Carl Icahn (Trades, Portfolio) is an iconic billionaire activist investor who is the founder and investment manager at Icahn Capital Management, an investment firm with ~$20 billion in its latest 13F equity portfolio for the third quarter of 2022.

Icahn's strategy focuses on activist investing, in which he buys a significant stake and launches proxy fights against companies that he believes are poorly managed in order to replace management and unlock shareholder value. Despite being 86 years old, Icahn is still very active in the stock market, is very outspoken and is not afraid to make bold bets.

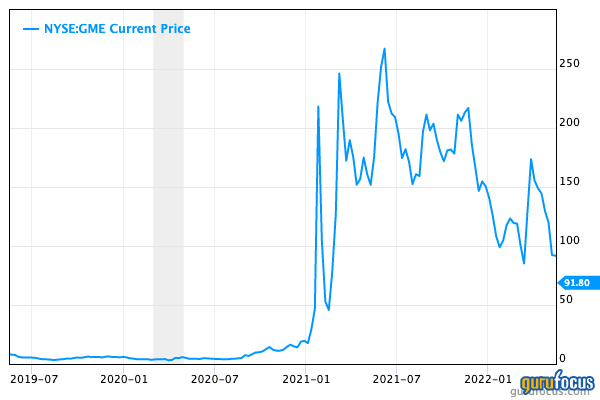

In a recent interview with Bloomberg, Icahn admitted to still having a short position on the popular meme stock, GameStop (GME, Financial), even though it has come down significantly from all-time highs. Investors should note that short positions are not required to be reported on the 13F or other SEC filings, so all of our information on this subject must come from Icahn himself. Let's take a look at the reasons why Icahn might still be holding on to this bearish bet.

The meme stock short

GameStop's (GME, Financial) stock price went vertical in the transition between 2020 and 2021, skyrocketing by over 1,700% from $4 to $80 per share between December 2020 and January 2021 (this was pre the four-to-one stock split which occurred in July 2022).

For those who missed the meme stock saga, GameStop was the original so-called "meme stock," which is a highly-shorted stock that retail traders piled into, causing a short squeeze as short-sellers were forced to cover their positions and bid the price up even further. The buyers of meme stocks had a variety of reasons; some genuinely believed the stock was undervalued at first, some just thought buying shares of an obviously struggling company was funny and others saw the opportunity to trigger a short squeeze and make fast money if they could get enough buyers to join in. A situation like this would be unlikely to happen outside of a raging bull market, as no cautious investor would take the risk.

Nowadays, GameStop trades around $25 per share, which may be down from all-time highs but is still over 400% higher than before the meme stock rally. Icahn said he was shorting the stock close to the peak of its price and still holds a short position against the company. It's unclear exactly what point he bought it at, but if he's still holding it, it seems likely that he timed it well and managed to avoid getting squeezed out himself before the stock price began to drop.

Shaky business model

So the question now is, is GameStop worth 400% more than its pre-meme-stock price or not?

For background, GameStop was founded in 1984 in Dallas, Texas and grew to become the largest video game retailer in the world. As of the first quarter of 2022, the company operates 4,573 stores with over 3,000 in the U.S., followed by 907 stores in Europe, 417 stores in Australia and 231 in Canada. The business benefited during 1980s, 1990s and early 2000’s as most people went into GameStop stores to purchase games. However, the rise of online game downloads and online game subscriptions disrupted the company’s entire business model.

Xbox launched its full-game download service in 2007, which was called “Xbox Originals." This was followed by PlayStation, which launched a similar offering. Then we have the rise of cloud gaming pioneered by companies such as Nvidia (NVDA, Financial), which really put a nail in the coffin for the franchise.

GameStop made a series of acquisitions between 2004 and 2016 as it aimed to diversify its business model. These acquisitions included BuyMyTronics, a Denver-based online marketplace for consumer electronics, acquired in 2012; Spring Mobile which was acquired in 2013; and 507 AT&T (T, Financial) store chains, acquired in 2016. These acquisitions didn’t really help the company, as its financial position continued to decline.

New management

A positive for GameStop was a management change in the first quarter of 2021. George Sherman stepped down and was replaced by Ryan Cohen, who is the founder of Chewy (CHWY, Financial), the leading e-commerce marketplace for pet owners. He is also an activist investor and a large GameStop shareholder, which means he has skin in the game. Cohen then appointed two experienced ex-Amazon (AMZN) executives, Matt Furlong and Mike Recupero, as a new CEO and chief financial officer to take the helm in June 2021. This was a great start, but just one month later, the CFO was fired and replaced.

NFT and FTX bankruptcy

A turnaround strategy GameStop envisaged was to become a leader in NFTs, or non-fungible tokens, by offering a physical place for digital assets. In September 2022, the company even scored a partnership with crypto exchange FTX, which resulted in strong positive press for the business.

However, those who've been keeping an eye on the news may have noticed that FTX imploded in mid-November 2022 and filed for bankruptcy after Binance refused to bail out the business.

This was really bad timing (and unlucky) for GameStop, as now legislators are pursuing increased crypto and possibly even NFT regulation, which could impact GameStop even more negatively.

Declining financials

Analyzing GameSop's financials, it is clear to see the business is declining. The company generated $6 billion in revenue during the trailing 12 months, which is down from the $6.4 billion generated in 2020. In addition, this revenue is lower than the $8.3 billion generated in 2019 and the $8.5 billion in 2018.

In the second quarter of 2022, revenue was $1.14 billion, which missed analyst expectations by $129 million. These are not great financial results for shareholders, but they are great for short sellers.

Profitability is also a challenge for GameStop as the company has reported just one profitable quarter over the past 10 quarters.

The only silver lining is in the second quarter of 2022, when the loss per share was just $0.36, which actually beat analysts' very low expectations by $0.19.

GameStop has continued to issue more shares as of the second quarter of 2021, as its share count increased from 277 million to 300 million. This has diluted shareholders but has allowed the company to raise its cash position from $694.7 million over $1.4 billion. This is a genius move by management as, if GameStop is overvalued, then raising capital at such a high share price is too good an opportunity to pass up.

High valuation

GameStop is trading at a fairly high valuation with a price-sales ratio of 1.2, which is 51% higher than its five-year average.

The GF Value line indicates a fair value of $21.38 per share, which means the stock is modestly overvalued.

Final thoughts

GameStop's business model is still on shaky ground and its financial position is not looking great. The raising of capital via share issuing could offer some dry powder to survive, but I imagine this is upsetting existing shareholders. Given these fundamental business issues, the stock isn’t exactly cheap. Therefore, I think it makes a lot of sense for Icahn to still has a short position on the stock. Of course, Icahn could exit the short position at any time without notifying the public, and GameStop's history as a meme stock is dangerous for short-sellers, so I might steer clear due to these reasons.