Gasoline prices are high. Inflation makes large dollar purchases more expensive. There’s talk of recession in the air as interest rates go up to tame inflation. This should be a difficult time for companies in the recreational vehicle business, and yet the world’s biggest manufacturer of RVs, Thor Industries Inc. (THO, Financial), appears to be doing well.

In late September, the company released its fourth quarter fiscal 2022 earnings results, and they were very upbeat. Net sales were up 6.4% from the same quarter of 2021. The gross profit margin increased by 90 basis points and earnings per diluted share popped by 25%.

This under-the-rader stock is also a holding in the portfolio of Bridgewater Associates, the investment firm founded by Ray Dalio (Trades, Portfolio). Bridgewater has been a shareholder since 2015 and recently added more shares in the second quarter of 2022. There were also six other gurus buying the stock that same quarter.

About Thor Industries

Thor owns a group of operating companies that altogether make it the largest manufacturer of RVs in North America and one of the largest RV manufacturers in Europe.

It sells these vehicles through independent, non-franchise dealers in the U.S., Canada and Europe. One key to its success in 2022 has been restocking dealers after their inventories were drawn down by the high demand for RVs during the beginning of the pandemic.

While industry sales fluctuate due to many different economic conditions, the company says it is optimistic about long-term retail sales in North America. In the near term, though, there are headwinds that could slow its growth. For example, its chassis suppliers have problems, including supply shortages, that probably will slow the sales of motorized RVs.

In Europe, there’s also bad news from chassis suppliers, and dealer inventories are below historical levels.

North America accounts for most sales, with 12,641,592 units sold in 2022, compared with 2,887,453 units in Europe.

Based in Elkhart, Indiana, Thor was founded in 1980 and began trading publicly in 1984. It has grown rapidly, with acquisitions responsible for a significant portion of that growth.

Competition

The company reports intense competition because the industry has low barriers to entry. Its main competitors in North America are Forest River Inc. (owned by Berkshire Hathaway (BRK.A, Financial)(BRK.B, Financial)) and Winnebago Industries Inc. (WGO, Financial). In Europe, its primary competitors include Trigano S.A. (TGNOF, Financial), Hobby/Fendt, Knaus Tabbert and various vehicle manufacturers.

Thor also notes, “Our ability to remain competitive depends heavily on our ability to provide a continuing and timely introduction of innovative product offerings to the market. Delays in the introduction or market acceptance of new models, designs or product features could have a material adverse effect on our business.”

Comparing its stock performance with Winnebago, Thor has been the underperformer:

Financial strength

Thor receives a 7 out of 10 ranking for its financial strength from GuruFocus based on its interest coverage, debt-to-revenue ratio and its Altman Z-Score.

After being mostly debt free over the past decade, it took on a major load of long-term debt in fiscal 2020, going from zero to $1.885 billion. Short-term debt totals just $13 million, while it has $312 million in cash or cash equivalents.

For 2022, it had operating income of $1.533 billion and its interest expense came in at $94 million, leaving it with an interest coverage ratio of 16.8.

Both the Piotroski F-Score and Altman Z-Score are high, signaling that the finances are well-managed and strong.

It is a value creator, with a return on invested capital of 21.69% compared to its weighted average cost of capital at 11.86%.

Profitability

Thor receives a perfect 10 out of 10 for profitability:

The ranking is based on several factors such as the operating margin, Piotroski F-Score, the trend of the operating margin, consistency of the profitability and business predictability rank.

Its operating margin is 9.40%, well ahead of the vehicle and parts industry median of 4.18, and over the past 10 years it has averaged growth of 1.06% per year.

The Piotroski F-Score is 8 out of 9, a high score. Looking at the consistency of profitability, earnings per share without non-recurring items was negative only one year in the past decade. For the past two years, bottom line growth has been outstanding:

The company has a business predictability rating of 4.5 out of 5 stars.

Growth

The company gets a full 10 out of 10 GuruFocus growth ranking, driven by the growth of its revenue and Ebtida over the past few years, as well as the predictability of its five-year revenue growth:

As the table above shows us, Thor’s growth rates have been exceptional, especially its earnings per share without non-recurring items. Two great years were driven by the unusually high popularity of RVs at the beginning of the Covid-19 pandemic. Cautious investors would expect that earnings growth to slow in the coming years.

Still, that big bump in revenue and earnings also led to a jump in free cash flow. In fiscal 2021, free cash flow was $398 million; it then soared 89.50% to $748 million. That’s a lot of additional cash flow available for internal improvements and external acquisitions (and Thor has been a busy acquisitor since its founding in 1980 - it began with the purchase of Airstream).

