The Third Avenue Value Fund (Trades, Portfolio) released its portfolio for the final quarter of 2021 in late December.

Part of the late Martin Whitman’s Third Avenue Management (Trades, Portfolio), which is based in New York, the fund relies on a high-conviction strategy, investing in undervalued securities across several different industries, market capitalizations and regions. Portfolio manager Matthew Fine uses fundamental analysis to find stocks trading below their intrinsic value that compound asset values at double-digit rates.

Taking these criteria into consideration, the fund entered two positions during the three months ended Oct. 31, sold out of two stocks and added to or trimmed a handful of other existing holdings. Its most notable trades included new positions in Valaris Ltd. (VAL, Financial) and Fila Holdings (XKRX:081660, Financial), the divestment of PGS ASA (OSL:PGS, Financial), an increased bet on Subsea 7 SA (OSL:SUBC, Financial) and a reduction in Mohawk Industries Inc. (MHK, Financial).

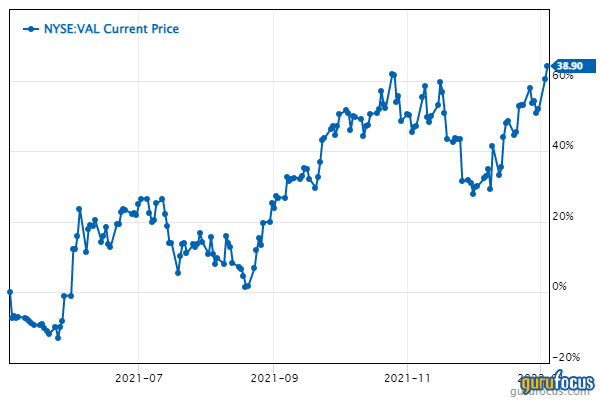

Valaris

The fund invested in 280,150 shares of Valaris (VAL, Financial), dedicating 1.72% of the equity portfolio to the position. The stock traded for an average price of $31.38 per share during the quarter.

The London-based offshore drilling contractor has a $2.92 billion market cap; its shares were trading around $39.22 on Tuesday with a price-book ratio of 2.81 and a price-sales ratio of 8.94.

The stock has climbed over 60% since being listed in May following the completion of Valaris’ restructuring. It had previously been delisted in August of 2020.

GuruFocus rated Valaris’ financial strength 4 out of 10 on the back of weak interest coverage and middling debt-related ratios that are generally outperforming over half of its competitors, but underperforming versus its own history.

The company is also being weighed down by negative margins and returns on equity, assets and capital.

Of the gurus invested in Valaris, Howard Marks (Trades, Portfolio)’ Oaktree Capital has the largest stake. Louis Moore Bacon (Trades, Portfolio) and Azvalor Managers FI (Trades, Portfolio) also own the stock.

Fila Holdings

Third Avenue picked up 219,791 shares of Fila Holdings (XKRX:081660, Financial), allocating 1.22% of the equity portfolio to the holding. Shares traded for an average price of 45,081.4 won ($37.67) each during the quarter.

The South Korean sportswear company has a market cap of 2.15 trillion won; its shares closed at 35,850 won on Monday with a price-earnings ratio of 9.18, a price-book ratio of 1.32 and a price-sales ratio of 0.58.

The GF Value Line suggests the stock is significantly undervalued currently based on historical ratios, past performance and future earnings projections.

Fila’s financial strength was rated 5 out of 10 by GuruFocus, driven by a comfortable level of interest coverage. The Altman Z-Score of 2.72, however, indicates the company is under some pressure. The return on invested capital overshadows the weighted average cost of capital, meaning value is being created as the company grows.

The company’s profitability scored an 8 out of 10 rating as a result of operating margin expansion, strong returns that top a majority of industry peers and a high Piotroski F-Score of 9 out of 9, indicating business conditions are healthy. Fila is also supported by a predictability rank of one out of five stars. According to GuruFocus, companies with this rank return an average of 1.1% annually over a 10-year period.

With 0.37% of outstanding shares, the fund is Fila’s largest guru shareholder. The iShares MSCI ACWI ex U.S. ETF (Trades, Portfolio) also owns the stock.

