The stock of APA Corp (APA, Financial) experienced a daily loss of 3.28%, but has seen a three-month gain of 17.18%. With an Earnings Per Share (EPS) (EPS) of 4.67, the question arises - is the stock fairly valued? This article aims to answer this question by providing a comprehensive valuation analysis of APA Corp. We invite you to delve into the following sections for a deeper understanding of the company's financial health, growth prospects, and intrinsic value.

Company Overview

Based in Houston, APA Corp is a leading independent exploration and production company. It operates primarily in the U.S., Egypt, the North Sea, and Suriname. As of 2022, its proved reserves totaled 890 million barrels of oil equivalent, with a net reported production of 400 thousand boe/d. The company's operations are largely focused on oil and natural gas liquids, accounting for 64% of the total production, with the remainder being natural gas.

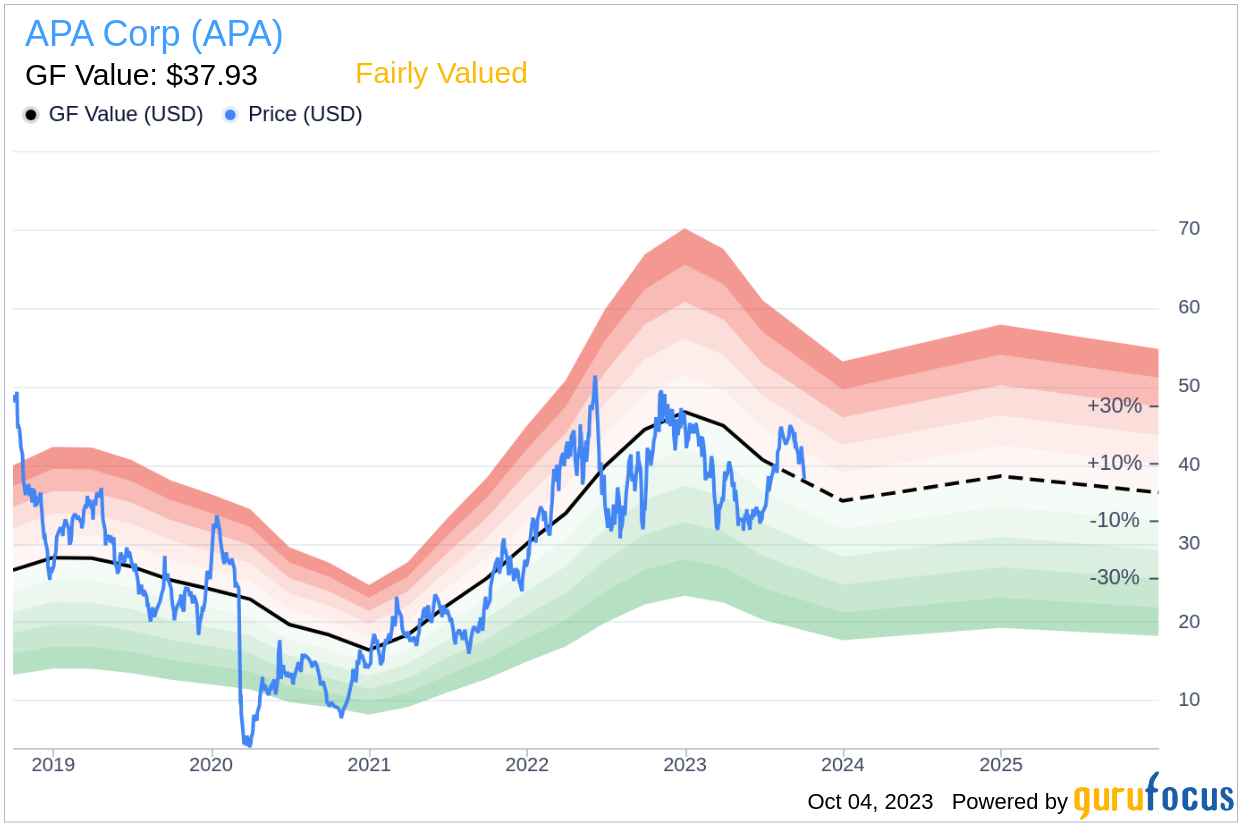

APA Corp's current stock price is $38.36, which is closely aligned with its GF Value of $37.93, suggesting that the stock is fairly valued. The following sections will provide a detailed analysis of the company's valuation, taking into account its financial health, profitability, and growth.

Understanding GF Value

The GF Value is a proprietary measure that represents the intrinsic value of a stock, calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line on the summary page provides an overview of the fair value at which the stock should ideally be traded.

