On September 12, 2023, Sheryl Palmer, Chairman, President, and CEO of Taylor Morrison Home Corp (TMHC, Financial), sold 112,500 shares of the company. This move is part of a series of transactions made by the insider over the past year, which have seen a total of 525,000 shares sold and no shares purchased.

Sheryl Palmer has been with Taylor Morrison Home Corp since 2007, leading the company through significant growth and expansion. Under her leadership, the company has become one of the largest homebuilders in the United States, with operations in more than 20 markets across the country.

Taylor Morrison Home Corp is a leading national homebuilder and developer that has been recognized as America's Most Trusted® Home Builder by Lifestory Research from 2016 to 2021. The company builds a wide array of consumer groups across the country, from first-time homeowners to those seeking luxury homes.

The insider's recent sell-off has raised some eyebrows among investors and analysts. Over the past year, there has been only one insider buy at Taylor Morrison Home Corp, compared to 39 insider sells. This trend is illustrated in the following chart:

The insider's selling activity often signals their outlook on the company's future performance. In this case, the insider's sell-off could suggest a less optimistic view of the company's future prospects.

On the day of the insider's recent sell, shares of Taylor Morrison Home Corp were trading at $46.01, giving the company a market cap of $4.99 billion. The stock's price-earnings ratio was 5.02, lower than both the industry median of 8.75 and the company's historical median price-earnings ratio.

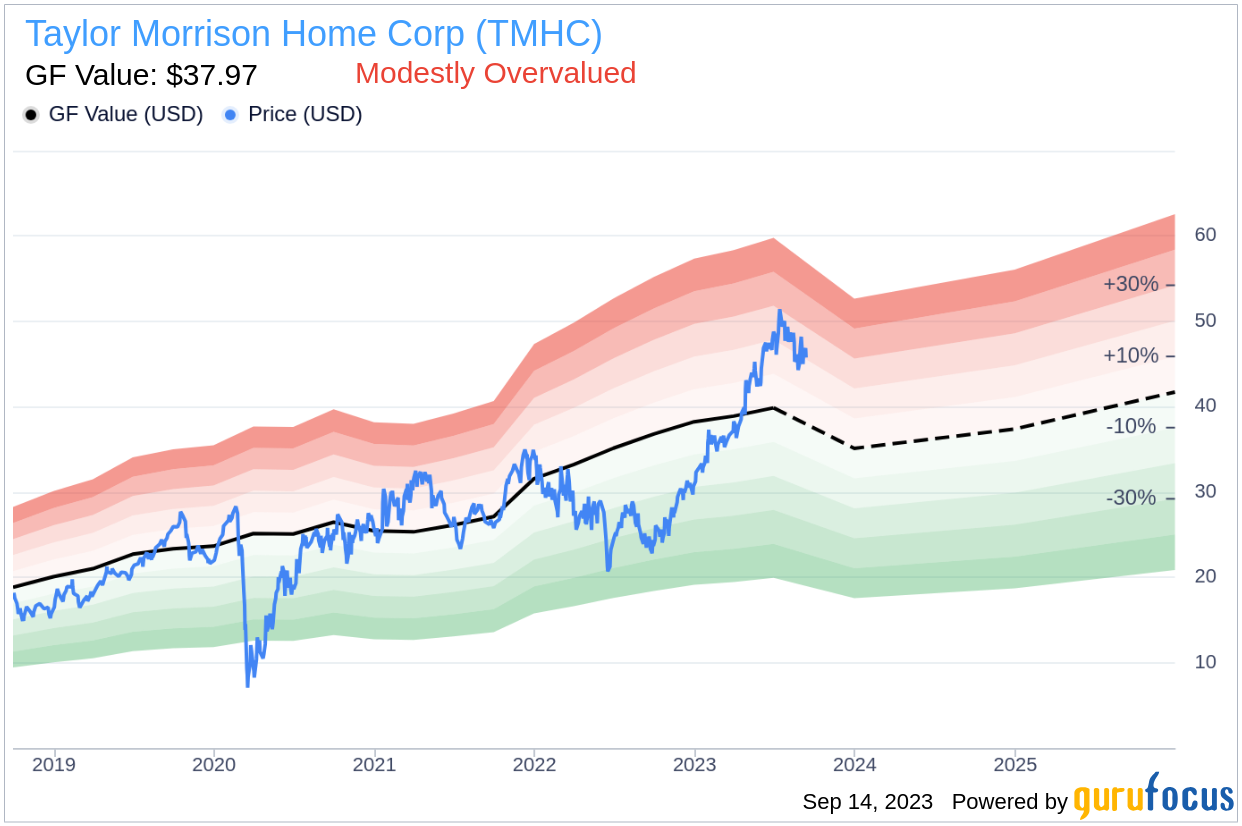

According to GuruFocus Value, the stock is modestly overvalued. With a price of $46.01 and a GuruFocus Value of $37.97, the stock has a price-to-GF-Value ratio of 1.21. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor, and future estimates of business performance from Morningstar analysts. The GF Value is illustrated in the following chart:

In conclusion, the insider's recent sell-off, coupled with the stock's modest overvaluation, may suggest a cautious approach for potential investors. However, it's essential to consider other factors, such as the company's financial health and market conditions, before making investment decisions.