Dividends and share repurchases

A modest amount of Thor’s free cash flow went toward increasing the dividend. In fiscal 2021, it paid $0.41 per share per quarter; in fiscal 2022 it increased the amount by 4.8% to $0.43 per quarter.

Based on the Oct. 13 share price of $78.38, that makes the dividend yield 2.19%, which is good for a growth company. And the dividend payout ratio remains very low at 0.08%.

Turning to share buybacks, the most recent round reversed five years of net share issuances:

Valuations

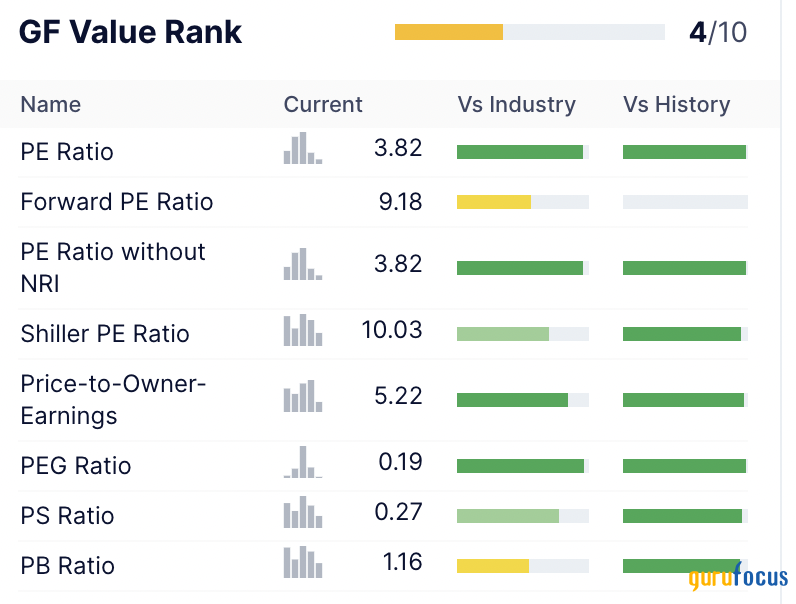

At 4 out of 10, Thor’s valuation ranking is at odds with its other key metrics.

This ranking is based on the price-to-GF-Value ratio. The price on Oct. 13 was $78.38 and this is the GF Value chart:

Based on the GF Value chart, the intrinsic value of $154.09 is roughly double the current price. Hence, the rating of significantly undervalued. However, the GF Value rank is just 4 out of 10 because, based on a historical study by GuruFocus, stocks that are this undervalued tend to underperform compared to stocks that are modestly undervalued or even fairly valued.

Its price-earnings ratio is just 3.8, lower than 95% of other companies in the vehicles and parts industry. Its five-year Ebitda growth rate comes in at 21.62%, and dividing 3.8 by 21.62% gives us a PEG ratio of 0.19, which also indicates significant undervaluation.

The GF Score summarizes the key financial metrics detailed above:

Despite the low score for GF Value, Thor still earns a very high overall score, with growth, profitability and momentum being the best performers.

Gurus

Thor has nine gurus among its significant shareholders, including:

- Hotchkis & Wiley, which had 201,550 shares on June 30. It established this as a new holding in the second quarter, and the stock represents 0.37% of Thor’s shares outstanding and 0.06% of the firm's 13F portfolio.

- Tweedy Browne (Trades, Portfolio) held 195,679 at the end of the second quarter, a reduction of 15.2%

- Ray Dalio (Trades, Portfolio)'s Bridgewater Associates increased its holding by 240.50%, to 101,435 shares.

The company enjoys high popularity among institutional investors, who hold 93.72% of its shares. Insiders own another 32.48%. The two groups own more than 100% of the shares outstanding, which means some shares may be shorted, there are overlaps in reporting, there are reporting delays, or more likely a combination of all three.

The two biggest holdings among insiders are those of Peter B. Orthwein, one of the founders and currently a director with 893,500 shares, and Robert W. Martin, the president and CEO who holds 278,083 shares.

Conclusion

Thor Industries holds a dominant position in the North American and European RV industries. The fundamentals are solid and important valuation measures indicate it is significantly undervalued. It also has a dividend that’s greater than the S&P 500's average.

Given the continuing shortage of materials and the potential for a market correction, 2023 and perhaps the few years after may be choppy, but in the longer run, I believe Thor should continue to grow profitably.