According to the GF Value, APA Corp's stock appears to be fairly valued. If the stock price is significantly above the GF Value Line, it suggests overvaluation and potentially poor future returns. Conversely, if the stock price is significantly below the GF Value Line, it suggests undervaluation and potentially higher future returns. Given the current price of $38.36 per share, APA Corp's stock appears to be fairly valued.

Because APA Corp's stock is fairly valued, the long-term return is likely to be close to the rate of its business growth.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength Analysis

Investing in companies with low financial strength could result in permanent capital loss. Therefore, it's crucial to review a company's financial strength before deciding whether to buy shares. APA Corp's cash-to-debt ratio is 0.03, ranking worse than 90.06% of companies in the Oil & Gas industry. Based on this, GuruFocus ranks APA Corp's financial strength as 4 out of 10, suggesting a poor balance sheet.

Profitability and Growth

Investing in profitable companies carries less risk, especially those that have demonstrated consistent profitability over the long term. APA Corp has been profitable for 5 out of the past 10 years. In the past 12 months, the company generated revenues of $9.20 billion and an EPS of $4.67. Its operating margin of 42.41% is better than 85.29% of companies in the Oil & Gas industry. Overall, GuruFocus ranks APA Corp's profitability as fair.

Growth is a crucial factor in a company's valuation. APA Corp's 3-year average annual revenue growth rate is 24.5%, ranking better than 76.51% of companies in the Oil & Gas industry. Its 3-year average EBITDA growth rate is 402.8%, ranking better than 99.88% of companies in the industry.

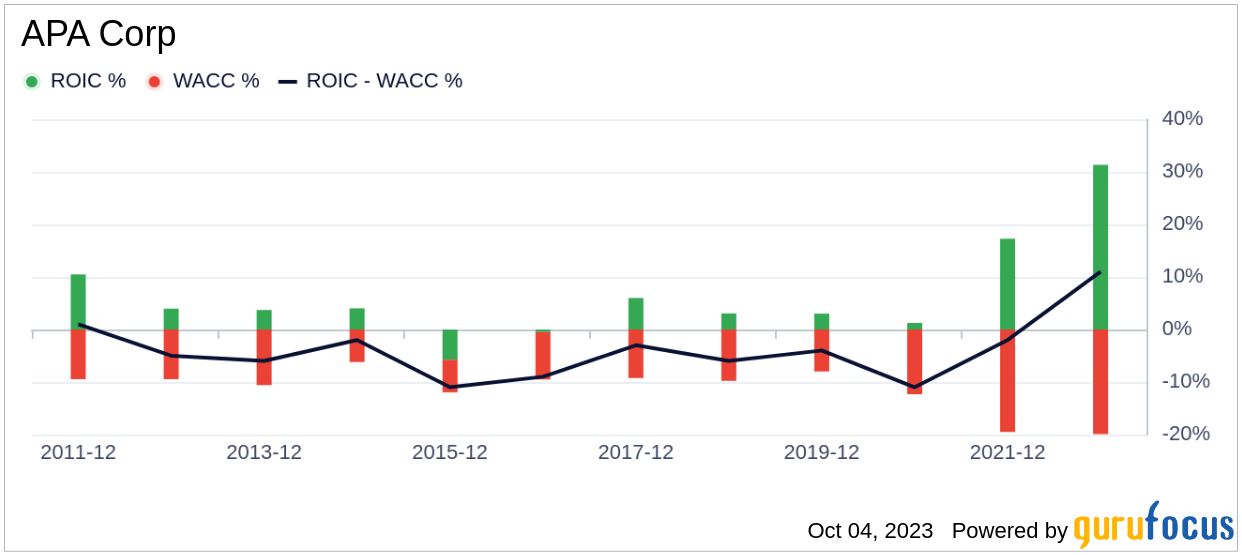

ROIC vs WACC

Comparing a company's Return on Invested Capital (ROIC) to its Weighted Average Cost of Capital (WACC) is another way to evaluate its profitability. If the ROIC is higher than the WACC, it indicates that the company is creating value for shareholders. In the past 12 months, APA Corp's ROIC was 17.81, while its WACC was 10.88.

Conclusion

In conclusion, APA Corp's stock appears to be fairly valued. The company's financial condition is poor, but its profitability is fair. Its growth ranks better than 99.88% of companies in the Oil & Gas industry. For more information about APA Corp's stock, you can check out its 30-Year Financials here.

For high-quality companies that may deliver above-average returns, check out GuruFocus High Quality Low Capex Screener.