The Matthews Pacific Tiger Fund (Trades, Portfolio) recently disclosed its portfolio updates on its website for the fourth quarter of 2022, which ended on Dec. 31.

The Matthews Pacific Tiger Fund (Trades, Portfolio) seeks sustainable long-term capital appreciation by investing mostly in Asian companies, excluding Japan, with a focus on emerging economies. It evaluates stocks using a bottom-up, fundamentals-based approach with a focus on long-term results. The fund is managed by Sharat Shroff, Inbok Song, Winnie Chwang and Andrew Mattock.

As China began rolling back Covid restrictions and analysts predicted lackluster outlooks for the global economy in 2023, the Matthews Pacific Tiger Fund (Trades, Portfolio) went on an extensive selling spree to end the year. Its sells included not only small caps, but even the likes of Taiwan Semiconductor Manufacturing Co. Ltd. (TPE:2330, Financial) and Baidu Inc. (HKSE:09888, Financial). The only buy on its quarterly update was Contemporary Amperex Technology Co. Ltd. (SZSE:300750, Financial).

Investors should be aware that portfolio updates for mutual funds do not necessarily provide a complete picture of a guru’s holdings. The data is sourced from the quarterly updates on the website of the fund(s) in question. This usually consists of long equity positions in U.S. and foreign stocks. All numbers are as of the quarter’s end only; it is possible the guru may have already made changes to the positions after the quarter ended. However, even this limited data can provide valuable information.

Taiwan Semiconductor Manufacturing

The fund slashed its top holding, Taiwan Semiconductor Manufacturing (TPE:2330, Financial), by 30.1%, leaving a remaining stake of 14,425,000 shares. The trade shaved 1.88% off the equity portfolio. During the quarter, shares averaged 442.17 New Taiwan dollars ($14.88).

Taiwan Semiconductor is the uncontested leader in the global semiconductor production market, making approximately 50% of the world’s chips and around 90% of its advanced chips. Its process leadership, lower costs and other economies of scale give it enormous competitive advantages.

One of the main reasons the company has become so dominant in its industry is there are so many steps in chip production that even a small error or inefficiency in the process can drastically reduce the success rate of finished products. This has a compounding effect down the line and means the company with the best process is able to create far more product at a much lower cost.

Those worried about geopolitical risks may find it reassuring the company has purchased a property in Arizona and plans to produce 3nm chips there in order to allay the fears of its U.S. customers. However, Taiwan Semiconductor must still contend with the broad economic slowdown as well as the cyclical correction in the semiconductor industry.

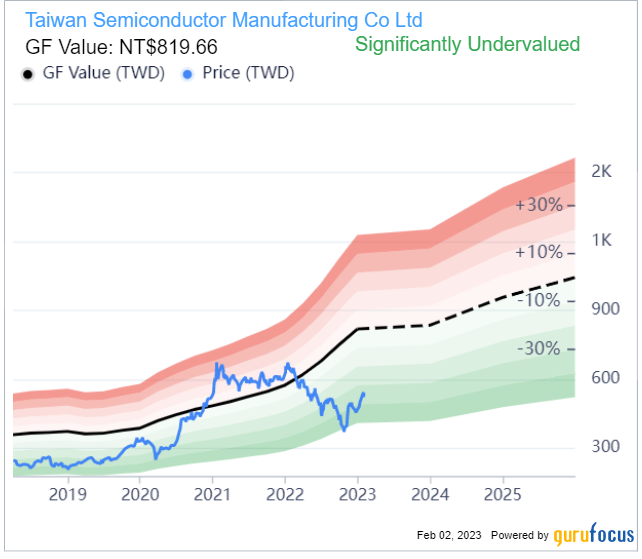

On Feb. 2, Taiwan Semiconductor traded around NT$540 per share for a market cap of NT$14 trillion. It has a GuruFocus financial strength rating of 10 out of 10 and a profitability rating of 10 out of 10. The GF Value chart rates the stock as significantly undervalued.

Baidu

The fund completely sold out of its 3,701,200-share stake in Baidu (HKSE:09888, Financial), which previously took up 1.25% of the equity portfolio. Shares changed hands for around 99.66 Hong Kong dollars ($12.70) during the quarter.

Baidu is a Chinese internet and technology giant that specializes in artificial intelligence, internet services, search engines and related products. Its primary source of revenue is the advertising income from its namesake search engine, which is the most popular search engine in China.

To combat the cyclicality of its online advertising business, Baidu is investing in a wide variety of technology and advertising opportunities. In terms of ability to spur growth, its artificial intelligence projects seem to provide the best outlook, and the company plans to launch its own AI chatbot in response to OpenAI’s ChatGPT.

However, it is also pivoting from traditional online ads more toward managed business pages and non-online marketing businesses. Baidu’s AI cloud platform is also slowing down on the growth front, though it is still gaining business steadily.

While Baidu’s revenue growth has been steady, its earnings growth has been choppy and has shown declines in recent years.

Contemporary Amperex Technology

The fund’s only buy for the quarter was Contemporary Amperex Technology (SZSE:300750, Financial). It purchased 174,916 shares, giving the stock a 0.27% weight in the equity portfolio at the quarter’s average share price of 400.27 Chinese yuan ($59.45).

Contemporary Amperex Technology, commonly known as CATL, is a Chinese battery company that specializes in manufacturing lithium-ion batteries for electric vehicles. It also provides energy storage systems and battery management systems.

In fact, CATL is the leading global supplier of EV batteries, supplying the likes of Nio (NIO, Financial), Ford (F, Financial) and now even Tesla (TSLA, Financial) as of the fourth quarter of 2022. Beginning in the fourth quarter, Tesla began receiving CATL’s M3P batteries for the Model Y. The M3P batteries use lithium manganese iron phosphate rather than lithium iron phosphate, allowing for greater energy density.

While battery sourcing will likely be as variable as lithium sourcing for the budding EV industry, with new suppliers and technologies rapidly being developed, the overall trend is positive as countries around the world ramp up their investments in electrification to help combat climate change and pollution.

CATL has a three-year revenue per share growth rate of 57.4%, a three-year earnings per share growth rate of 60.9% and a return on invested capital that its higher than its weighted average cost of capital, indicating value creation.

See also

As of the quarter’s end, the fund held shares in 52 common stocks valued at a total of $3.67 billion. The turnover rate for the quarter was 0%.

The top holding was still Taiwan Semiconductor (TPE:2330, Financial) despite the reduction with an equity portfolio weight of 5.71%, followed by Samsung Electronics (XKRX:005930, Financial) with 4.82% and Tencent Holdings Ltd. (HKSE:00700, Financial) with 4.64%.

In terms of sector weighting, the fund was most invested in the technology, consumer cyclical and financial services sectors.