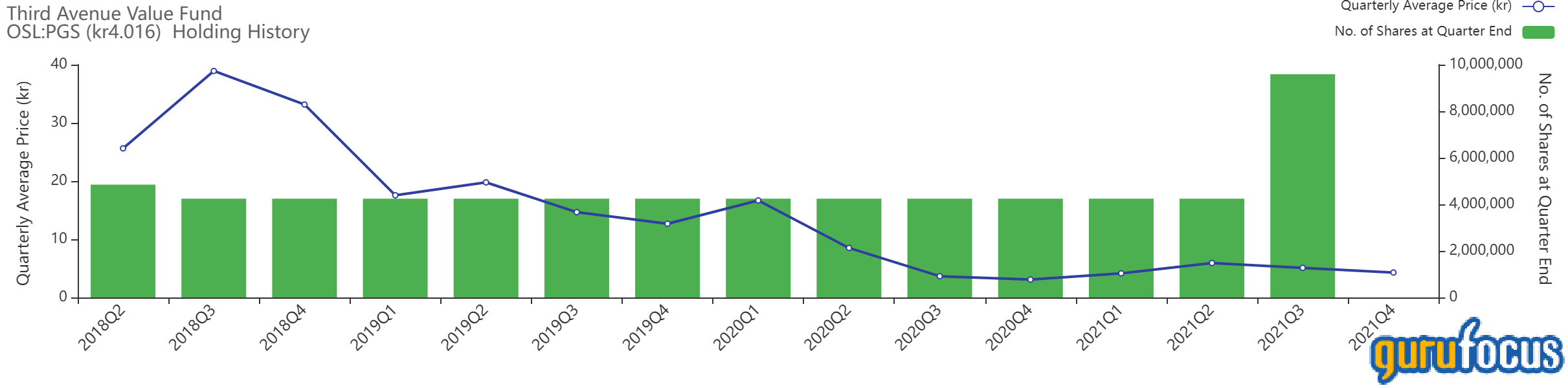

PGS

The fund dumped it 9.5 million-share stake in PGS (OSL:PGS, Financial), impacting the equity portfolio by -0.86%. The stock traded for an average per-share price of 4.29 kroner (49 cents) during the quarter.

GuruFocus estimates Third Avenue lost 57.24% on the investment.

The Norwegian company, which provides seismic services to energy companies to locate oil and gas reserves offshore, has a market cap of 1.61 billion kroner; its shares closed at 4.02 kroner on Monday with a price-book ratio of 0.62 and a price-sales ratio of 0.3.

According to the GF Value Line, the stock is a potential value trap currently, so investors should do thorough research before making a decision.

GuruFocus rated PGS’s financial strength 2 out of 10. In addition to weak debt-related ratios, the Altman Z-Score of -0.36 warns the company could be at risk of bankruptcy if it does not improve its liquidity.

The company’s profitability fared a bit better with a 4 out of 10 rating. Regardless, its margins and returns are negative and underperform a majority of competitors. PGS also has a moderate Piotroski F-Score of 5, indicating operations are typical for a stable company. Although revenue per share has declined in recent years, it still has a one-star predictability rank.

No gurus are currently invested in PGS.

