APA Corp (APA, Financial) has seen a daily gain of 3.02% and a 3-month gain of 29.67%, with an Earnings Per Share (EPS) (EPS) of 4.67. Despite these promising figures, the question remains: is the stock modestly overvalued? The following analysis dives deep into APA's financials and valuation to provide a well-rounded perspective.

Company Introduction

Based in Houston, APA Corp is an independent exploration and production company with operations primarily in the U.S., Egypt, the North Sea, and Suriname. As of the end of 2022, APA's proved reserves totaled 890 million barrels of oil equivalent, with a net reported production of 400 thousand boe/d that year. 64% of this production consisted of oil and natural gas liquids, with the remainder being natural gas.

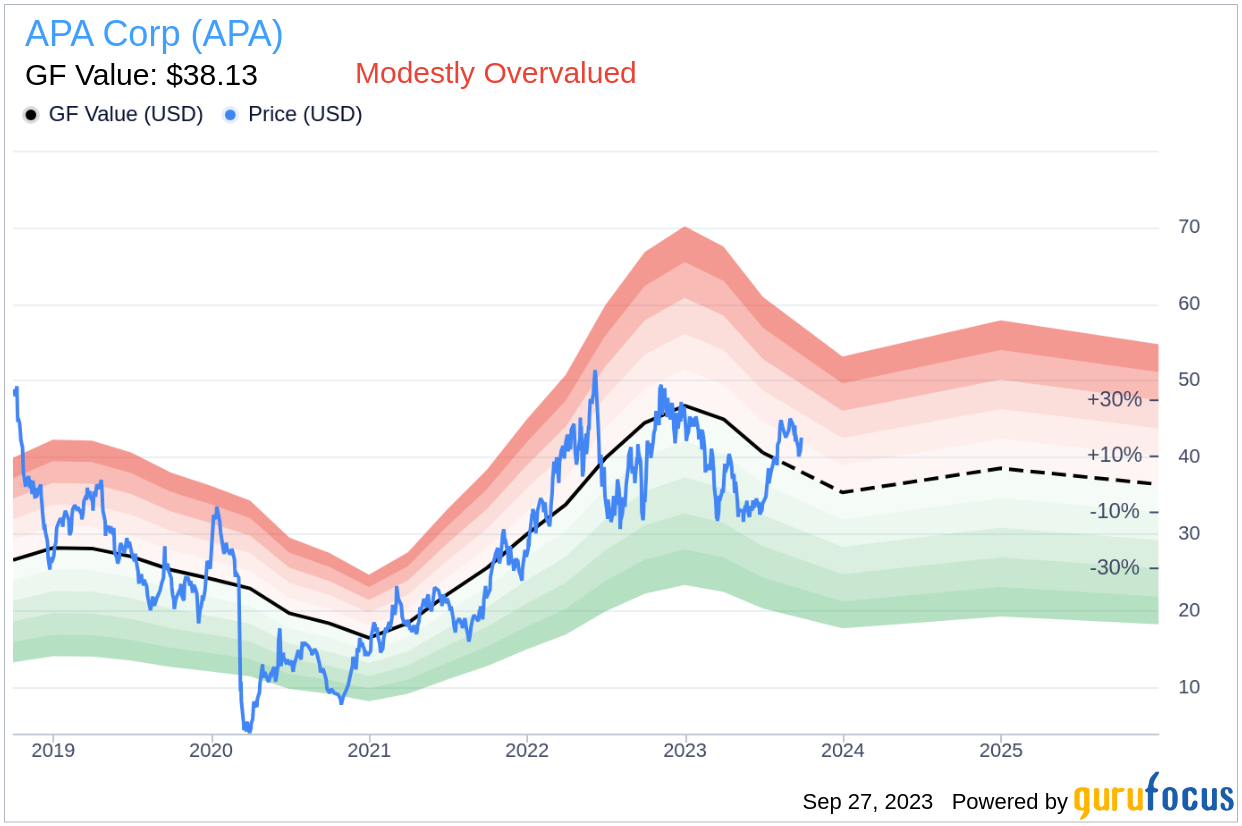

The company's current stock price stands at $42.29, with a market cap of $13 billion. When compared to the GF Value of $38.13, it appears that APA stock might be modestly overvalued. Let's delve deeper into the company's value by examining its financials and intrinsic value.

Understanding GF Value

The GF Value is a proprietary measure that represents the current intrinsic value of a stock. This value is derived from historical multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates.

