Warren Buffett (Trades, Portfolio), who heads the world's largest investment conglomerate Berkshire Hathaway (BRK.A, Financial)(BRK.B, Financial), has been extremely active in 2022. In previous posts, I’ve written about how Buffett showed restraint in 2020 but is now splashing the cash in a variety of investments, “being greedy while others are fearful” so to say. In the third quarter of 2022, according to its latest 13F filing with the SEC, Berkshire Hathaway continued this trend by investing into three new stocks: Taiwan Semiconductor Manufacturing (TSM, Financial), Louisiana-Pacific Corp. (LPX, Financial), and Jefferies Financial Group (JEF, Financial).

Investors should be aware that 13F reports do not provide a complete picture of a guru’s holdings. They include only a snapshot of long equity positions in U.S.-listed stocks and American depository receipts as of the quarter’s end. They do not include short positions, non-ADR international holdings or other types of securities. However, even this limited filing can provide valuable information.

1. Taiwan Semiconductor Manufacturing

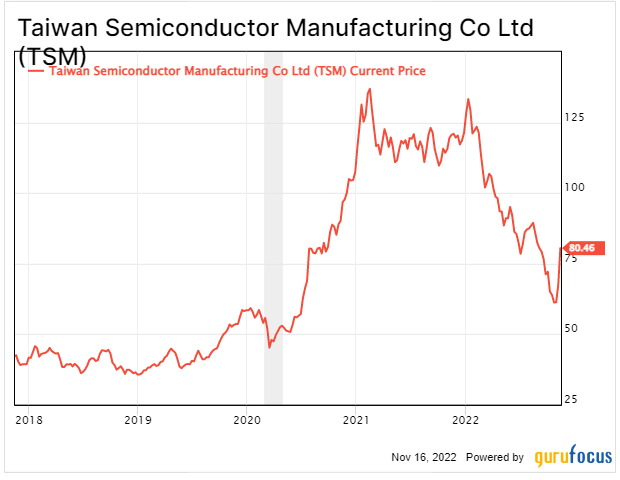

In the third quarter of 2022, Berkshire Hathaway loaded up on ~60 million shares of Taiwan Semiconductor Manufacturing (TSM, Financial) for a huge $4 billion stake at an average price of $83 per share. This is close to where the stock trades at the time of writing.

Buffett has historically steered clear of the technology industry, as it is often rapidly changing and hard to predict the winners. Even though Buffett has said in the past that positions worth more than $1 billion need his approval, that doesn't negate the possibility that one of his portfolio managers, Todd Combs or Ted Weschler, could have been the driving force behind the Taiwan Semiconductor holding. The portfolio managers could have more input on the firm's larger investing decisions as Buffett leaves more of the business to them.

A wonderful business with a moat

Taiwan Semiconductor Manufacturing is the world's largest chip manufacturing company. The business has ~54% market share of the foundry industry and is well ahead of its closest competitor Samsung (XKRX:005930, Financial), which has ~16% share of the chip manufacturing market according to Statista.

The semiconductor industry is continually innovating and chips are getting smaller and smaller thanks to Moore’s law. The leaders in the industry are those who can produce the smallest ships, with the highest power at scale.

Intel (INTC, Financial) is also a manufacturer of semiconductors, but the company has fallen behind massively since production delays in 2020. Intel fell behind with its 7 nanometer chip production, which meant the company has had to outsource its manufacturing of new chips to Taiwan Semiconductor. This is testament to the technological and manufacturing prowess of Taiwan Semiconductor, which now produced much smaller 5 nanometer chips and is even starting to produce ultra-tiny 3 nanometer chips.

The company’s customers include Apple (AAPL, Financial), which generates around one quarter of the revenue for Taiwan Semiconductor. Apple designs the A-17 chip used in the iPhone 14 but then outsources its manufacturing to Taiwan Semiconductor. Its other customers include leading chip designers such as Nvidia (NVDA, Financial), Advanced Micro Devices (AMD, Financial), Qualcomm (QCOM, Financial) and many more.

