Catherine Wood (Trades, Portfolio) is the founder and chief investment officier at Ark Invest, an investment firm that specializes in a range of active exchange-traded funds (ETFs) in the “disruptive technology” space.

Wood rose to stardom in 2020 after her ETFs posted returns of over 100% thanks to big bets like Tesla (TSLA, Financial), which increased by nearly eight-fold over the year. However, since February 2021, Ark's flagship fund ARKK has declined by over 77%. This has mainly been driven by the high inflation and rising interest rate environment.

Despite the vast decline, Ark Invest's funds are starting to attract investors again as the firm has achieved over $1.3 billion of inflows in 2022, with over $400 million of inflows in the last couple of months alone. This is an indication investors are seeing value in Ark Invest’s funds. Thus, in this article, I'm going to break down two undervalued growth stocks which Ark Invest has been buying in the third quarter of 2022 according to its latest 13F filing with the SEC; let’s dive in.

Investors should be aware that 13F reports do not provide a complete picture of a guru’s holdings. They include only a snapshot of long equity positions in U.S.-listed stocks and American depository receipts as of the quarter’s end. They do not include short positions, non-ADR international holdings or other types of securities. However, even this limited filing can provide valuable information.

1. Shopify Inc.

Shopify (SHOP, Financial) is a software platform that gives entrepreneurs everything they need to sell online. Shopify’s stock price is down an eye-watering 82% from its all-time highs in November 2021, which has mainly been driven by the macroeconomic environment. Cathie Wood increased her firm's position in the stock by over 1,000% in the third quarter of 2022. Ark invest purchased approximately 14 million shares at an average price of $34 per share, which is ~12% more expensive than where the stock trades at the time of writing.

Business model

Shopify is a platform that enables small businesses or entrepreneurs to set up their own e-commerce website simply and easily. The company has a 10% market share in the U.S. e-commerce market, which is second to Amazon (AMZN, Financial) with a 40% market share.

Small businesses are an underserved market when it comes to access to credit, due to the uncertainty of cash flow and lack of consistent track records. However, as Shopify has all the data on a business' sales, it can assess its capital requirements accurately and thus offer loans via its Shopify Capital business. This is especially useful for e-commerce companies which may have a large portion of their funds tied up in stock or just require extra funds to fulfill purchase order obligations.

Shopify has also partnered with Meta Platforms (META, Financial) to offer “Shop Pay” checkout via Facebook and Instagram. In addition, the platform has integrated with TikTok Shopping, as TikTok is investing extensively into live streaming. The company is even testing an NFT program with its Shopify Plus customers in the U.S.

Growing financials

Despite the decline in share price, Shopify has grown its Gross Merchandise Volume (GMV) by 11% year over year to $46.9 billion. This is slower than past growth rates, but still equates to a three-year compounded annual growth rate of 50%, which is fantastic. This growth was driven by strong gross payments volume of $24.9 billion, as Shopify Pay and its Point of Sale solutions gain further market traction.

The company generated revenue of $1.3 billion in its most recent quarter, which increased by a rapid 16% year over year. This also equated to a three-year compound annual growth rate of 53%.

The company generated solid monthly recurring revenue of $107.2 million, which was driven by increased merchant adoption of its Point of Sale platform. Its Subscription Solutions revenue was $366.4 million, which increased by 10% year over year.

Shopify did generate an eye-watering operating loss of $190.2 million, or 15% of revenue, in the second quarter of 2022. This was worse than the loss of $139.4 million or 12% of revenue generated in the second quarter of 2021. This was due to investments into its fulfillment network, which is expected to be a drag on profitability at least until it reaches a significant scale.

The company acquired “Deliverr,” a shipping logistics company, for $1.7 billion in cash and $420 million earlier in stock in 2022. This acquisition is expected to help vertically integrate the business and ultimately improve margins longer term. In addition, the upcoming holiday season is forecasted to generate strong merchant transaction growth, which is a positive.

Valuation

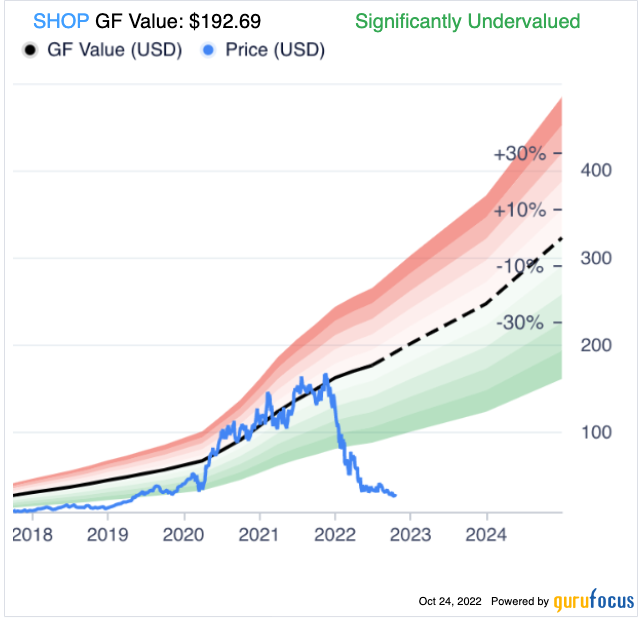

Shopify trades at a price-sales ratio of 6.9, which is 77% cheaper than its five-year average. Although, as we can see on the chart below, this valuation is still higher than stocks such as Amazon and ebay (EBAY, Financial).

The GF Value calculator indicates a fair value of $192 per share for the stock, which means the stock is “significantly undervalued” at the time of writing.

2. Fiverr

Fiverr (FVRR, Financial) is a marketplace platform that connects freelancers with companies for contracting jobs. These jobs include everything from graphic design to website design.

Ark Invest purchased 62,808 shares of Fiverr in the third quarter of 2022 at an average price of $35 per share. This is 19% more expensive than where the stock trades at the time of writing.

According to a study by Mastercard (MA, Financial), global gig economy-related transactions is forecasted to grow at 17% per year to approximately $455 billion by 2023. Fiverr and competitor Upwork (UPWK, Financial) are forecasted to benefit from this growth trend.

Growing financials

Fiverr generated revenue of $85 million in its most recently reported quarter, which increased by 13% year over year. This growth was driven by a 14% increase in average spend per buyer to $259 and a 60% increase in average buyer annual spending to $10,000.

The company also generated solid adjusted Ebitda of $4.6 million at a 5.4% adjusted Ebitda margin. Fiverr generated earnings per share of $0.12, which beat analyst expectations by $0.03 per share.

Fiverr rolled out its “Project Briefing” feature to enable buyers to describe projects with a complex scope in a more structured manner. The company has also streamlined its cost structure which, combined with a strong balance sheet, means the business is in a strong position moving forward.

Valuation

Fiverr trades at a price-sales ratio of 3.18, which is 81% cheaper than its five-year average. The stock has historically traded at a higher valuation than competitor Upwork but trades at a similar level at the time of writing.

According to the GF Value calculator, Fiverr has a fair value of $130 per share, which means the stock is undervalued at the time of writing. However, the GF system does indicate a possible “value trap,” which is perhaps due to the sharp revenue decline, although I don’t believe this is an issue.

Final thoughts

Both Shopify and Fiverr are growth stocks that are currently facing short-term headwinds. The businesses have solid market positions and are forecasted to benefit from industry trends across the small business landscape. I do expect some volatility within the next year due to the macroeconomic environment but in the longer term, these stocks could be great investments in my opinion, and Ark Invest seems to agree based on the latest 13F data.