Mueller Industries Inc. (MLI, Financial) has a market capitalization of $3.3 billion, a modest amount of debt, is growing its Ebitda quickly and appears to be reasonably priced (when that Ebitda growth is considered). As a result, its share price, too, has grown rapidly.

What is Mueller Industries?

On the home page of its website, the company describes itself as “an industrial manufacturer that specializes in copper and copper alloy manufacturing while also producing goods made from aluminum, steel, and plastics.” Those products include tubing, valves, vessels and other plumbing and HVACR systems items.

Its headquarters are in Collierville, Tennessee and it operates a network in North America, Europe, Asia and the Middle East. End users include businesses in the construction, appliance, defense, energy and automotive sectors.

It does business through 21 subsidiaries, including six that carry the Mueller name. The key business segments are Piping Systems, Climate Products and Industrial Metals.

Competition

The company reports in its 10-K for 2020 that competitors vary according to product lines. For example, in the U.S. copper tube business (one of its mainstays), its main competitors are the privately held companies Cerro Flow Products and Cambridge-Lee Industries.

On its list of Mueller peers, GuruFocus includes Carpenter Technology Corp. (CRS, Financial), a supplier of premium alloys, titanium and stainless steel; and Allegheny Technologies Inc. (ATI, Financial), which supplies nickel-based alloys, titanium products, titanium alloys and other specialty alloys.

As for competitive advantages, a few show up in various Mueller media:

- The company was founded in 1917, giving it a history of more than a hundred years.

- On its website, the company claims its companies “have built a well-earned reputation for providing high-quality products.”

- In the chairman’s letter to shareholders, in the 2020 annual report, he references the company’s “core pursuit to be the low cost producer.” So presumably, the company already has some standing on that metric.

Risks

According to the 10-K, these are some of the risk factors:

- Since it cannot always pass along price increases to its customers, higher prices for raw materials can be a threat. In addition, the availability of materials is also a concern, as the company learned during the Covid-19 pandemic.

- The company faces risks from what it calls “recent and pending climate change regulations and initiatives”; greenhouse gas mitigation measures may affect energy availability and costs.

- Economic conditions constitute a risk because its business is sensitive to the broader economy, especially the housing and commercial construction industries.

- Competitive conditions are risk factors; the company points to the effects of imports, substitute products and technologies. There is also some consolidation among customers, while other companies are sourcing from low-cost countries.

- Currency exchange rates: Mueller does business through subsidiaries in several countries and exports to many countries. Therefore, changes in the U.S. dollar could depress (or boost) revenue and earnings.

Financial strength

While the company carries some debt, the first four lines on the table indicate it is not enough for concern. Mueller had enough operating income to pay its interest expenses 43 times over (during the quarter, the company paid down its debt by $230 million) at the end of third-quarter 2021.

That’s backed up by the Altman Z-Score, which is close to the top of the scale.

The company has managed its capital well. It pays 8.32% on the invested and borrowed money it receives, while it earns 27.73% on that capital. In the 2020 annual report, it showed how it has been using its funds:

The following 10-year chart, to the end of 2020, shows how free cash flow grew quickly in 2018 and 2019, before falling off in 2020 (pandemic effect):

Cash flow has since recovered. The third-quarter news release also reports cash flow from operations more than tripled from $106.39 million in third-quarter 2020 to $348.43 million in third-quarter 2021.

Profitability

The light green bars on the two margin lines tell us Mueller outperforms its competitors and peers in the industrial products industry. More specifically, its net margin is currently higher than 76.99% of other industry players.

The dark green bars next to return on equity and return on assets indicate the company has done far better than competitors and peers. For example, its ROE is higher than 98.40% of firms in the industry.

There’s also a lot to like about the three growth bars at the bottom of the table. Revenue grew only slightly, but management converted that into significantly higher Ebitda and even higher earnings per share.

Performance

The growth of Ebitda is one reason why Mueller has outperformed Carpenter Technology and Allegheny Technologies:

This GuruFocus table summarizes its annual and periodic performance numbers:

Valuation

A 10-year chart shows how Mueller’s share price has nearly tripled since March 16, 2020 (almost 22 months):

Note how choppy this chart has been—definitely one you want to buy on a dip.

The GF Value Line, which does not appear to include Ebitda growth (some of the metrics are proprietary and not shown), finds Mueller seriously overvalued:

However, the PEG ratio, which does include Ebitda growth, clocks in at 0.91, putting the company in undervalued territory.

The discounted cash flow calculator, using the earnings-based approach as recommended by GuruFocus, shows undervaluation and a solid margin of safety:

Cautious investors will want to further research Mueller’s valuation before proceeding further.

Dividends

Mueller’s dividend falls below the average for S&P 500 stocks, but it has increased it several times over the past decade:

The increase in 2021 raised the annual payment to 52 cents per share.

The dividend payout is low at 7%, leaving room for more solid increases in the coming years.

Shareholdings

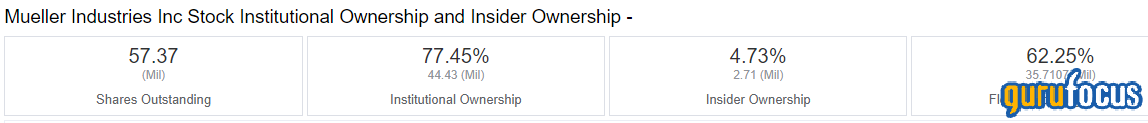

After a big buyback in the fourth quarter of 2012, the share count has declined only slightly:

Here’s the story on how those shares are distributed:

The biggest owner among the insiders is Gregory L. Christopher, the chairman and CEO; he held 501,165 shares as of August 2, 2021.

Gurus

The investing gurus traded Mueller 322 times in the third quarter, and they did more selling than buying:

At the end of the quarter, seven gurus held stakes, and the three largest positions were those of:

- Mario Gabelli (Trades, Portfolio) of GAMCO Investors. He owned 3,158,776 shares, representing 5.51% of Mueller’s shares and 1.15% of his assets under management. During the quarter, he trimmed his holding by 0.71%.

- Chuck Royce (Trades, Portfolio)'s Royce Investment Partners, which cut its position by 27.34% to finish with 623,278 shares.

- Jeremy Grantham (Trades, Portfolio) of GMO LLC reduced his holding by 2.79%, finishing the quarter with 125,638 shares.

Conclusion

It might be a stretch to say Mueller Industries is undervalued, as the DCF analysis suggests, but reasonable to say it could be fairly valued. The latter statement assumes Ebitda growth matters to you and your investing strategy.

Overall, this is a quality company with solid financials and profitability, but not much of a dividend (thanks to a fast-rising share price) and not much in the way of share buybacks.

Still, it would be worth the attention of growth investors, assuming they can buy on a dip. Value investors, too, might see potential in Mueller after the price pulls back significantly. As we’ve noted, this will not be a stock for income investors.