The S&P 500 has sunk by nearly 5% this week, seeing basic materials as the big loser, with the Materials Select Sector SPDR ETF (XLB, Financial) receding by 6.65%.

This week's market activity conveys broader underlying economic issues, which have caused a series of sharp market drawdowns since the turn of the year.

Basic materials exhibit excess volatility relative to the economic cycle as the sector is intertwined with broad-based consumption.

In light of the bearish outlook for cyclical assets, here are two overvalued basic material stocks to avoid.

Cameco

Cameco Corp. (CCJ, Financial) is the world's leading Uranium producer, supplying approximately 18% of global demand. The company's operations span from North America to Kazakhstan, emphasizing vertical integration.

The mining company's issues span beyond potential price pressure. First, Cameco has several assets locked down, with all its Canadian mines currently under maintenance.

To elaborate, Cameco's Rabbit Lakes and Crow Butte mines are currently defunct, while its McArthur River asset will only reach its production potential by 2024.

Furthermore, the company's flagship Inaki mine in Kazakhstan is offline due to supply constraints caused by the Russia-Ukraine war.

Apart from its operational issues, Cameco's stock is severely overvalued. The asset's quoted price is trading at more than 225 times the company's earnings per share and 2.89 times its book value. Additionally, Cameco's dividend yield of 0.33% just is not cutting it, prompting me to classify the stock as overvalued.

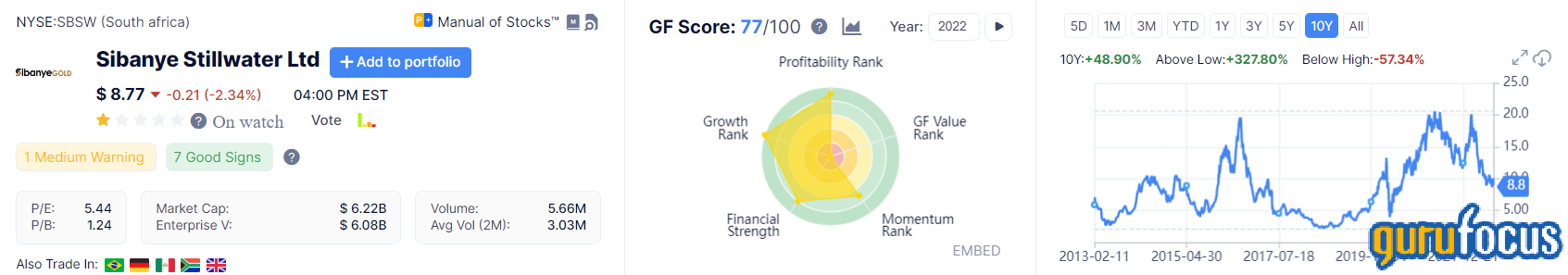

Sibanye-Stillwater

Sibanye-Stillwater Ltd. (SBSW, Financial) is one of the bright prospects in the platinum group metals space. However, recent events suggest that its operational efficiency is lacking, which could coalesce with commodity price pressure to cause a downward spiral in the company's stock price.

Operationally, Sibanye's been struggling with an array of labor union strikes in South Africa relating to its gold mines and later its platinum mines. Furthermore, a few months ago, the company backed out of a $1.2 billion copper-gold acquisition deal with Appian Capital Advisory, dragging the mining house into an extended period of costly litigation.

Operational issues aside, Sibanye's stock is overvalued, trading at 1.12 times its book value and 4.89 times its earnings per share, which could easily be exacerbated if we enter a global recession.

Sibanye's dividend yield of 15.01% is viewed as "best-in-class" by many, but with persistent operational concerns, it has to be questioned whether the dividend yield is sustainable.

Concluding thoughts

Basic material stocks tend to experience excess volatility in a down market. Cameco and Sibanye-Stillwater are both struggling on an operational front, putting them in the firing line if 2022's bear market persists. Additionally, both stocks are overvalued and their dividend persistence is questionable.