Were you surprised by how well small-cap value held up during the volatile first quarter?

Chuck Royce (Trades, Portfolio) Not at all. For more than a year now, small-cap investors have experienced very different outcomes depending on whether they leaned more towards value or growth stocks. Based on history, the current market environment is providing multiple reasons for value to hold up better than other styles going forward. With all of the focus on increasing inflation and rising rates, we think it’s helpful to recall that these developments often accompany robust nominal economic growth, which has historically benefited small-cap value stocks. Rising rates also tend to hit the highest valuation stocks hardest—which is precisely what we’ve been seeing with small-cap growth stocks. Small-cap growth has also endured sector-specific challenges in its highest weighted areas, namely Information Technology, Health Care, and Consumer Discretionary. Of course, we should also mention the intensified uncertainty that the Russian invasion of Ukraine has inserted into an already volatile economic and market setting. However, we think many investors would be surprised to know that small-caps bottomed a month before the invasion began and posted positive returns in both February and March. As awful as the war is, it seems so far to be having a minimal effect on small-cap performance.

Frank Gannon To build on Chuck’s point about the first quarter having extended existing trends, I think it’s also important to mention that the quarter resembled calendar 2021 in that not only did the Russell 2000 Value Index do better within small-cap, down 2.4% versus a loss of 7.5% for the Russell 2000 Index, but it beat large-cap as well—the Russell 1000 Index was down 5.1% in 1Q22. We think this speaks to both the resilience of small-cap value during challenging periods and what we continue to see as a long-term outperformance phase for value within small-cap.

Was the underperformance for the Russell 2000 versus the Russell 1000 in 1Q22 also not surprising?

CR It wasn’t a surprise to me. Nearly every U.S. stock index dropped by 5% or more in January, mostly in the space of just a few weeks. When we see these kinds of rapid, widespread market declines, small-caps usually drop more than mid-caps, which lose more than large-caps. This is one of the occupational hazards, as it were, of being a small-cap specialist—though it’s one that we consistently try to use to our long-term advantage by buying companies when their prices fall to what we think are attractively low levels. None of us can predict surges in volatility. I’ve learned that the best course of action is to accept where we are and try to plant seeds that ultimately bear fruit for our investors.

What does the negative return for the Russell 2000 over the last year suggest for returns going forward?

FG First, it’s fairly typical that most of the commentary around stocks focuses on large-caps, so the fact that the Russell 2000 has been trending downward for the last year has mostly flown under the radar. But the small-cap index was down 5.8% for the one-year period ended 3/31/22. So, in spite of some very solid to impressive earnings growth over the last year for many small-cap companies, it appears that most investors have yet to recognize some of the fundamental strengths and/or growth prospects that we see in many small-cap companies. We think this will change when these companies report quarterly earnings mostly in May and again in August. These next two earnings seasons should give investors a chance to recognize the solid underlying fundamentals that we see.

What has the Russell 2000’s history been for the 12 months following negative first-quarter performances?

FG It’s been mostly good news after a bad calendar quarter to start the year. Since the inception of the Russell 2000 in 1979, most first quarters have had positive returns. Only 16 of 44 have been negative. Interestingly, the subsequent 12-month periods following these negative opening quarters have been very positive for small-cap stocks. The Russell 2000 posted positive returns in 93% of the subsequent 12-month periods—while averaging a 32.7% return. As welcome as that kind of return would be, we don’t think that level of performance looks likely over the next year.

What Follows Negative First-Quarter Returns for the Russell 2000?

Subsequent 12-Month Returns for the Russell 2000 Following Negative First Quarter Performances as of 3/31/22 Since Inception (12/31/78)

Past performance is no guarantee of future results.

Do you feel investors should be worried about the yield curve inverting?

