Steven Cohen (Trades, Portfolio), chairman and CEO of Point72 Asset Management, disclosed in regulatory filings that his firm established a position in Progress Acquistion Corp. (PGRWU, Financial) and boosted its holdings of Relmada Therapeutics Inc. (RLMD, Financial) and Immunic Inc. (IMUX, Financial).

According to GuruFocus Real-Time Picks, a Premium feature based on SEC Form 4, Schedule 13D and 13G filings, the Stamford, Connecticut-based firm made the trades during the week of Oct. 10.

Firm background

Prior to founding Point72, Cohen received a B.S. in economics at the University of Pennsylvania Wharton School of Business and managed proprietary capital at Gruntal & Co. Cohen converted his investment operations to the Point72 Asset Management family office in 2014 and purchased the New York Mets baseball team in 2020.

Point72 invests using a long-short equity style that combines sector-aligned models with fundamental analysis and bottom-up research.

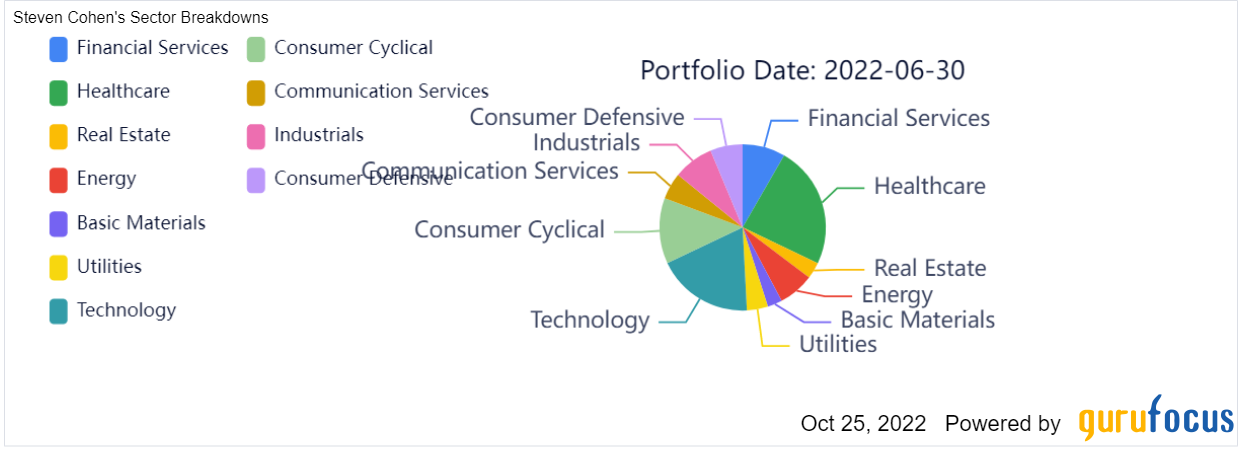

The firm’s $23.35 billion 13F equity portfolio contains 1,341 stocks with a quarterly turnover ratio of 43%. The top four sectors in terms of weight are health care, technology, consumer cyclical and financial services, representing 21.31%, 17.70%, 12.59% and 7.50% of the equity portfolio.

Investors should be aware 13F filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

If a guru makes a purchase or a sale of a company in which he or she owns more than a 5% stake, the guru must file the trade using the Schedule 13D or 13G filing within 10 days of the transaction date.