Taiwan Semiconductor has a competitive advantage due to its strong leadership in manufacturing and continual innovation. While Intel is thinking about breakfast, Taiwan Semiconductor is already eating its lunch.

High-growth financials

Taiwan Semiconductor generated solid financial results for the third quarter of 2022. The company reported a staggering $19.2 billion in revenue, which increased by a solid 29% year over year. This was despite a cyclical downturn in the semiconductor industry, which looks to be a short-term adjustment after the demand boom and supply shortage of 2022. The majority of its revenue, ~41%, is derived from smartphone chips for companies such as Apple. However, its Internet of Things (IoT) segment is growing rapidly, as revenue for this segment increased by 33% year over year.

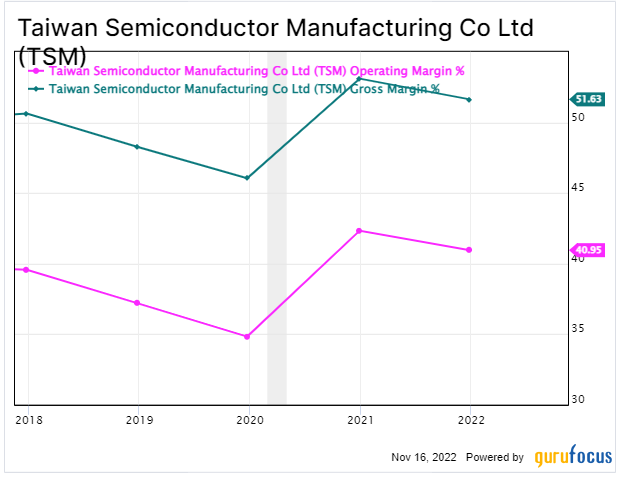

Taiwan Semiconductor is immensely profitable with operating income of $9.7 billion in the third quarter, which increased by a rapid 57% year over year, at over a 40% operating margin.

Free cash flow was also strong at $1.9 billion, which increased by over 200% year over year.

Taiwan Semiconductor has a fortress balance sheet with cash and marketable securities of $48 billion versus a debt level of $28.3 billion, only $735 million of which is “current debt" due within the next two years.

Valuation

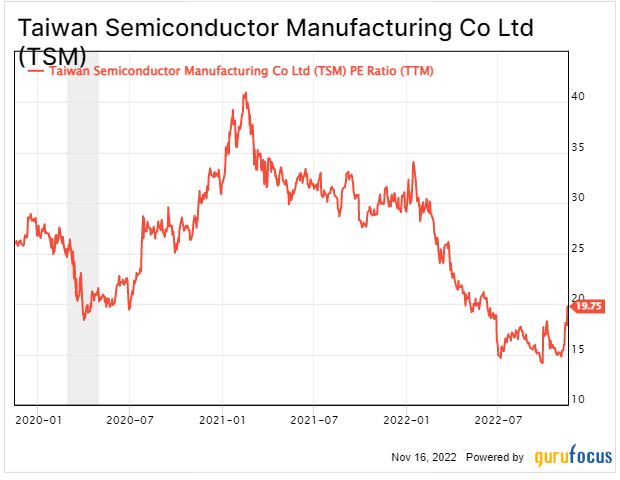

Taiwan Semiconductor has a forward price-earnings ratio of 12.53 as of this writing, which is 44% cheaper than its five-year average. It also trades cheaper than Intel, which has a forward price-earnings ratio of 15.8.

The GF Value chart indicates a fair value of $125 per share, which means the stock is “significantly undervalued” at the time of writing.

