Manchester United PLC (MANU, Financial) recently recorded a daily gain of 2.94%, despite a 3-month loss of -13.38% and an Earnings Per Share (EPS) loss of 0.71. This raises the question: is the stock modestly overvalued? Let's delve into the valuation analysis to uncover the answers.

Introduction to Manchester United PLC

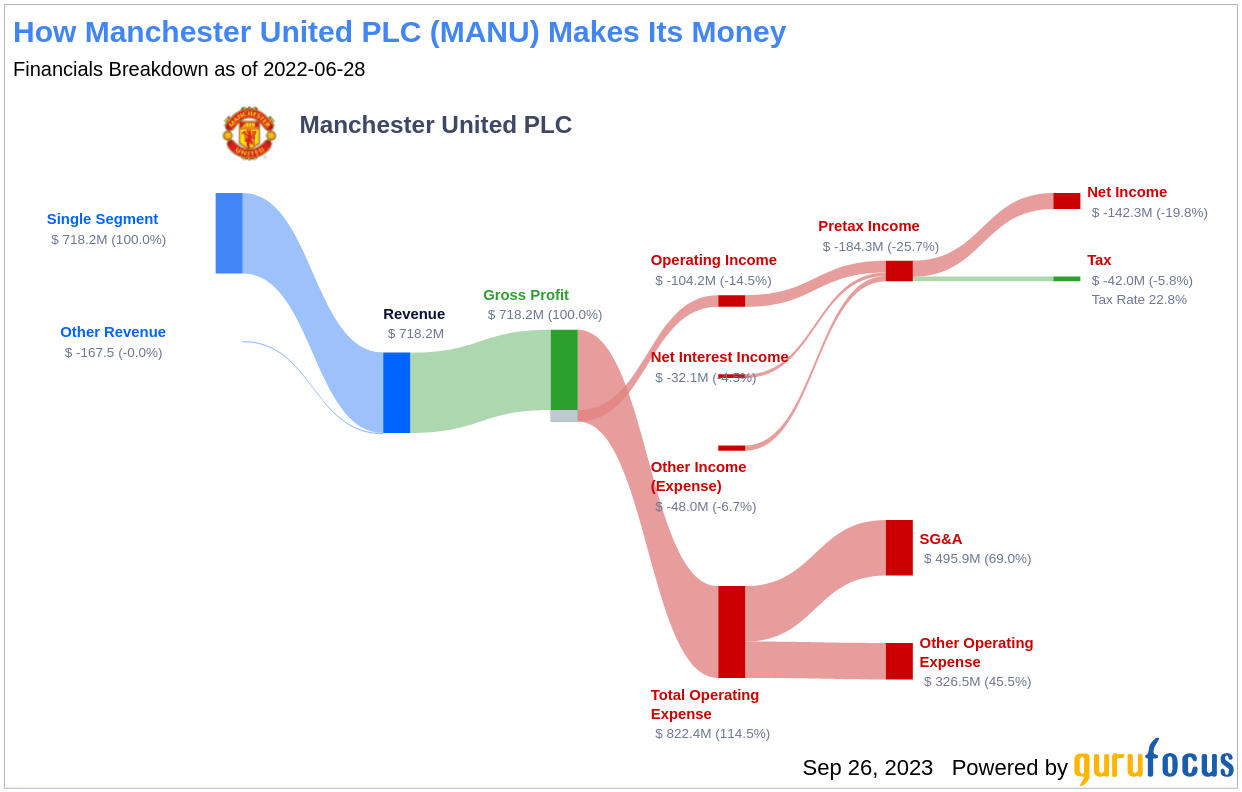

Manchester United PLC operates a professional football club, managing the soccer team and all affiliated club activities of the Manchester United Football Club. This includes the media network, foundation, fan zone, news, sports features, and team merchandise. The company is based in England and generates the majority of its revenue from three principal sectors: Commercial, Broadcasting, and Matchday. The current stock price stands at $19.93, while the estimated fair value (GF Value) is $16.96.

Understanding the GF Value

The GF Value is an exclusive valuation method that estimates the current intrinsic value of a stock. It is based on historical multiples, a GuruFocus adjustment factor derived from the company's past performance, and future business performance estimates. The GF Value Line provides an overview of the fair value at which the stock should ideally be traded.

Manchester United PLC appears to be modestly overvalued according to the GF Value calculation. The current price of $19.93 per share and the market cap of $3.20 billion suggest that the stock is trading above its fair value. Hence, the long-term return of Manchester United PLC's stock is likely to be lower than its business growth.

For potentially higher future returns at reduced risk, consider these high-quality companies.

Evaluating Financial Strength

Investing in companies with poor financial strength can lead to a higher risk of permanent capital loss. It is crucial to review the financial strength of a company before deciding to buy its stock. A great starting point is looking at the cash-to-debt ratio and interest coverage. Manchester United PLC's cash-to-debt ratio of 0.1 is worse than 84.66% of companies in the Media - Diversified industry, indicating poor financial strength.

Profitability and Growth

Investing in profitable companies, especially those demonstrating consistent profitability over the long term, poses less risk. Manchester United PLC has been profitable 5 over the past 10 years. However, its operating margin of -12.9% ranks worse than 76.57% of companies in the Media - Diversified industry, indicating fair profitability.

One of the most important factors in the valuation of a company is growth. Companies that grow faster create more value for shareholders. Manchester United PLC's average annual revenue growth is -3%, which ranks worse than 57.65% of companies in the Media - Diversified industry.

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) can also evaluate its profitability. If the ROIC exceeds the WACC, the company is likely creating value for its shareholders. Manchester United PLC's ROIC is -4.14 while its WACC is 8.02.

Conclusion

Manchester United PLC (MANU, Financial) stock appears to be modestly overvalued. The company's financial condition is poor, its profitability is fair, and its growth ranks worse than 91.31% of companies in the Media - Diversified industry. To learn more about Manchester United PLC stock, you can check out its 30-Year Financials here.

For high-quality companies that may deliver above-average returns, visit the GuruFocus High Quality Low Capex Screener.