CR With the caveat that interest rates are not our area of expertise, we certainly understand that investors feel anxious when the yield curve inverts because inversion has a pretty reliable record of predicting recessions. It’s important to know, however, that its predictive powers are not perfect. There’s also robust disagreement about which part of the yield curve inverting is the most reliable signal. Finally, I’d note that the calm in credit markets is providing a much more stable outlook for corporate profits than the anxiety in the government bond markets.

Are you concerned about the possibility of a recession?

FG Based on our conversations with companies, particularly about their order books, we don’t see any signs of a recession on the horizon in the near term. The incredibly strong labor market, with unemployment at near-record lows, is also inconsistent with an impending recession. People often use the term ‘recession’ when they really mean a temporary slowdown in the pace of economic growth in the midst of a longer growth cycle. Actual economic recessions are relatively rare occurrences.

Do you expect small-cap stocks to maintain their multi-decade record of outpacing inflation?

CR Over the intermediate term, it seems more likely than not. Over the short term, it’s hard to say because inflation always occurs in the context of other events that can affect stocks in different ways. I feel more confident in the prospects for small-caps with earnings growth or high-quality small-caps—that is, those with consistently high returns on invested capital (ROIC)—to outpace inflation. The current lack of visibility in the global economy should make companies that consistently generate high ROIC or demonstrate solid to strong earnings growth that much more attractive, particularly if their multiples are reasonable or attractively low.

FG When thinking about stock performance in the context of inflation, it’s also important to remember that inflation affects different businesses and business models in varied ways. Banks, for example, would be one area that we see as a long-term beneficiary of both inflation and rising interest rates—despite the recent inversion of the yield curve. Rising rates obviously help banks because the increases allow them to widen the spread between their deposits and loan rates. Inflation can help because it’s usually accompanied by vigorous economic growth—which tends to spur loan growth. We also like distributors in both the industrial and technology areas. Distributors generally work on narrow margins, so if prices are climbing, they can pass on the increase across a wide range of sales volume, which can boost their profitability.

What do you think the likely effects will be for small-cap companies if the nascent trend toward de-globalization lasts?

CR We think de-globalization will be an important trend for many years to come. This move, which is already underway, is receiving added impetus from Russia’s invasion of Ukraine. In fact, we suspect that geopolitical instability is likely to be protracted and spread to other parts of the globe—which will only underscore the need to keep manufacturing close to home or with trading partners who have earned trust. What’s equally compelling are the long-term investment opportunities these changes are creating—and will continue to create in the years ahead. The market appears to be just beginning to acknowledge the likely impact of this highly consequential shift. In other words, we have seen little if any evidence of these changes—or their potential effect—priced in. I think this shift will ultimately be a real positive for small-cap stocks, and could be especially favorable for value and cyclical companies because of the additional economic activity it will encourage.

What does recent volatility suggest to you about small-cap returns going forward?

FG We have gleaned some interesting insights from studying the VIX, which tracks the market’s expectations for near-term volatility. Its higher-than-average range in the first quarter offers some interesting historical parallels. Higher-than-average volatility indicates that risk aversion is running hotter than usual. However, investor sentiment has historically been a contrary indicator—which suggests that the market will soon move in a different direction. Since its inception in 1990, the VIX monthly average was roughly 19%. In March 2022, however, it averaged 27%. This is relevant because subsequent three-year average annualized returns following months where the VIX averaged more than 25% were 14.1% for the Russell 2000 and 9.4% for the Russell 1000. Moreover, small-cap beat large-cap in 83% of these three-year periods—which is a very impressive batting average. This trend underpins our long-term optimism for both absolute and relative small-cap returns.

Three-Year Returns Following Highly Volatile Markets

Subsequent Monthly Rolling Average Annualized Three-Year Performance for the Russell 2000 in Monthly Rolling CBOE S&P 500 Volatility Index (VIX) Ranges

From 12/31/89 to 3/31/22

Past performance is no guarantee of future results. ‘Batting Average’ refers to the percentage of 3-year periods in which the Russell 2000 Index outperformed the Russell 1000 Index. Source: Bloomberg.

