David Herro (Trades, Portfolio), manager of the Oakmark International Fund, disclosed in a regulatory portfolio filing this week his fund’s fourth-quarter 2021 13F portfolio update, revealing new positions in Samsung Electronics Co. Ltd. (XKRX:005935, Financial) and Daimler Truck Holding AG (XTER:DTG, Financial), the relocation of its Alibaba Group Holding Ltd. (BABA, Financial)(HKSE:09988, Financial) to U.S.-based shares, and a boost to its holding in Worldline SA (XPAR:WLN, Financial).

The fund, which is part of Chicago-based Oakmark Funds, seeks long-term growth appreciation by investing in companies not only trading at a discount to intrinsic value, but also have the potential to increase shareholder value over time. Oakmark International seeks high-quality companies that have positive free cash flow and management teams focused on achieving business growth.

As of December 2021, the fund’s $26.63 billion equity portfolio contains 65 stocks with a quarterly turnover ratio of 12%. The top four sectors in terms of weight are consumer cyclical, financial services, industrials and health care, representing 25.58%, 22.89%, 11.78% and 10.34% of the equity portfolio.

Samsung

Oakmark International purchased 5,866,100 shares of Samsung (XKRX:005935, Financial), allocating 1.32% of its equity portfolio to the stake. Shares averaged 65,000 won ($54.44) during the fourth quarter; the stock is fairly valued based on Thursday’s price-to-GF Value ratio of 1.04.

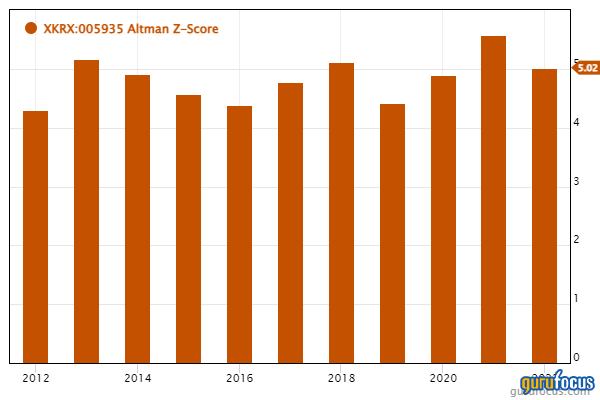

GuruFocus ranks the South Korean consumer electronics giant’s financial strength and profitability 9 out of 10 on several positive investing signs, which include a 3.5-star business predictability rank, a strong Altman Z-score of 4.78 and profit margins and returns that are outperforming more than 85% of global competitors.

Other gurus with holdings in Samsung include the Yacktman Fund (Trades, Portfolio) and the Yacktman Focused Fund (Trades, Portfolio).

Daimler Truck Holding

The fund gained 5,893,750 shares of Daimler Truck Holding (XTER:DTG, Financial) following the company's spinoff from Daimler AG. The shares have 0.81% equity portfolio weight and averaged 32.06 euros ($35.66) during the fourth quarter.

The German company manufactures trucks and buses through brands like Bharat Benz, Freightliner, Fuso and Mercedes-Benz.

Alibaba

Oakmark International purchased 35,406,300 U.S.-based shares of Alibaba (BABA, Financial), giving the stake 2.03% equity portfolio weight.

The fund also sold all 13,756,200 Hong Kong-based shares of Alibaba (HKSE:09988, Financial), trimming 0.98% of its equity portfolio.

U.S.-shares of Alibaba averaged $145.10 during the fourth quarter; the stock is significantly undervalued based on Thursday’s price-to-GF Value ratio of 0.26.

GuruFocus ranks the Chinese e-commerce giant’s profitability 9 out of 10 on several positive investing signs, which include a three-star business predictability rank and profit margins and returns that are outperforming more than 80% of global competitors.

Worldline

Oakmark International added 6,104,200 shares of Worldline (XPAR:WLN, Financial), boosting the position by 166.94% and its equity portfolio by 1.28%.

Shares of Worldline averaged 53.82 euros ($59.54) during the fourth quarter; the stock is significantly undervalued based on Thursday’s price-to-GF-Value ratio of 0.62.

GuruFocus ranks the French payment software company’s profitability 8 out of 10 on the back of profit margins outperforming more than 70% of global competitors.