On September 13, 2023, President DEVILLIERS DAVID H JR sold 96 shares of FRP Holdings Inc (FRPH, Financial). This move comes amidst a series of insider transactions that have taken place over the past year.

DEVILLIERS DAVID H JR is a key figure at FRP Holdings Inc, serving as the company's President. His role involves overseeing the company's operations and making strategic decisions that impact the company's performance and stock value.

FRP Holdings Inc is a company that operates in the real estate sector. It is involved in various aspects of real estate, including acquisition, development, leasing, and management of commercial properties. The company's portfolio includes office buildings, warehouse facilities, and retail centers.

Over the past year, the insider has sold a total of 3,416 shares and has not made any purchases. This trend is reflected in the company's overall insider transactions, with 1 insider buy and 11 insider sells over the same period.

The relationship between insider transactions and the stock price is often seen as an indicator of a company's internal view of its performance. In this case, the insider's sell transactions could suggest a cautious outlook. However, it's important to note that insider transactions are just one of many factors that investors should consider when evaluating a stock.

On the day of the insider's recent sell, FRP Holdings Inc's shares were trading at $57, giving the company a market cap of $542.963 million. The stock's price-earnings ratio stands at 124.30, significantly higher than the industry median of 13.5 and the company's historical median price-earnings ratio.

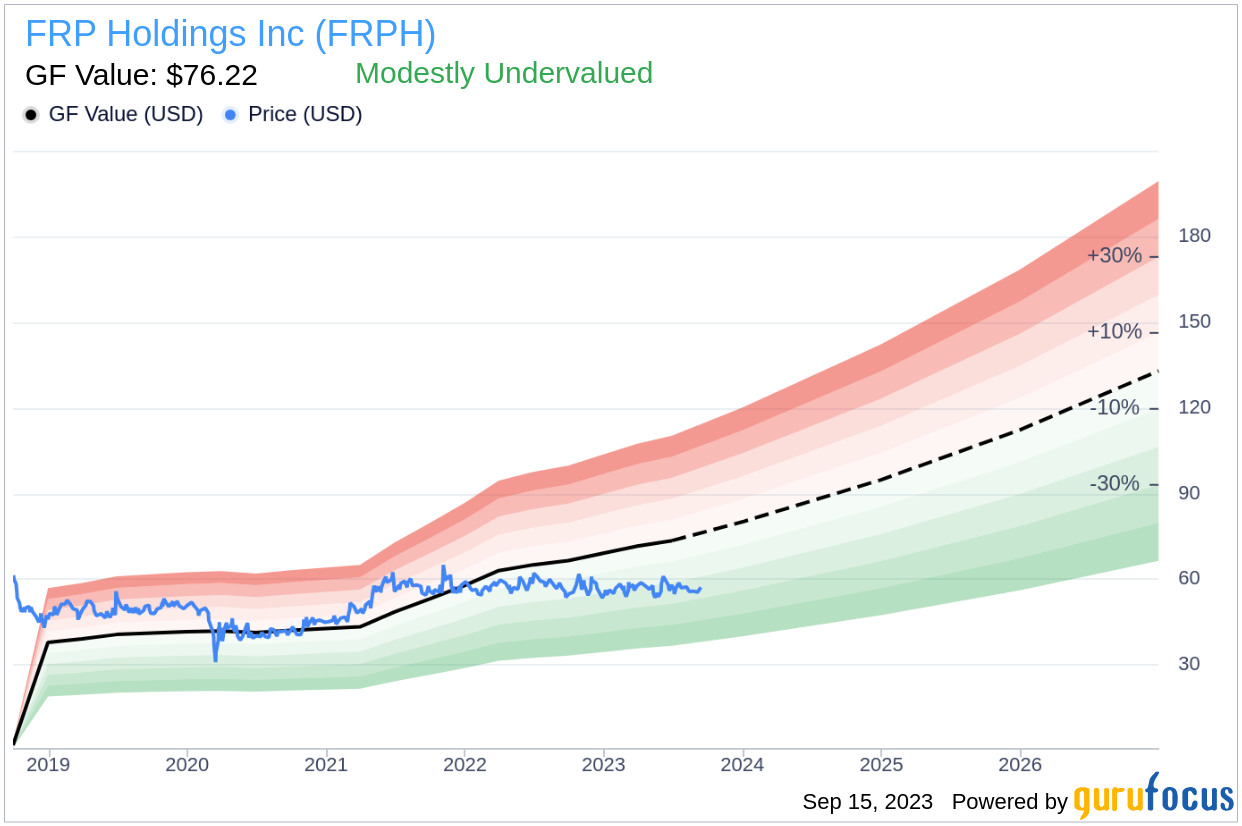

Despite this, the stock appears to be modestly undervalued based on its GF Value. With a price of $57 and a GuruFocus Value of $76.22, the stock has a price-to-GF-Value ratio of 0.75.

The GF Value is a proprietary estimate of intrinsic value developed by GuruFocus. It is calculated based on historical multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

In conclusion, while the insider's recent sell transaction and the high price-earnings ratio may raise some concerns, the stock's modest undervaluation based on its GF Value suggests potential upside. As always, investors should consider all relevant factors and conduct thorough research before making investment decisions.