Given all of the conflicting signals in the current environment, what’s your long-term outlook for small caps?

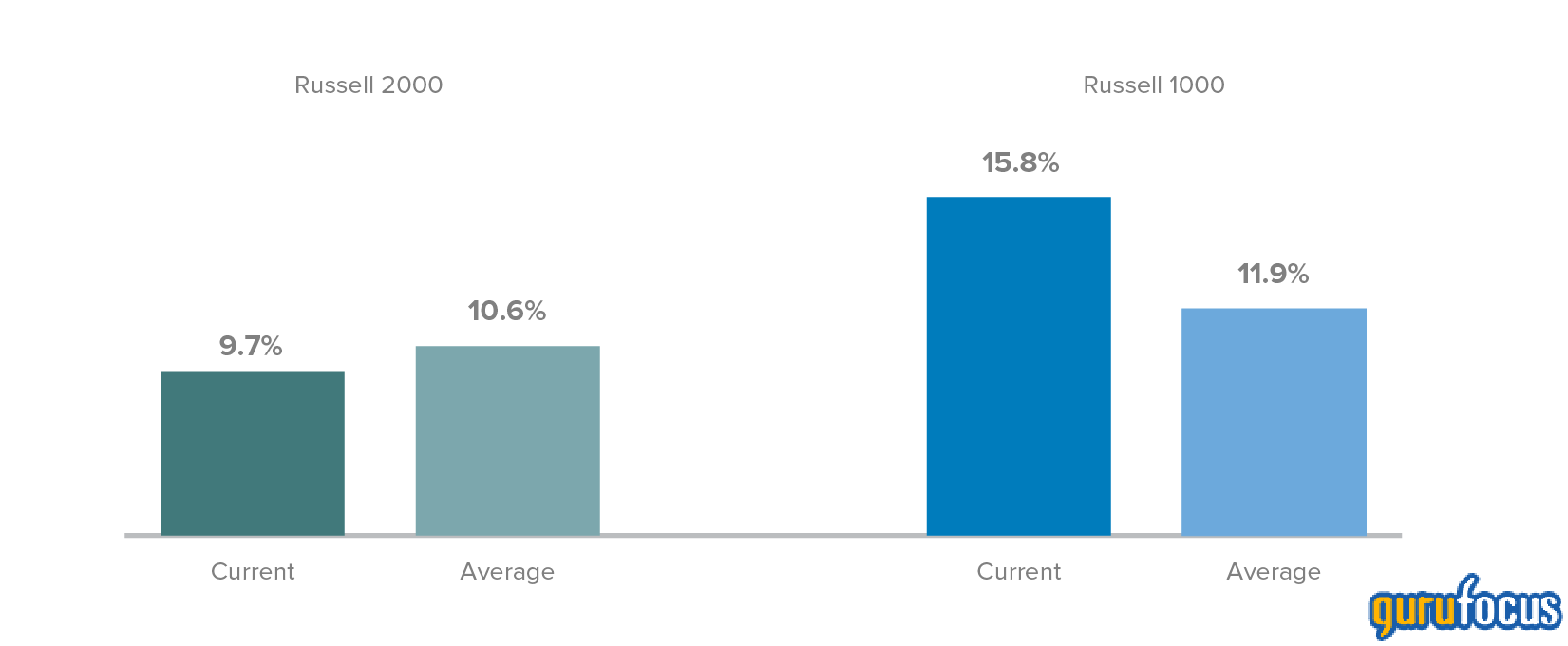

FG We continue to think that small-cap will enjoy solid, respectable absolute returns that are likely to exceed large-cap’s results. First, let’s look at where returns stood at the end of March. For the five-year period ended 3/31/22, the Russell 2000 was shy of its monthly rolling average return, advancing 9.7% versus its 10.6%, while the Russell 1000 substantially exceeded its monthly rolling average, up 15.8% versus its 11.9% average. This shows that we’ve been in a prolonged outperformance phase for large-cap during a period of mostly below-average economic growth and abundant monetary accommodation. These conditions show signs of reversing, so we expect intermediate-term large-cap returns to land below, perhaps well below, their long-term historical average. On the other hand, small-cap stocks did not benefit as much during the prior regime and seem more likely to have returns in the low double digits from this lower starting point.

