.

Evaluating ROIC vs. WACC

Comparing Return on Invested Capital (ROIC) to the Weighted Average Cost of Capital (WACC) provides insight into a company's profitability relative to the capital invested. BJ's Wholesale Club Holdings' ROIC of 10.4 is nearly double its WACC of 5.58, signaling the company's capability to create value for its shareholders.

Conclusion

In summary, BJ's Wholesale Club Holdings (BJ, Financial) is currently showing signs of modest undervaluation. The company maintains fair financial health and profitability, with growth rates that are commendable within its industry sector. For a more detailed financial overview, interested investors can review BJ's 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.