David Herro (Trades, Portfolio), manager of the Oakmark International Fund, disclosed earlier this month the fund's top five trades for the second quarter included the closure of its holding in EXOR NV (MIL:EXO, Financial), a reduction to its holding in Bayer AG (XTER:BAYN, Financial), a new holding in Kering SA (XPAR:KER, Financial) and boosts to its holdings in adidas AG (XTER:ADS, Financial) and Koninklijke Phillips NV (XAMS:PHIA, Financial).

The fund, which is part of the Oakmark Funds, seeks long-term capital appreciation by investing in international stocks that not only trade at a discount to intrinsic value, but also have potential to grow shareholder value over time. The fund looks for companies with good business quality and management teams that are focused on achieving per-share value growth.

As of June, the fund’s $20.40 billion equity portfolio contains 65 stocks, with two new positions and a quarterly turnover ratio of 9%. The top four sectors in terms of weight are consumer cyclical, financial services, industrials and communication services, representing 26.86%, 20.51%, 12.85% and 11.39% of the equity portfolio.

Investors should be aware that portfolio updates for mutual funds do not necessarily provide a complete picture of a guru’s holdings. The data is sourced from the quarterly updates on the website of the fund(s) in question. This usually consists of long equity positions in U.S. and foreign stocks. All numbers are as of the quarter’s end only; it is possible the guru may have already made changes to the positions after the quarter ended. However, even this limited data can provide valuable information.

EXOR

The fund sold all 6,729,079 shares of EXOR (MIL:EXO, Financial), trimming 2.13% of its equity portfolio.

Shares of EXOR averaged 65.70 euros ($66) during the second quarter; the stock is significantly overvalued based on Wednesday’s price-to-GF Value ratio of 4.39.

The Dutch vehicle manufacturing company has a GF Score of 61 out of 100 based on a momentum rank of 10 out of 10, a profitability rank of 6 out of 10, a financial strength rank of 4 out of 10, a growth rank of 2 out of 10 and a GF Value rank of 1 out of 10.

Gurus with holdings in EXOR include Bestinfond (Trades, Portfolio) and Azvalor Managers FI (Trades, Portfolio).

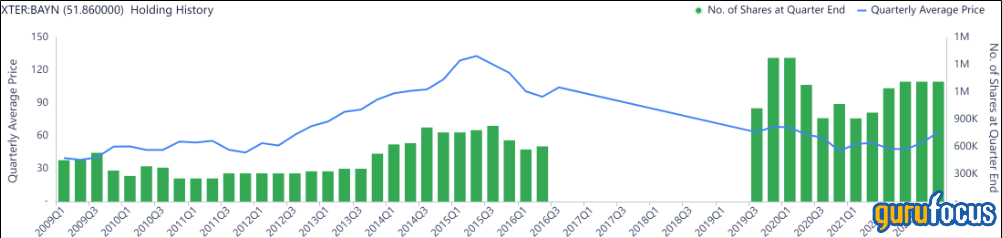

Bayer

The fund sold 4.755 million shares of Bayer (XTER:BAYN, Financial), slicing 34.02% of the stake and 1.35% of the equity portfolio.

Shares of Bayer averaged 63.57 euros during the second quarter; the stock is modestly undervalued based on Wednesday’s price-to-GF Value ratio of 0.83.

The German health care company has a GF Score of 79 out of 100: Although the company has a rank of 9 out of 10 for GF Value and momentum, Bayer’s growth ranks just 3 out of 10, while profitability and financial strength rank 7 out of 10.

Other gurus with holdings in Bayer include Causeway International Value (Trades, Portfolio) and Azvalor Internacional FI (Trades, Portfolio).

Kering

The fund invested in 402,100 shares of Kering (XPAR:KER, Financial), giving the position 1.01% equity portfolio weight.

Shares of Kering averaged 502.26 euros during the second quarter; the stock is significantly undervalued based on Wednesday’s price-to-GF Value ratio of 0.68.

The French luxury goods conglomerate has a GF Score of 90 out of 100, driven by a rank of 9 out of 10 for profitability and growth, a GF Value rank of 8 out of 10 and a financial strength rank of 6 out of 10 despite momentum ranking just 4 out of 10.

Adidas

The fund added 1.02 million shares of Adidas (XTER:ADS, Financial), boosting the holding by 106.55% and its equity portfolio by 0.88%.

Shares of Adidas averaged 184.75 euros during the second quarter; the stock is significantly undervalued based on Wednesday’s price-to-GF Value ratio of 0.51.

The German sportswear company has a GF Score of 78 out of 100 based on a rank of 8 out of 10 for profitability and growth, a financial strength rank of 6 out of 10, a GF Value rank of 4 out of 10 and a momentum rank of 2 out of 10.

Koninklijke Phillips

The fund added 7,665,422 shares of Koninklijke Phillips (XAMS:PHIA, Financial), expanding the stake by 168.91% and its equity portfolio by 0.81%. Shares averaged 24 euros during the second quarter.

GuruFocus’ GF Value line labeled the Dutch health care company a possible value trap based on its low price-to-GF Value ratio of 0.4 as of Wednesday, a momentum rank of 1 out of 10 and a rank of 4 out of 10 for financial strength and growth.

Based on its low ranks for financial strength, growth, momentum and GF Value, Koninklijke Phillips has a GF Score of 59 out of 100 despite profitability ranking 7 out of 10.