Taiwan Semiconductor Manufacturing Co. Ltd. (TSM, Financial) is the world's largest semiconductor company. The business is the backbone of the semiconductor industry as it manufactures the vast majority of chips in all sorts of devices, from smartphones to PCs.

The semiconductor industry is going through a cyclical downturn, but Taiwan Semiconductor has still beat analyst forecasts for growth on both its top and bottom lines.

In this analysis, I will break down its business model and financials. Let’s dive in.

Backbone of the industry

Taiwan Semiconductor Manufacturing has developed the largest semiconductor foundry in the world. It manufactures close to 12,000 products for over 500 different customers.

Many gold standard chip designers, such as Advance Micro Devices (AMD, Financial), Nvidia (NVDA, Financial) and Qualcomm (QCOM, Financial), all use the company's facilities to manufacture their chips. This is because the actual manufacturing process is continuously evolving and is truly a specialist skill. The difficulty of this feat can be highlighted by Intel (INTC, Financial), which has had to bow its head to Taiwan Semiconductor to help manufacture some of its 7 nanometer chips.

Giants such as Apple (AAPL, Financial), which has started to design its own Apple Silicon chips, also leverage Taiwan Semiconductor for the actual manufacturing.

The company has continued to innovate on its technology and is supplying tiny 5 nanometer chips to Apple. The company is also planning to launch even smaller 3 nm chips in 2023. Meanwhile, Samsung (XKRX:005930, Financial) has struggled with its 3 nm chip process.

International expansion

The main risk for Taiwan Semiconductor is its location off the coast of China, which could be under threat if geopolitical tensions or even war arises. China has made claim to Taiwan as a part of China, although this has been disputed by international parties.

Either way, the strategic importance of the company is recognized and governments from around the world are offering billion-dollar incentives to entice the building of facilities in their countries. A prime example is the $52 billion CHIPS act, introduced by the U.S. Incentives such as this should help Taiwan Semiconductor and other companies to absorb the higher manufacturing costs outside of Taiwan.

Taiwan Semiconductor started to build a fabrication facility in Arizona in 2021, which is on an “aggressive schedule” for completion. However, the company is struggling to find skilled workers in the region to install the specialist equipment required. Therefore, the business is looking to bring experienced workers from Taiwan to train local workers in the U.S.

The company is also building a facility in Japan, which is on track for volume production by the end of 2024. In Europe, Germany has been selected for a specialist fab to help supply the automotive industry.

Despite the geopolitical tensions with China, Taiwan Semiconductor has expanded its facility in Nanjing and continues to invest in Taiwan.

Cyclical financials

Taiwan Semiconductor reported solid financial results for the second quarter of 2023. Its revenue of $15.44 billion beat analyst forecasts by $60.49 million, despite declining 14% year over year. This reduction was expected due to the cyclical pullback in the semiconductor industry after a major boom in 2021.

In terms of revenue by technology, its latest 5 nanometer process technology contributed to a solid 30% of total wafer revenue. While its 7nm process accounted for 23%.7 nm and below contributed to 53% of total wafer revenue. This is a positive sign as it shows the vast improvement in the wafer process and how far the company is ahead.

Breaking this revenue down by platform, its high-performance computing segment declined by 5% sequentially and contributed to 44% of revenue in the second quarter.

Smartphone revenue also fell by 9% and contributed to 33% of the total. Its smaller segments did report strong momentum with a 3% increase in automotive revenue to 8% of the total, while its data communications equipment reported a 25% increase to 3% of the total.

Margins, cash flow and balance sheet

Taiwan Semiconductor reported a gross margin of 54%, which was down from 59% in the prior-year quarter. However, this was still solid overall.

Its operating income was $6.48 billion, down from the $8.8 billion reported a year ago. However, this was mainly driven by the cyclical downturn in the industry, which has caused a supply glut and lower prices. Therefore, Taiwan Semiconductor’s operating margin was squeezed down by 3.5% to 42%.

