Long-established in the Steel industry, POSCO Holdings Inc (PKX, Financial) has enjoyed a stellar reputation. However, it has recently witnessed a daily loss of 4.1%, juxtaposed with a three-month change of 20.16%. Fresh insights from the GF Score hint at potential headwinds. Notably, its diminished rankings in financial strength, growth, and valuation suggest that the company might not live up to its historical performance. Join us as we dive deep into these pivotal metrics to unravel the evolving narrative of POSCO Holdings Inc.

Understanding the GF Score

The GF Score is a stock performance ranking system developed by GuruFocus using five aspects of valuation, which has been found to be closely correlated to the long-term performances of stocks by backtesting from 2006 to 2021. The stocks with a higher GF Score generally generate higher returns than those with a lower GF Score. Therefore, when picking stocks, investors should invest in companies with high GF Scores. The GF Score ranges from 0 to 100, with 100 as the highest rank.

- Financial strength rank: 6/10

- Profitability rank: 7/10

- Growth rank: 6/10

- GF Value rank: 1/10

- Momentum rank: 3/10

Based on the above method, GuruFocus assigned POSCO Holdings Inc the GF Score of 67 out of 100, which signals poor future outperformance potential.

POSCO Holdings Inc: A Snapshot of Its Business

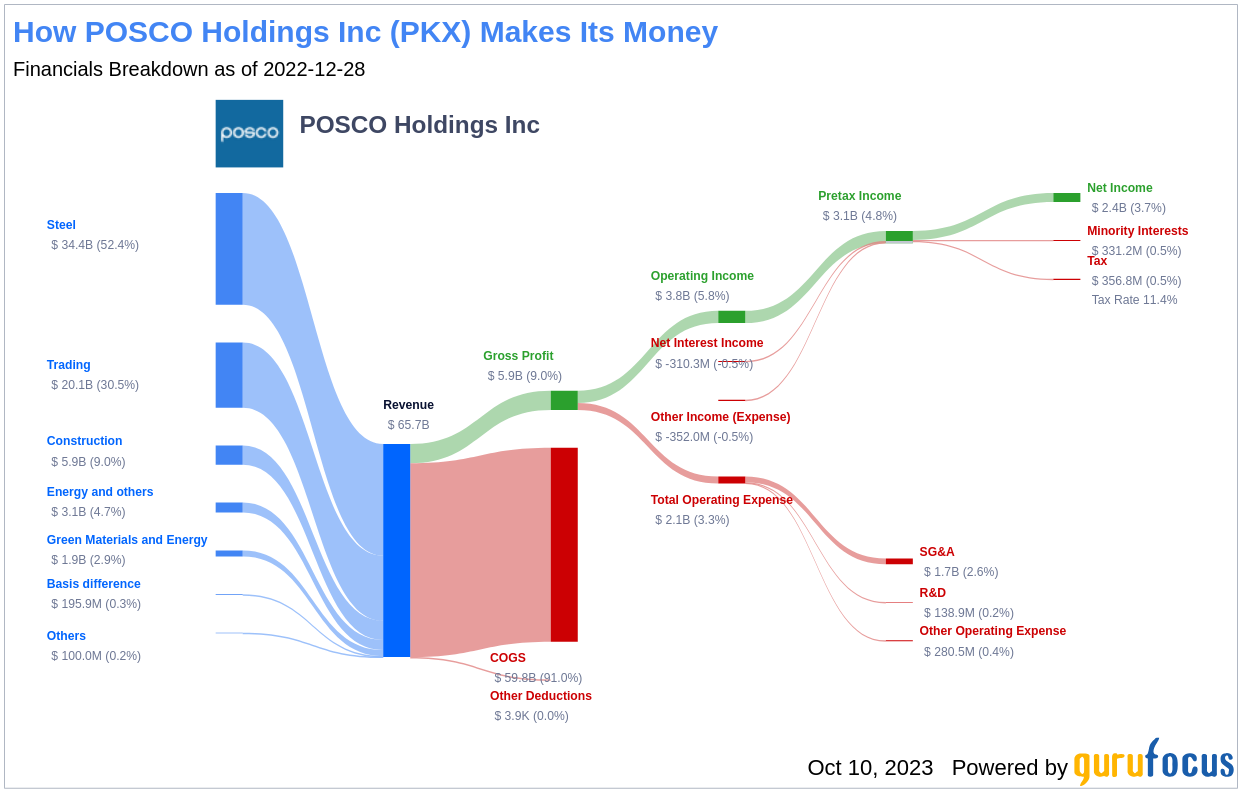

POSCO Holdings Inc is a holding company with a market cap of $28.18 billion and sales of $60.58 billion. It operates through its subsidiaries, with an operating margin of 3.29%. The company's operating segments include the production and sale of steel products, the provision of infrastructure and related services, trading and natural resources development activities, planning, designing and construction of industrial plants, civil engineering projects and buildings, power generation and information technology and operational technology services, and manufacturing and sale of energy-related and other industrial materials.

Looking Ahead

Given the company's financial strength, profitability, and growth metrics, the GF Score highlights the firm's unparalleled position for potential underperformance. While POSCO Holdings Inc has a strong history in the steel industry, its current financial and growth rankings suggest that it may struggle to maintain its past performance. This analysis underscores the importance of thorough research and careful consideration when investing.

GuruFocus Premium members can find more companies with strong GF Scores using the following screener link: GF Score Screen

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.