ARK Investment Management, the disruptive innovation firm founded by Catherine Wood (Trades, Portfolio), disclosed in a regulatory filing that its top five trades during the third quarter included boosts to its holdings in Shopify Inc. (SHOP, Financial) and Gingko Bioworks (DNA, Financial) and reductions of its holdings in Signify Health (SGFY, Financial), Spotify Technology SA (SPOT, Financial) and Stratasys Ltd. (SSYS, Financial).

The St. Petersburg, Florida-based firm applies an iterative investment process that combines top-down and bottom-up research. ARK Invests seeks to identify opportunities in companies that engage in technological innovations centered around DNA sequencing, robotics, artificial intelligence, energy storage and blockchain technology.

As of September, the firm’s $14.35 billion 13F equity portfolio contains 249 stocks, with 15 new positions and a quarterly turnover ratio of 11%. The top four sectors in terms of weight are health care, technology, communication services and consumer cyclical, representing 37.81%, 32.53%, 11.90% and 11.66% of the equity portfolio.

Investors should be aware 13F filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

Shopify

ARK Invest purchased 13,319,042 shares of Shopify (SHOP, Financial), expanding the position by 1,097.59% and its equity portfolio by 2.50%.

Shares of Shopify averaged $34.02 during the third quarter; the stock is significantly undervalued based on its price-to-GF Value ratio of 0.15 as of Tuesday.

The Ottawa, Ontario-based e-commerce company has a GF Score of 71 out of 100 based on a financial strength rank of 8 out of 10, a growth rank of 7 out of 10, a momentum rank of 5 out of 10, a profitability rank of 4 out of 10 and a GF Value rank of 2 out of 10.

Shopify’s financial strength ranks 8 out of 10 on several positive investing signs, which include a high Altman Z-score of 10.45 and an equity-to-asset ratio that outperforms more than 80% of global competitors.

Gingko Bioworks

ARK Invest added 39,460,799 shares of Gingko Bioworks (DNA, Financial), boosting the stake by 45.17% and its equity portfolio by 0.86%. Shares averaged $2.98 during the first quarter.

The Boston-based biotech company merged in September 2021 with blank-check company Soaring Eagle Acquisition Corp. (SRNGU, Financial). Gingko’s platform enables biotech applications across diverse markets, including food and agriculture, industrial chemicals and pharmaceuticals. As of Tuesday, the company has a market cap of $4.97 billion with an enterprise value of $3.43 billion.

Gingko Bioworks’ financial strength ranks 7 out of 10, driven by a cash-to-debt ratio that outperforms approximately 61% of global competitors and a debt-to-equity ratio that outperforms approximately 78% of global peers.

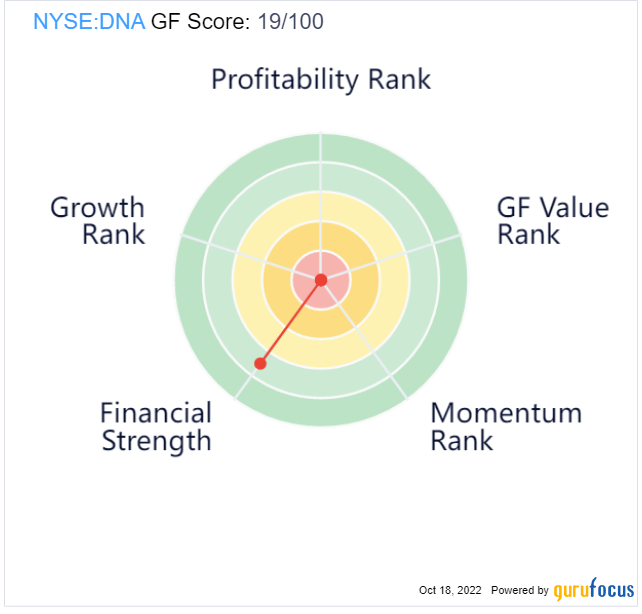

Despite good financial strength, Gingko Bioworks does not have enough data to compute a profitability rank, a growth rank, a GF Value rank and a momentum rank. Thus, the GF Score of 19 out of 100 may give an incomplete picture of the company’s potential.

Signify Health

ARK Invest sold 19,786,600 shares of Signify Health (SGFY, Financial), chopping 90.42% of the position and 1.59% of its equity portfolio. Shares averaged $23.03 during the third quarter.

The Norwalk, Connecticut-based health care technology company has a financial strength rank of 7 out of 10, driven by a high Altman Z-score of 5.84 despite cash-to-debt ratios outperforming just over 55% of global competitors.

Despite good financial strength, Signify Health has a low profitability rank of 2 out of 10. Additionally, the company does not have enough data to compute a growth rank, a GF Value rank and a momentum rank and thus, the GF Score of 23 out of 100 may give an incomplete picture of the stock’s potential.

Spotify

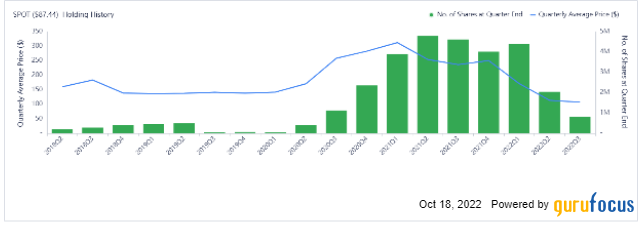

ARK Invest sold 1,243,076 shares of Spotify (SPOT, Financial), slicing 60.83% of the position and 0.83% of its equity portfolio.

Shares of Spotify averaged $107.01 during the third quarter; the stock is significantly undervalued based on its price-to-GF Value ratio of 0.35 as of Tuesday.

The Stockholm, Sweden-based music streaming service has a GF Score of 73 out of 100 based on a momentum rank of 7 out of 10, a rank of 6 out of 10 for financial strength and growth, and a rank of 4 out of 10 for profitability and GF Value.

Stratasys

ARK Invest sold 6,600,411 shares of Stratasys (SSYS, Financial), trimming 80.75% of the position and 0.78% of its equity portfolio. Shares averaged $17.80 during the third quarter.

GuruFocus’ GF Value Line labeled the Eden Prairie, Minnesota-based 3-D printing and manufacturing company a possible value trap based on its low price-to-GF-Value ratio of 0.67 and rank of 2 out of 10 for profitability and growth.

Although the company has a GF Value rank of 10 out of 10 and a financial strength rank of 7 out of 10, Stratasys has a GF Score of 63 out of 100, driven by its low ranks for profitability, growth and momentum.