Progress Acquisition

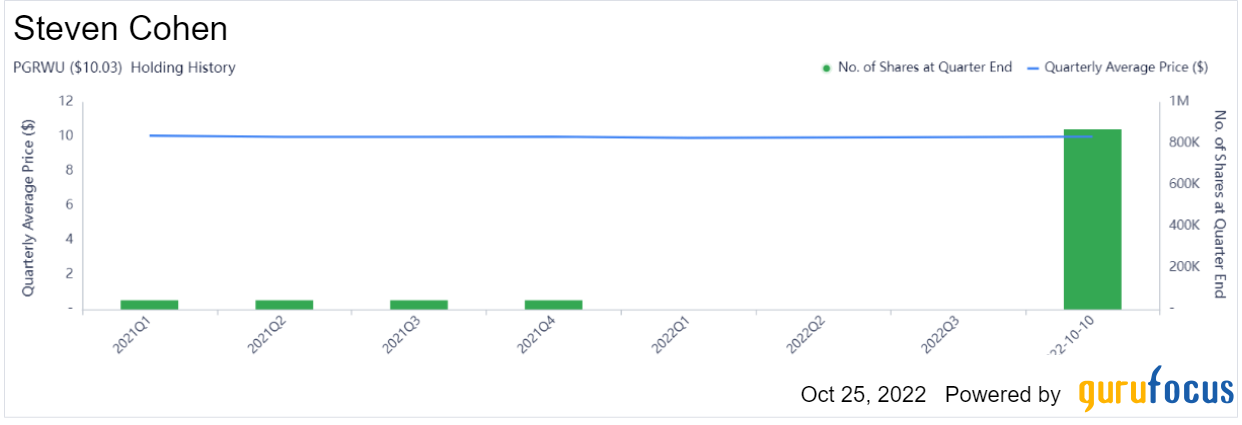

Point72 invested in 870,229 shares of Progress Acquisition (PGRWU, Financial), giving the position 0.04% of equity portfolio space. The stock traded around $10.01 on the Oct. 10 transaction date.

According to the company’s website, the Boston-based special purpose acquisition company seeks opportunities to deliver value and efficient access to public markets for companies in the advertising, marketing, media and entertainment sectors. Emphasis is placed on companies that drive digital revolutions in the media sector.

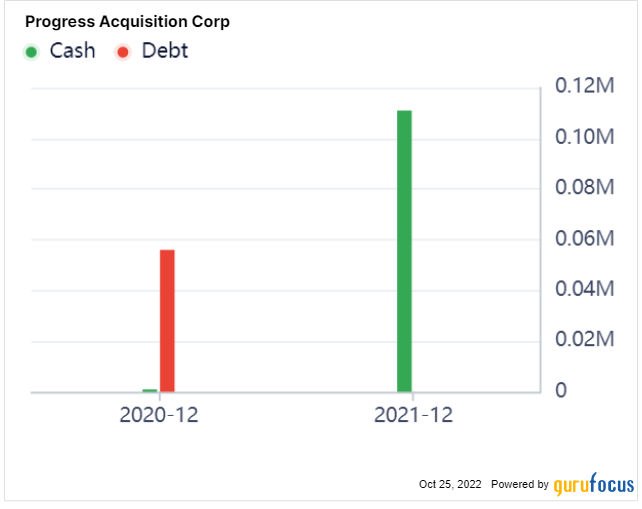

The SPAC said in its June quarterly report that it has not commenced any operations since its September 2020 inception, apart from the formation and initial public offering of securities. As of June, the company has approximately $172.89 million in total assets, including $2,354 in cash and cash equivalents and approximately $172.7 million in money market funds held in its trust account.

Relmada Therapeutics

Point72 added 829,463 shares of Relmada Therapeutics (RLMD, Financial), boosting the position by 65.18% and its equity portfolio by 0.02%. Shares traded around $6.47 on the Oct. 13 transaction date.

The Coral Gables, Florida-based clinical-stage biotech company develops chemical entities with novel versions of drug products that treat central nervous system diseases. Relmada is focused on developing esmethadone for the treatment of depression and other potential indications.