2. Louisiana-Pacific Corp

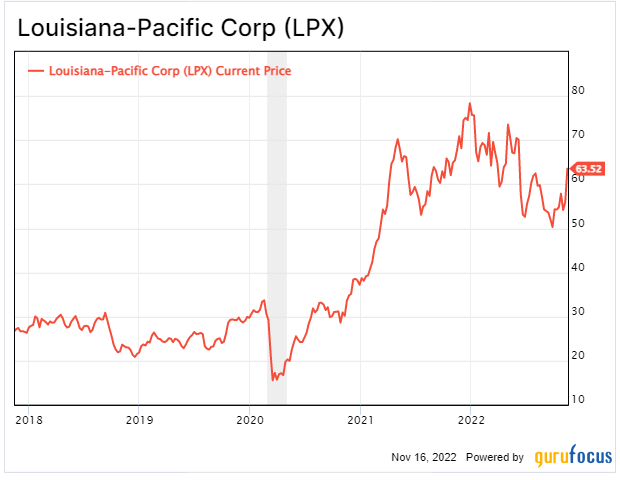

In the third quarter of 2022, Berkshire Hathaway also purchased 5.8 million shares of wood products company Louisiana-Pacific Corp. (LPX, Financial). The stock price averaged ~$57 per share during the quarter. This was a much smaller stake than the Taiwan Semiconductor investment, with an approximate investment value of ~$331 million. Thus, it's highly likely this position came from one of Buffett's portfolio managers.

Solid business model

Louisiana-Pacific is a manufacturing business that specializes in wood products. The company is the world's largest producer of Oriented Strand Board (OSB) panels, which we call chipboard in the U.K. These are those behind the scenes boards that are made up from a combination of various wood chippings and shavings, hence the name. The boards are mainly used as a plywood substitute, where low-cost materials are required. For example, temporary building sites are often constructed using chipboard as it's easy to put together and cheap.

This type of material disrupted the marketplace for traditional hardwoods. For example, historically everything from coffee tables to bookcases were manufactured from solid oak or pine. This was great for aesthetics and quality, but it wasn’t cheap. OSB panels solve this problem as they are very cheap and can even be coated with plastic veneer which looks like real wood. For example, if you look at your kitchen cabinets, it is likely made from this type of material.

Louisiana-Pacific has 24 mills in total, with 15 across the U.S., six in Canada, two in Chile and one in Brazil.

Solid financials

Louisiana-Pacific generated strong financial results for the third quarter of 2022. The company generated $852 million in revenue, which beat analyst expectations by $21.3 million.

The company also generated strong profits with earnings per share of $3.05, which blew analyst estimates out of the water by $1.55.

It has a strong balance sheet with $469 million in cash and short term investments versus just $386 million in total debt. The company also pays a 1.36% dividend, which is better than nothing.

Valuation

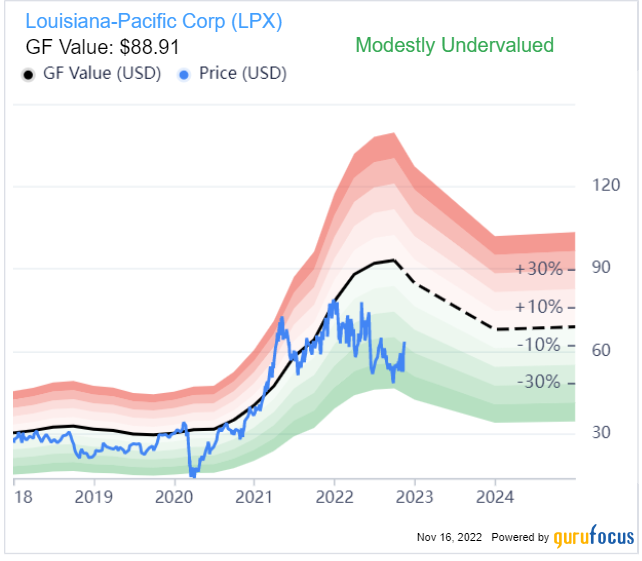

Louisiana-Pacific trades at a price-earnings ratio of just 5, which is 61% cheaper than its five-year average.

