Fairholme Capital Management recently disclosed its portfolio updates for the first quarter of 2023, which ended on March 31.

Bruce Berkowitz (Trades, Portfolio) founded Fairholme Capital Management in 1999. From 2000 to 2010, Fairholme’s funds achieved strong returns that outpaced the S&P 500, and Berkowitz was named Domestic Stock Fund Manager of the Decade by Morningstar in 2010. Berkowitz holds a concentrated value-based portfolio, inspired by Benjamin Graham's "The Intelligent Investor." He focuses on companies that have exceptional management, generate free cash and are cheaply priced compared to intrinsic value, as well as those that have an upcoming catalyst.

According to its latest portfolio report, Fairholme was mostly selling stocks in the first quarter. It slashed its stake in Commercial Metals Co. (CMC, Financial), sold out of Old Republic International Corp. (ORI, Financial) and reduced or sold out of five other stocks. Its only buys for the quarter were a couple of midstream companies, Magellan Midstream Partners LP (MMP, Financial) and Enterprise Products Partners LP (EPD, Financial).

Investors should be aware that portfolio updates for mutual funds do not necessarily provide a complete picture of a guru’s holdings. The data is sourced from the quarterly updates on the website of the fund(s) in question. This usually consists of long equity positions in U.S. and foreign stocks. All numbers are as of the quarter’s end only; it is possible the guru may have already made changes to the positions after the quarter ended. However, even this limited data can provide valuable information.

Commercial Metals

The fund slashed its Commercial Metals (CMC, Financial) position by 42.87%, leaving a remaining stake of 1,272,900 shares. At the quarter’s average share price of $51.80, this shaved 3.86% off the equity portfolio.

As its name suggests, Commercial Metals is a commercial metals producer. Through its subsidiaries, the Texas-based company manufactures, recycles and fabricates steel and other metal products, with major operations in the U.S., Europe and Asia.

Metals are highly cyclical commodities that depend on a wide variety of economic factors to determine pricing. In general, if the sale prices of metals are down, the stock prices of the producers of those metals can be expected to decline as well. The World Steel Association expects steel prices to keep dropping in 2023 and 2024 after a poor performance in 2022, driven by factors such as high inflation in the U.S. and the war in Ukraine.

Commercial Metals has a GuruFocus financial strength rating of 8 out of 10 and a profitability rating of 8 out of 10. The GF Value chart rates the stock as modestly overvalued.

Old Republic International

The fund exited its 316,100-share position in Old Republic International (ORI, Financial), which previously took up 0.64% of the equity portfolio. During the quarter, shares traded for an average price of $25.17.

Old Republic is an Illinois-based property insurance and title deed company that operates in the U.S and Canada. It is one of the top 50 largest insurance groups in the U.S. and primarily provides liability insurance to companies and mortgage guaranty insurance to home buyers.

The company's outlook has weakened as the U.S. economy, particularly the housing market, has slowed down. Over the next few years, analysts are mostly looking for results to be flat. Nevertheless, insurance tends to hold up well in the long run, and Old Republic still has a reasonable dividend yield of 3.78%.

The company receives a financial strength rating of 5 out of 10 and a profitability rating of 7 out of 10 from GuruFocus. The GF Value chart rates the stock as modestly overvalued.

Magellan Midstream Partners

The fund’s only new buy of the quarter was Magellan Midstream Partners (MMP, Financial). It ended the quarter with 28,600 shares, giving the position a weight of 0.13% in the equity portfolio. Shares traded for an average price of $52.99 over the three-month period.

Magellan is a midstream company that owns and operates petroleum and ammonia pipelines and storage facilities in the mid-continent oil province of the U.S. While most parts of the oil and gas industry tend to be more cyclical, that is often not the case for midstream companies like Magellan, as long-term contracts and the built-in monopolies of pipelines help ensure predictable and profitable cash flows.

On May 14, fellow pipeline company ONEOK Inc. (OKE, Financial) announced that it will be acquiring Magellan in a cash-and-stock deal valued at $18.8 billion, expected to close in the third quarter of 2023. The companies expect to achieve cost savings and tax synergies as a result of the merger.

At a market cap of $12.02 billion, Magellan is trading at a significant discount to the value that the ONEOK deal places on it. However, only $25 per share of the deal is in cash while the rest is in stock, so the full value may go unrealized until after the merger or even potentially after the combined companies can demonstrate growth.

Enterprise Products Partners

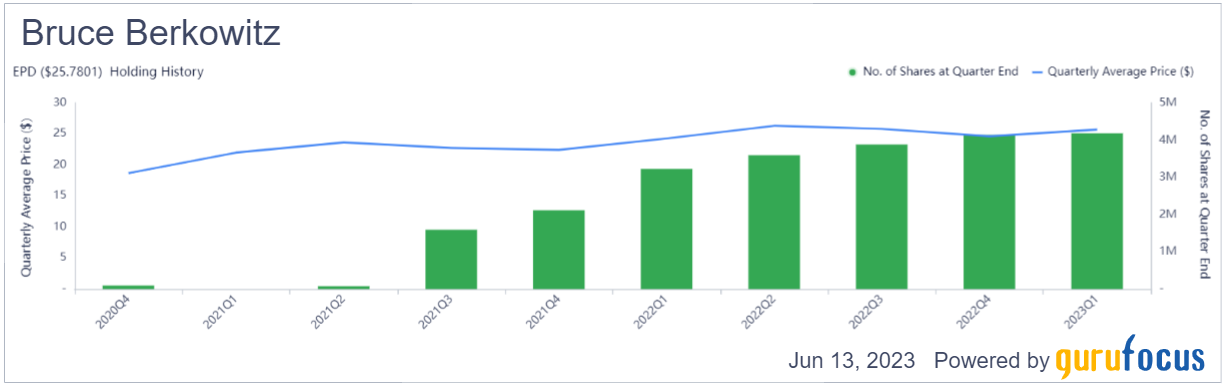

The fund upped its stake in Enterprise Products Partners (EPD, Financial) by 0.97% for a total holding of 4,182,800 shares. The trade added 0.09% to the equity portfolio at the quarter’s average share price of $25.69.

Enterprise is another midstream company that owns natural gas and crude oil pipelines and storage facilities. In fact, it is one of the largest midstream companies in North America, with more than 50,000 miles of pipeline, and it even transports to international markets.

Enterprise may not have a record as a great stock from a capital gains perspective, but it sports an incredible dividend yield of 7.37% at a payout ratio of 0.75. With a share buyback ratio of 0.3, it is not funding the dividend with share issuances.

The company’s GuruFocus financial strength rating is 4 out of 10, while its profitability rating is 8 out of 10. The GF Value chart rates the stock as modestly undervalued.

See also

As of the quarter’s end, the firm held 11 stocks in an equity portfolio valued at $1.21 billion. The top holdings were The St. Joe Co. (JOE, Financial) with 83.08% of the equity portfolio, Enterprise Products Partners with 8.96% and Commercial Metals with 5.15%.

In terms of sector weighting, the fund was most invested in real estate via St. Joe, followed distantly by energy and basic materials.