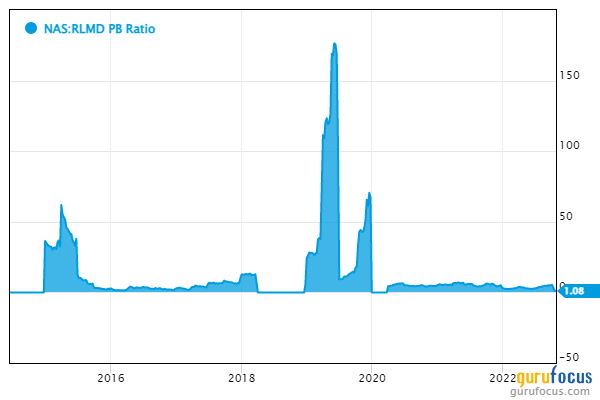

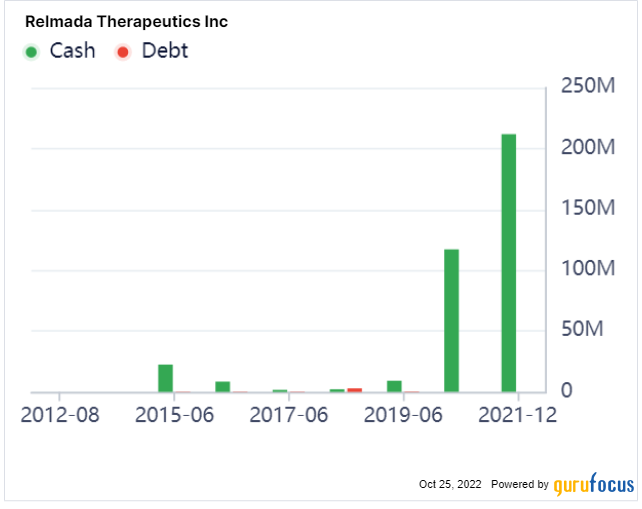

As of Tuesday, the company has a market cap of $202.55 million. Relmada’s price-book ratio of 1.05 is near a nine-year low and outperforms approximately 75% of global competitors.

Relmada’s financial strength ranks 9 out of 10 on several positive investing signs, with include no long-term debt and an equity-to-asset ratio that outperforms over 91% of global competitors.

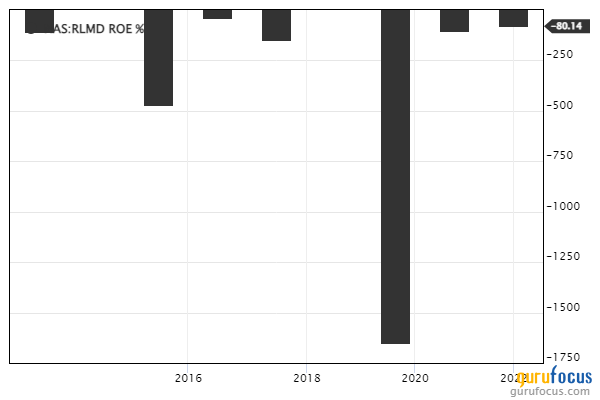

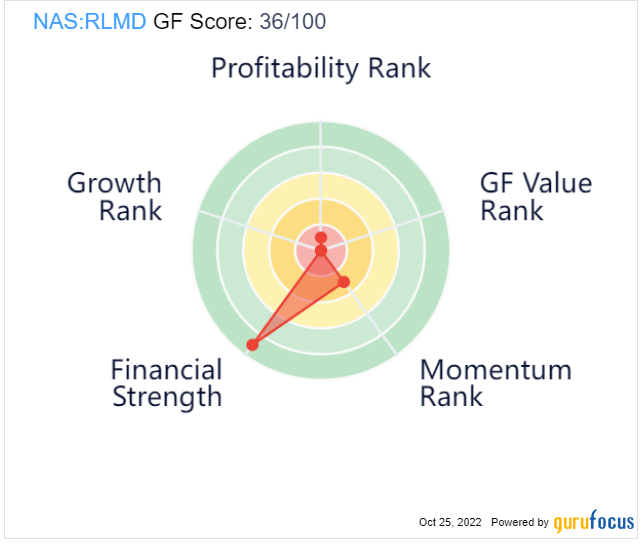

Despite high financial strength, Relmada has a low profitability rank of 1 out of 10, driven by returns on equity and assets underperforming more than 80% of global competitors. GuruFocus also ranks Relmada’s momentum a low 3 out of 10 even though the company’s 14-day relative strength index of 20.33 outperforms over 97% of global competitors.

Relmada’s GF Score of 36 out of 100 may give an incomplete picture of the stock’s potential because the company does not have enough data to compute a growth rank or a GF Value rank.

Immunic

Point72 purchased 592,546 shares of Immunic (IMUX, Financial), boosting the position by 44.72% and its equity portfolio by 0.02%. Shares traded around $9.67 on the Oct. 12 transaction date.