According to our calculations, APA (APA, Financial) appears to be modestly overvalued. The GF Value is GuruFocus' estimate of the fair value at which the stock should be traded. If the price of a stock is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher. Given APA's current price of $42.29 per share and the market cap of $13 billion, the stock appears to be modestly overvalued.

Because APA is relatively overvalued, the long-term return of its stock is likely to be lower than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

Assessing APA's Financial Strength

Companies with poor financial strength pose a high risk of permanent capital loss to investors. To avoid this, it's crucial to assess a company's financial strength before purchasing shares. Key indicators of financial strength include the cash-to-debt ratio and interest coverage. APA's cash-to-debt ratio of 0.03 ranks lower than 89.85% of 1034 companies in the Oil & Gas industry, indicating that APA's financial strength is poor.

Profitability and Growth

Investing in profitable companies, especially those with consistent profitability over the long term, is generally less risky. APA has been profitable 5 out of the past 10 years. Over the past twelve months, the company had a revenue of $9.20 billion and Earnings Per Share (EPS) of $4.67. Its operating margin is 42.41%, which ranks better than 84.86% of 984 companies in the Oil & Gas industry, indicating fair profitability.

Growth is one of the most important factors in the valuation of a company. Companies that grow faster create more value for shareholders, especially if that growth is profitable. The average annual revenue growth of APA is 24.5%, which ranks better than 76.68% of 862 companies in the Oil & Gas industry. The 3-year average EBITDA growth is 402.8%, which ranks better than 99.88% of 829 companies in the Oil & Gas industry.

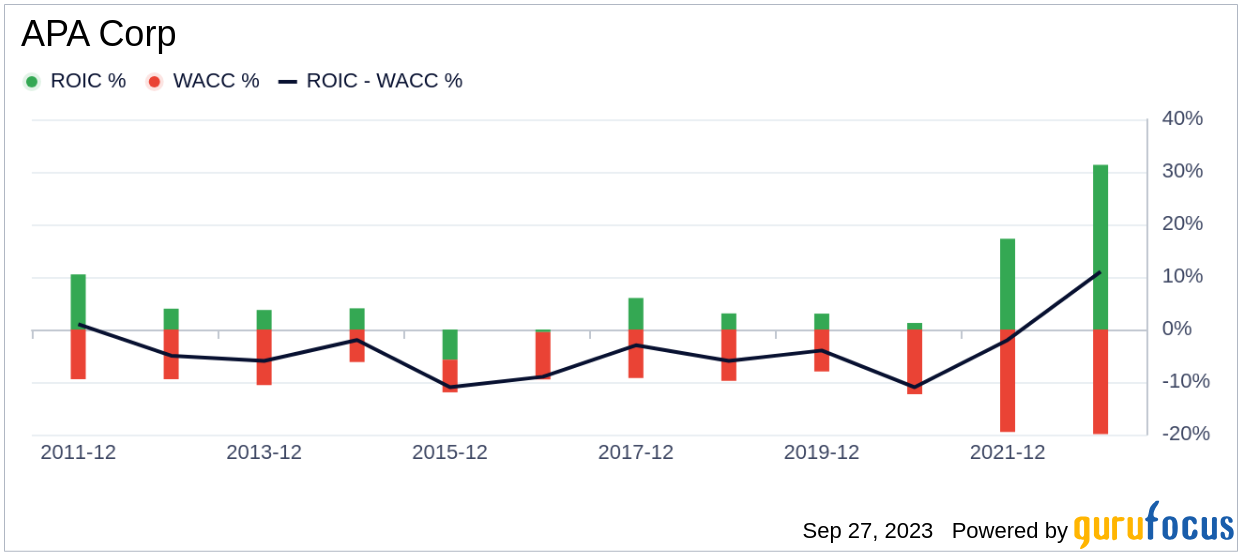

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) is another way to assess its profitability. ROIC measures how well a company generates cash flow relative to the capital it has invested in its business, while WACC is the rate that a company is expected to pay on average to all its security holders to finance its assets. Ideally, ROIC should be higher than WACC. For the past 12 months, APA's ROIC is 17.81, and its WACC is 10.84.

Conclusion

In conclusion, APA (APA, Financial) appears to be modestly overvalued. The company's financial condition is poor, but its profitability is fair. Its growth ranks better than 99.88% of 829 companies in the Oil & Gas industry. To learn more about APA stock, you can check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.