Shareholders of Credit Suisse Group AG (CS, Financial) and GameStop Corp. (GME, Financial) have seen their stocks fall dramatically over the past year, significantly underperforming the S&P 500 Index. It also seems the profitability of these companies is not improving, while financial conditions could be much better. Additionally, most sell-side analysts on Wall Street have given these companies lackluster recommendation ratings (for reference, most of the market has an overweight median rating). This suggests these stocks are likely to underperform the market in the coming months.

Credit Suisse

Credit Suisse (CS, Financial) is a Zurich, Switzerland-based provider of wealth management, financing and lending, investment banking and banking solutions. The customer base includes consumers, wealthy individuals, companies, public organizations and pension funds. These clients are located in Switzerland and abroad, which the company reaches through a network of 311 offices and branches.

Shares have fallen by nearly 49% over the past year, underperforming the S&P 500 by approximately 42.3%.

Currently, Credit Suisse pays dividends to its shareholders, resulting in a forward dividend yield of 1.84% as of Aug. 25.

The Swiss bank has an overall financial strength situation that GuruFocus rates with a very modest score of 3 out of 10. Given that the banking sector has a better rating, this suggests the average peer of Credit Suisse has opted for a more resilient balance sheet and thus is better prepared for the additional headwinds that could arise if a recession occurs.

A sharp slowdown in economic activity, which would pose a significant threat to corporate profit margins, is likely to follow the aggressive stance of U.S. and European central banks in an attempt to contain runaway inflation. Through significantly higher interest rates in the longer term, tightening monetary policy increases the burden on highly indebted companies, leading to a greater risk of corporate bankruptcy and, consequently, more bad loans for the banks to handle. Hence, the need for Credit Suisse to have a much stronger financial situation than the current one.

In terms of the profitability of its operations, it has a rating of a modest 4 out of 10 assigned by GuruFocus. This is driven by a net margin that is deep red at a rate of -20.64%, while the sector median is 27%.

The most recent second quarter was negative for Credit Suisse, as total sales fell nearly 30%. All segments of wealth management, investment banking and asset management were affected, with Swiss banking being the only segment that got away with it.

Provisions against credit loss risk were mainly created for the Investment Bank segment, where a higher risk was perceived than the other segments.

The company also reported a CET1 capital ratio of 13.5%, in line with the guideline, while the CET1 leverage ratio and Tier 1 leverage ratio stood at 4.3% and 6.1%.

For the next three years, analysts predictthe company will report revenue of $18.247 billion in 2022, $19.333 billion in 2023 and $18.893 billion in 2024. Earnings per share is expected to be a loss of 24 cents per share in 2022 before rising to a profit of 46 cents in 2023 and 71 cents in 2024.

Shares closed at $5.44 on Thursday for a market capitalization of $14.26 billion and a 52-week range of $5.05 to $11.04.

On Wall Street, the stock has a recommendation rating of underweight.

GameStop

GameStop (GME, Financial) is a Grapevine, Texas-based specialty retailer that provides games and entertainment products through its e-commerce properties and 4,573 stores (as of January 2022) in North America, Australia and Europe. The company also had 50 pop culture-themed stores under the Zing Pop Culture brand.

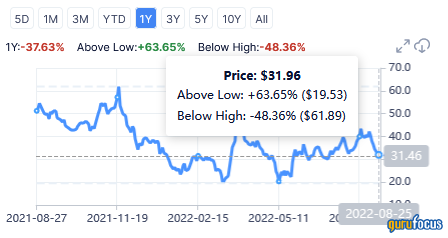

Shares have dropped 37.63% over the past year, underperforming the S&P 500 by about 31%.

GuruFocus awards a 7 out of 10 rating to GameStop's financial strength, which is no small feat, but a closer look at the financial indices that make up the score reveals one detail that is of some concern.

At the time of writing, GameStop's weighted average cost of capital was -3.16%, while the return on invested capital was -37.88%. This means the company is struggling to create value as it grows.

Over the past 12 months through April 30, cash outflows were close to $720 million. Cash and equivalents gradually deteriorated through the quarters to $1.03 billion from $1.72 billion as of July 30, 2021.

When it comes to profitability, all financial metrics are negative except for the gross margin, which, among other things, is well below the industry median (21.53% versus 37.86%).

Three-year revenue growth of 0.7% versus the industry median of 2.2% indicates the company is selling far less than most peers in a highly challenging environment due to the presence of many players and some very fierce competitors.

Overall, the video game industry is not doing well, as it reported sales declines of 11% in June and 9% in July, according to The NPD Group Inc., a U.S. market research company. In addition, the situation for video game sales could deteriorate due to high inflation and the rise in interest rates to curb it, affecting household consumption. Thus, household spending is likely to be focused on more essential goods and services in the coming months.

Shares traded around $31.96 at close on Thursday for a market capitalization of $9.35 billion and a 52-week range of $19.39 to $63.92.

On Wall Street, the stock has a median recommendation rating of underweight.