Yacktman Asset Management (Trades, Portfolio) released this week its fourth-quarter 2021 update through 13-F filings, revealing its top trades included a new position in Reliance Steel & Aluminum (RS, Financial) and reductions to its holdings in Macy’s Inc. (M, Financial), The Walt Disney Co. (DIS, Financial), Sysco Corp. (SYY, Financial) and Alphabet Inc. (GOOGL, Financial)(GOOG, Financial).

Led by Stephen Yacktman, the Austin, Texas-based firm seeks long-term capital appreciation by investing in the stock of growth companies at low prices. Yacktman considers the following three pillars: good business, shareholder-oriented management and attractive purchase price.

As of December 2021, the firm’s $11.22 billion equity portfolio contains 64 stocks with a quarterly turnover ratio of 2%. The top four sectors in terms of weight are consumer defensive, financial services, communication services and technology, representing 24.12%, 15.77%, 15.51% and 14.32% of the equity portfolio.

Reliance Steel & Aluminum

Yacktman purchased 1,053,500 shares of Reliance Steel & Aluminum (RS, Financial), giving the position 1.52% equity portfolio weight. Shares averaged $154.94 during the fourth quarter; the stock is fairly valued based on Friday’s price-to-GF Value ratio of 1.04.

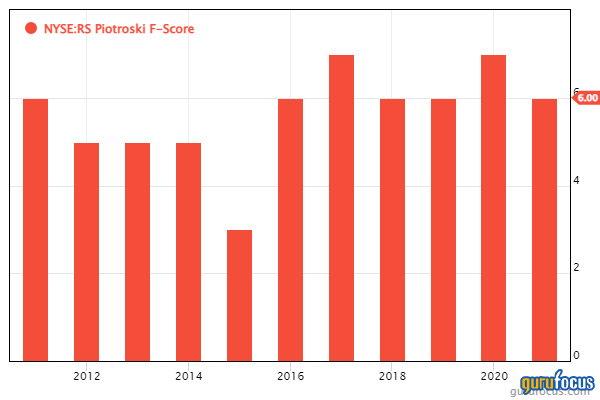

GuruFocus ranks the Los Angeles-based steel company’s profitability 8 out of 10 on several positive investing signs, which include a four-star business predictability rank, a high Piotroski F-score of 7 and profit margins and returns that are outperforming more than 70% of global competitors.

Other gurus with holdings in Reliance Steel include the Yacktman Fund (Trades, Portfolio), the Yacktman Focused Fund (Trades, Portfolio) and Chuck Royce (Trades, Portfolio)’s Royce Investment Partners.

Macy’s

The firm sold 3,627,318 shares of Macy’s (M, Financial), slicing 64.98% of the position and 0.79% of its equity portfolio.

Shares of Macy’s averaged $27.38 during the third quarter; the stock is signficantly overvalued based on Friday’s price-to-GF Value ratio of 1.35.

GuruFocus ranks the New York-based omnichannel retail company’s profitability 6 out of 10 on the back of a high Piotroski F-score of 8 despite profit margins and returns outperforming just over 60% of global competitors.

Other gurus with holdings in Macy’s include David Tepper (Trades, Portfolio)’s Appaloosa LP, Jim Simons (Trades, Portfolio)’ Renaissance Technologies and Jana Partners (Trades, Portfolio).

Walt Disney

The firm sold 358.370 shares of Walt Disney (DIS, Financial), curbing 16.8% of the position and 0.58% of its equity portfolio.

Shares of Walt Disney averaged $161 during the fourth quarter; the stock is fairly valued based on Friday’s price-to-GF Value ratio of 1.04.

GuruFocus ranks the Burbank, California-based entertainment giant’s financial strength 4 out of 10 on the back of a low Altman Z-score of 2.07 and interest coverage and debt ratios underperforming over 70% of global competitors.

Sysco

The firm sold 637,673 shares of Sysco (SYY, Financial), trimming 11.75% of the position and 0.48% of its equity portfolio.

Shares of Sysco averaged $76.89 during the third quarter; the stock is fairly valued based on Friday’s price-to-GF Value ratio of 1.02.

GuruFocus ranks the Houston-based food service company’s financial strength 5 out of 10 on the back of interest coverage and debt ratios underperforming more than 78% of global competitors despite the company having a high Altman Z-score of 4.79.

Alphabet

The firm sold 16,632 Class C shares of Alphabet (GOOG, Financial), trimming 7.25% of the position and 0.43% of its equity portfolio.

The company announced on Tuesday a 20-for-1 stock split. Class C shares averaged $2,894.54 during the fourth quarter; the stock is modestly overvalued based on Friday’s price-to-GF Value ratio of 1.16.

GuruFocus ranks the online search giant’s profitability 9 out of 10 on several positive investing signs, which include a 4.5-star business predictability rank and profit margins and returns that outperform more than 88% of global competitors.