The GF Value chart indicates a fair value of $89 per share, making the stock “modestly undervalued” at the time of writing.

3. Jefferies Financial Group

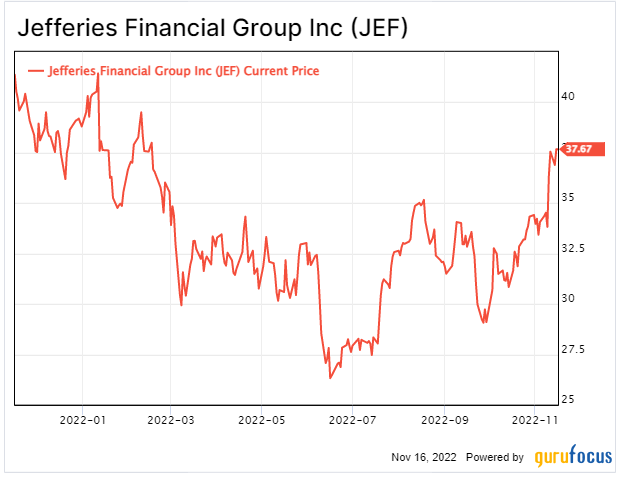

In the third quarter of 2022, Berkshire Hathaway purchased 433,000 shares of Jefferies Financial Group (JEF, Financial) at an average price of $32 per share. This is only a tiny investment for Berkshire, worth "just" $14 million, so again, it was likely to have been initiated by one of his portfolio managers.

Jefferiesis a U.S.-based investment bank and financial services company. The company provides its clients with financial advice, “securities” or stock research and asset management services and acts as a broker for large institutions.

Strong third quarter results

The company generated strong financial results for the third quarter of 2022. Revenue was $1.52 billion, which beat analyst estimates by $162 million.

The company also generated strong earnings per share of $0.78, which beat analyst estimates by $0.01. On an adjusted basis, its earnings beat was much greater with $1.10 reported at a $0.37 beat over expectations. Its operating margin has been on an upward trend and is over 25%, which is fantastic.

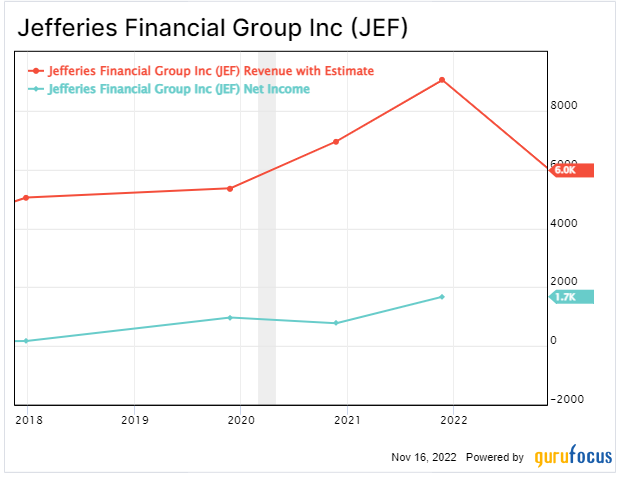

Its free cash flow per share has increased by tenfold since 2018. With just $1.15 per share in free cash flow reported for 2018, this metric has risen to $10.88 per share for the trailing 12 months.

The company trades at a price-earnings ratio of 11.6, which is 91% cheaper than its five-year average. In addition, the company trades at a price-book ratio of 0.87, which is cheaper than the financial industry average of 1.31.

Final thoughts

Berkshire Hathaway has been very active in the market in 2022. The Oracle of Ohama's firm has loaded up on these three wonderful companies which are trading at fair prices. Berkshire's biggest new bet is on Taiwan Semiconductor Manufacturing, which is a business with high returns on capital and a dominant market position. Louisiana-Pacific and Jeffries are smaller positions that are more likely to have been initiated by Buffett's portfolio managers, but both still look like solid value stocks.