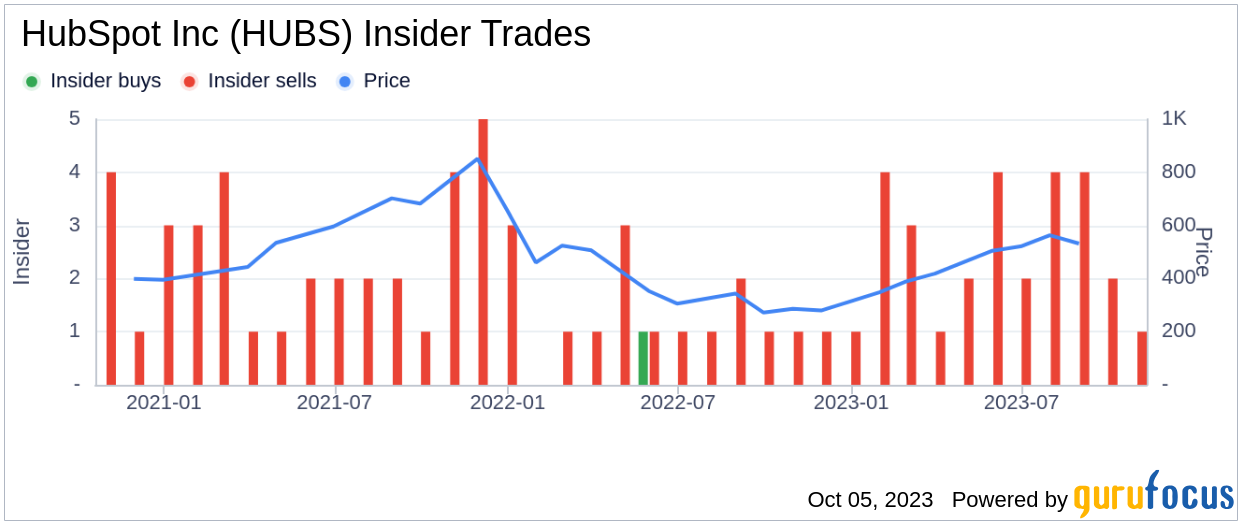

On October 3, 2023, Kathryn Bueker, the Chief Financial Officer of HubSpot Inc (HUBS, Financial), sold 604 shares of the company. This move is part of a larger trend of insider selling at HubSpot Inc, with 30 insider sells over the past year.

Kathryn Bueker has been with HubSpot Inc for several years, serving as the company's CFO. In her role, she oversees the company's financial operations and strategy. Over the past year, the insider has sold a total of 5,111 shares and has not made any purchases.

HubSpot Inc is a leading provider of inbound marketing and sales software. The company's software platform features integrated applications to help businesses attract visitors, convert leads, and close customers. These applications include social media, search engine optimization, blogging, website content management, marketing automation, email, sales productivity, CRM, analytics, and more.

The insider's recent sell comes at a time when HubSpot Inc's shares were trading at $489.17, giving the company a market cap of $23.85 billion. Despite the insider selling, the stock appears to be significantly undervalued based on its GuruFocus Value of $680.76, with a price-to-GF-Value ratio of 0.72.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the company’s past returns and growth, and future estimates of business performance from Morningstar analysts.

The insider's sell-off could be seen as a bearish signal, especially considering the overall trend of insider selling at HubSpot Inc. However, it's important to note that insider selling can occur for a variety of reasons, and it doesn't necessarily indicate a negative outlook on the company's future.

The relationship between insider transactions and stock price can be complex. While a high volume of insider selling can sometimes precede a drop in the stock price, this is not always the case. Other factors, such as the company's financial performance, market conditions, and industry trends, can also significantly impact the stock price.

In conclusion, while the insider's recent sell-off and the overall trend of insider selling at HubSpot Inc may raise some eyebrows, the stock's current undervaluation and the company's strong business fundamentals suggest that there may still be potential for growth. As always, investors should conduct their own thorough research before making any investment decisions.