The New York-based clinical-stage biotech company develops a pipeline of oral immunology therapies aimed at treating chronic inflammatory and autoimmune diseases, including ulcerative colitis, Crohn’s disease, relapsing-remitting multiple sclerosis and psoriasis. The company said in its June quarterly report that its vidofludimus calcium (IMU-838) drug candidate, which targets a key enzyme in the intracellular metabolism of immune cells, reached Phase 3 trials for relapsing multiple sclerosis and Phase 2 trials for progressive multiple sclerosis. The company also develops two other candidate molecules: IMU-935 for the inverse agonist of RORyt and IMU-856 for the restoration of the intestinal barrier function.

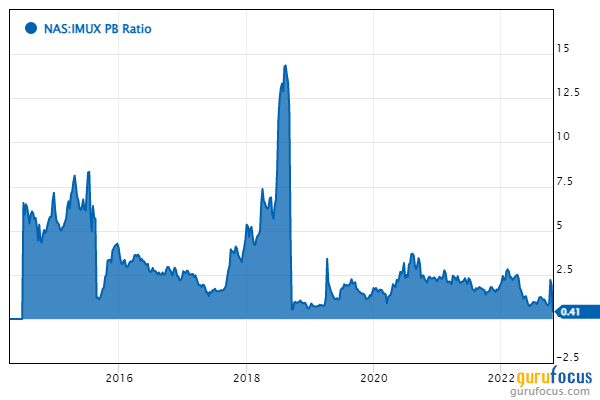

As of Tuesday, Immunic has a market cap of $51.96 million. The company’s price-book ratio of 0.41 outperforms approximately 93% of global competitors.

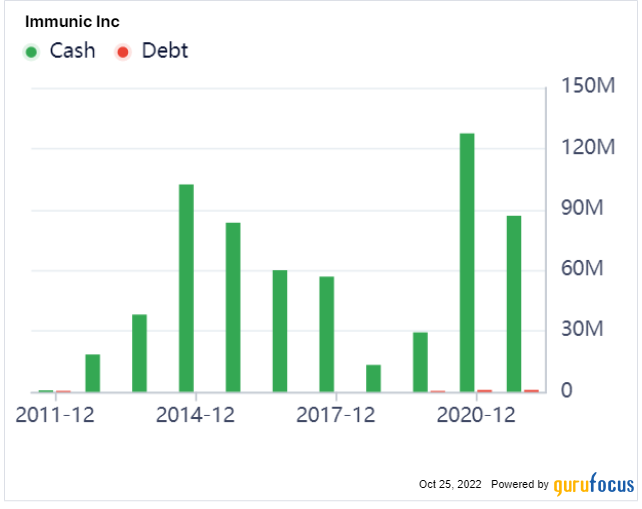

Immunic’s financial strength ranks 8 out of 10 on several positive investing signs, which include a cash-to-debt ratio that outperforms over 75% of global competitors and a debt-to-equity ratio that outperforms more than 98% of global biotech companies.

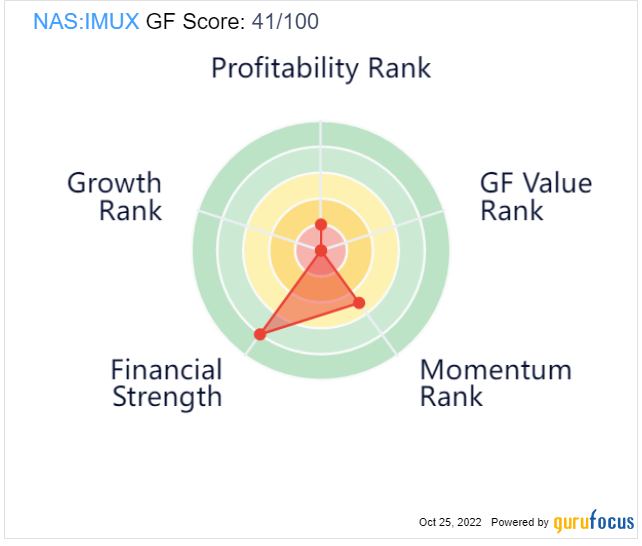

Immunic’s momentum ranks 5 out of 10, while profitability ranks 2 out of 10 on the back of returns on equity and assets underperforming more than 65% of global competitors. Despite this, the company does not have enough data to compute a growth rank or a GF Value rank and thus, the GF Score of 41 out of 100 may give an incomplete picture of its potential.