Despite these challenges, the company continues to aggressively invest in research and development with $1.37 billion invested in the second quarter. This is slightly higher than the prior year's figure.

Its earnings per share of $1.14 also beat analyst forecasts by 6 cents.

In terms of cash flow, the company reported $5.2 billion in cash from operations and $7.8 billion in capital expenditures.

Taiwan Semiconductor also pays a healthy 2% dividend, which is surprising for a technology company. It also has a solid balance sheet with $48 billion in cash and marketable securities.

Its debt levels reached $30.6 billion, which may seem high, but for a legacy large-scale manufacturing company, this is expected.

Valuation

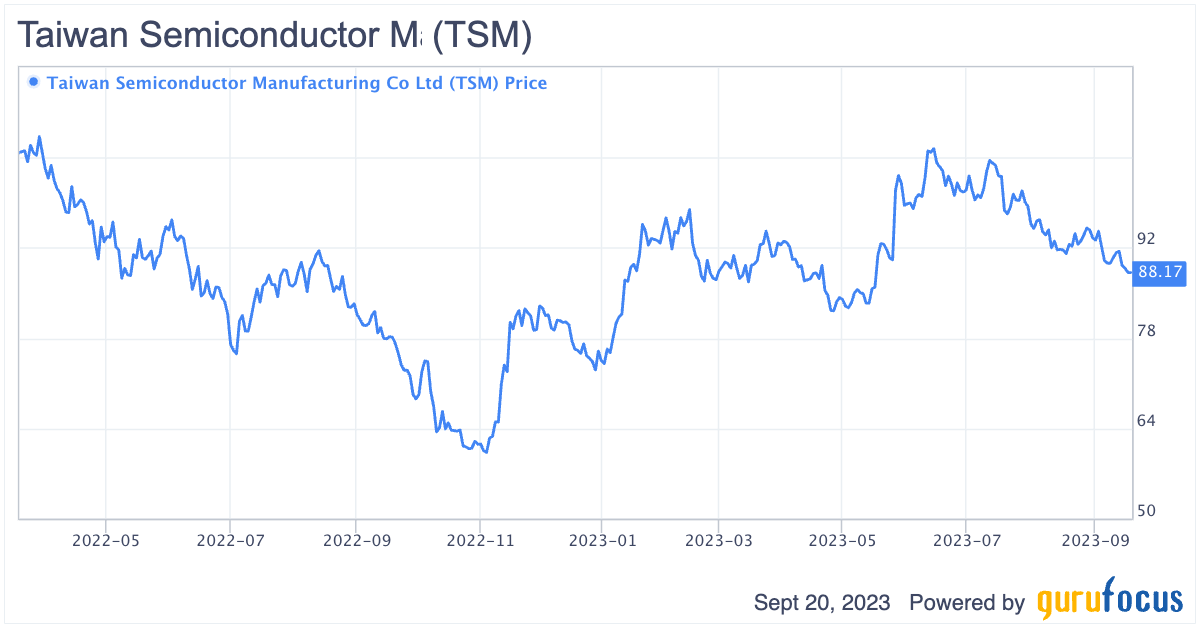

The stock trades with a price-sales ratio of 6, which is lower than its five-year average.

Its price-earnings ratio of 18 is also below its five-year average.

Based on historical ratios, past financial performance and analysts' future earnings projections, the GF Value Line indicates a fair value of $127 per share. thus the stock is significantly undervalued at the time of writing.

Final thoughts

Taiwan Semiconductor Manufacturing is one of the greatest businesses in history. The company is of vast strategic importance to many governments and its technology is best in class. Therefore, it has multiple competitive advantages and its dominance is expected to continue long term. The main risk with the business is its main location off the coast of Taiwan, which could be vulnerable if a conflict with China arose. A positive is the company is aiming to mitigate this risk by scaling its international facilities.