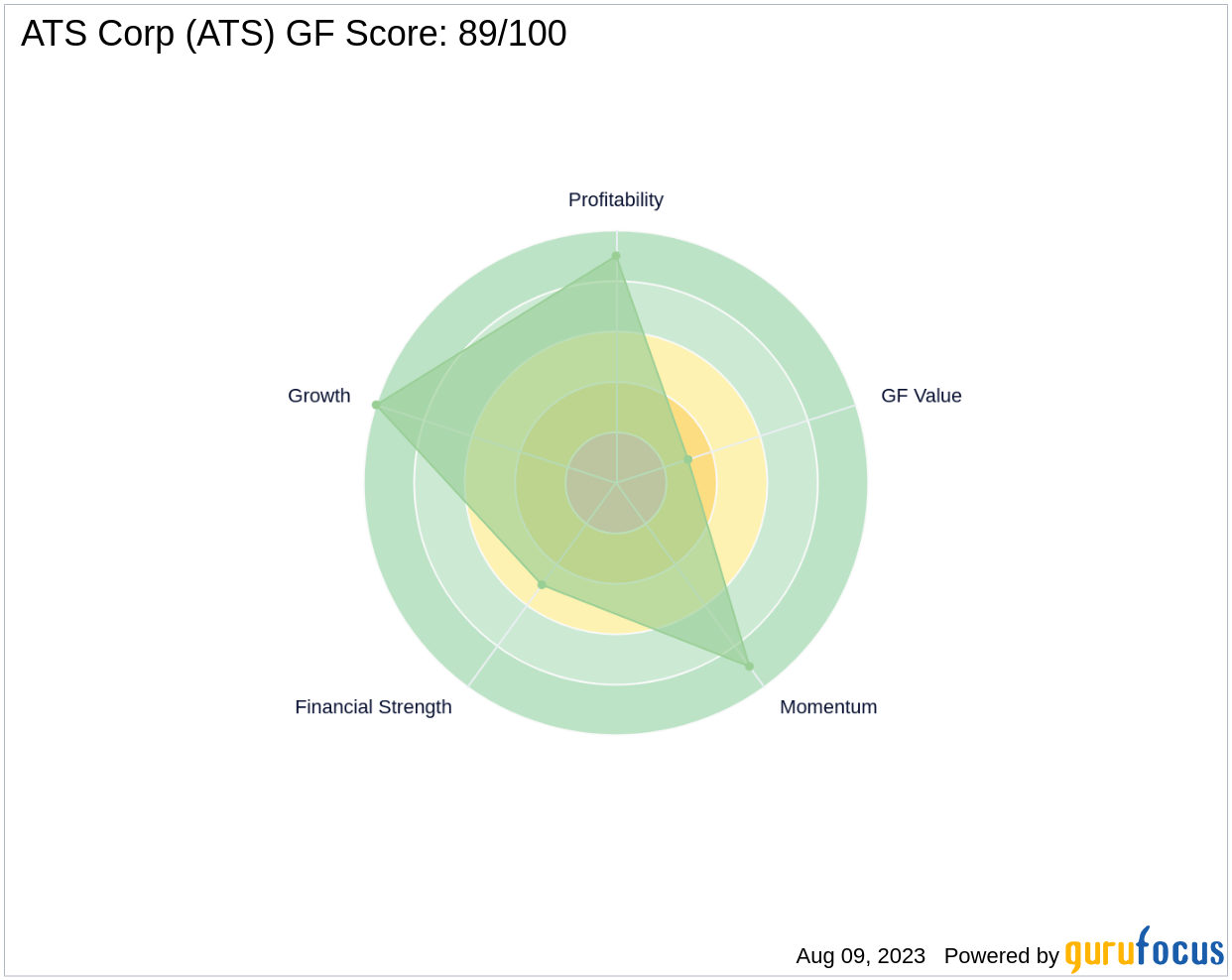

ATS Corp (ATS, Financial), a prominent player in the Industrial Products sector, is currently trading at $44.3 with a market capitalization of $4.38 billion. Despite a slight dip of 1.60% over the past four weeks, the stock has seen a gain of 5.75% today. According to GuruFocus, ATS Corp has a GF Score of 89 out of 100, indicating good outperformance potential.

Financial Strength Analysis of ATS Corp

The Financial Strength of ATS Corp is ranked at 5/10. This score is based on its interest coverage of 3.86, a debt to revenue ratio of 0.49, and an Altman Z score of 2.67. These figures suggest that the company has a moderate debt burden and a relatively stable financial situation.

Profitability Rank Analysis of ATS Corp

ATS Corp's Profitability Rank stands at an impressive 9/10. This high score is attributed to its operating margin of 9.70%, a Piotroski F-Score of 7, and a consistent profitability trend over the past 10 years. The company's 5-year average operating margin trend is 3.40%, indicating a steady uptrend in profitability.

Growth Rank Analysis of ATS Corp

With a perfect Growth Rank of 10/10, ATS Corp demonstrates strong growth in terms of revenue and profitability. The company's 5-year revenue growth rate is 18.70%, and its 3-year revenue growth rate is 21.80%. The 5-year EBITDA growth rate is also robust at 23.30%, indicating a consistent growth in the company's business operations.

GF Value Rank Analysis of ATS Corp

The GF Value Rank of ATS Corp is 3/10, suggesting that the stock is currently fairly valued. This rank is determined by the price-to-GF-Value ratio, a proprietary metric calculated based on historical multiples and an adjustment factor based on the company's past returns and growth.

Momentum Rank Analysis of ATS Corp

ATS Corp's Momentum Rank is 9/10, indicating strong price performance. This rank is determined using the standardized momentum ratio and other momentum indicators, suggesting that the stock has a strong momentum in the market.

Comparison with Competitors

When compared to its main competitors in the Industrial Products sector, ATS Corp holds a strong position. Ballard Power Systems Inc (TSX:BLDP, Financial) has a GF Score of 64, Savaria Corp (TSX:SIS, Financial) scores 96, and Velan Inc (TSX:VLN, Financial) has a GF Score of 57. These scores can be found on the competitors page.

Conclusion

In conclusion, ATS Corp's overall performance, as indicated by its GF Score of 89, suggests good outperformance potential. The company's strong profitability and growth ranks, coupled with its fair valuation and strong momentum, make it an attractive investment option for value investors. However, investors should also consider the company's moderate financial strength and the competitive landscape in the Industrial Products sector.