A Prolonged Period of Large-Cap Outperformance

Five-Year Average Annual Total Returns for the Period Ended 3/31/22 vs. Five-Year Monthly Rolling Average Returns for the Russell 2000 and Russell 1000 Since Each Index’s Inception (12/31/78)

Past performance is no guarantee of future results.

Within small caps, where do you see the best opportunities?

CR We still think we’re in the early stages of a multi-year period of value leadership, due to both ongoing tailwinds for small-cap value and headwinds for small-cap growth. Unfortunately, we also seem to be mired in a period of persistently higher geopolitical risk, which breeds higher levels of volatility and greater uncertainty in the market. Nonetheless, we believe the higher equity risk premium will continue to have a greater negative impact on valuations for small-cap growth stocks than lower-multiple small-cap value stocks. The full economic recovery continues to be delayed by the effects of COVID variants, related supply chain issues, and, most recently, the Russian invasion. Yet all of these will pass, and I expect we’ll get a resumption of cyclical growth that will disproportionately benefit our cyclical value holdings.

What other opportunities has market volatility been creating in both the quality and value segments of the small-cap universe?

CR It’s creating many, both among existing positions whose prices have come down to what we think are attractive levels as well new holdings that have come up in the course of our regular screening and research. The average stock in the Russell 2000 was down around 33%, with many stocks down 50% or more, from their respective 52-week highs through the end of March, so there’s been no shortage of potential portfolio candidates for us to look at. In addition to banks and distributors, we still like machinery companies and those involved in construction. We also like select chemical companies and even more select consumer names, particularly those with premium or iconic brands that can offer some insulation against likely inflation-driven declines in consumer spending. There are also leading niche companies, such as Forrester Research, which is a research and advisory company, and Transcat, a company that distributes test and measurement instruments, where we’ve taken advantage of price declines. And as I mentioned earlier, we’re highly intentional about striving to take advantage of volatility—that’s a longstanding practice for us.

FG Across our major strategies, we’ve been leaning more toward B2B companies than consumer facing areas. Many of the former continue to see robust order books and steady or increasing demand while consumer companies face more formidable challenges from lingering inflation and rising energy prices that may crimp consumer spending. We’ve been actively looking at semiconductors and semi equipment companies, which have been beaten down recently. In certain strategies, we’ve also been looking at companies involved in industrial and commercial aircraft and that repair and maintain aircraft, as well as companies in aerospace & defense. We’re also buying companies involved in infrastructure as the demand for steel and other materials heats up.

In light of all of the current uncertainties we’re facing, what are the most important questions you have for company management teams?

CR Currently, I think the most important questions are “How are you preparing for deglobalization?” and “Have you been able to handle recent instability in a productive way?” But we also look carefully for shifts in perspective or tone. Has their message around the growth of the business been consistent? Do they seem relaxed, confident, or optimistic? By and large, we’ve been hearing more optimism than you would think from the headlines we all see every day. The generally assured tone we’ve been hearing from management teams has bolstered our own confidence that the next three to five years should be good ones for small-cap stocks.

Mr. Royce’s and Mr. Gannon’s thoughts and opinions concerning the stock market are solely their own and, of course, there can be no assurance with regard to future market movements. No assurance can be given that the past performance trends as outlined above will continue in the future.

The performance data and trends outlined in this presentation are presented for illustrative purposes only. Past performance is no guarantee of future results. Historical market trends are not necessarily indicative of future market movements.