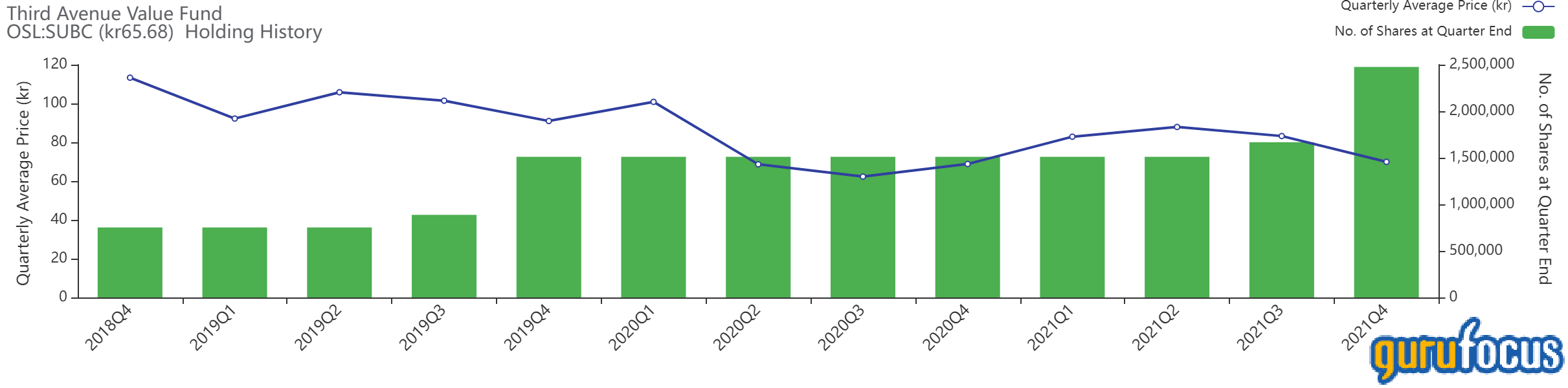

Subsea 7

The Value Fund upped its Subsea 7 (OSL:SUBC, Financial) stake by 48.86%, buying 808,130 shares. The transaction had an impact of 1.26% on the equity portfolio. During the quarter, the stock traded for an average price of 69.91 kroner per share.

The fund now holds 2.47 million shares total, which represent 3.87% of the equity portfolio. GuruFocus data shows it has lost an estimated 27.79% on the investment so far.

Headquartered in London, the company, which provides subsea engineering and construction services to the oil and gas industry, has a market cap of 19.41 billion kroner; its Norwegian-listed shares closed at 65.68 kroner on Monday with a forward price-earnings ratio of 35.34, a price-book ratio of 0.54 and a price-sales ratio of 0.49.

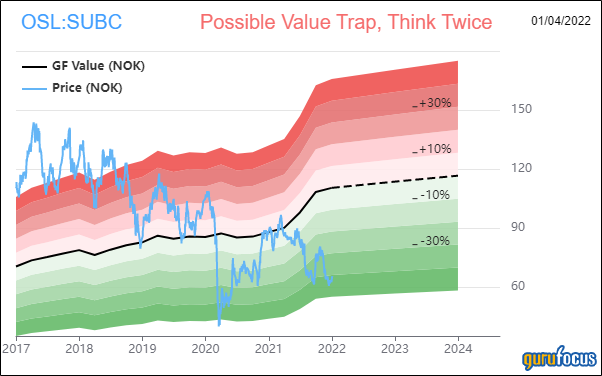

Based on the GF Value Line, the stock appears to be a potential value trap currently.

Subsea’s financial strength and profitability were both rate 6 out of 10 by GuruFocus. In addition to having weak interest coverage, the Altman Z-Score of 1.68 warns the company could be in danger of going bankrupt. The WACC also eclipses the ROIC, so the company is struggling to create value.

The company is also being weighed down by margins and returns that underperform over half of its industry peers. It has a high Piotroski F-Score of 7, however, and, even though it has recorded a decline in revenue per share in recent years, a one-star predictability rank.

Third Avenue holds 0.84% of Subsea’s outstanding shares. Francisco Garcia Parames (Trades, Portfolio) also owns the stock.

Mohawk Industries

The fund curbed its Mohawk Industries (MHK, Financial) holding by 30.82%, selling 26,753 shares. The transaction had an impact of -0.95% on the equity portfolio. During the quarter, shares traded for an average price of $191.39 each.

Third Avenue now holds 60,057 shares total, which make up 1.86% of the equity portfolio. GuruFocus data shows it has gained approximately 29.01% on the investment so far.

The Calhoun, Georgia-based company, which manufactures flooring products, has a $12.79 billion market cap; its shares were trading around $188.57 on Tuesday with a price-earnings ratio of 12.08, a price-book ratio of 1.46 and a price-sales ratio of 1.18.

The GF Value Line suggests the stock is modestly overvalued currently.

GuruFocus rated Mohawk’s financial strength 6 out of 10 on the back of a comfortable level of interest coverage and a high Altman Z-Score of 3.39 that indicates it is in good standing even though assets are building up at a faster rate than revenue is growing. The ROIC also exceeds the WACC, so value creation is occurring.

The company’s profitability fared better with a 7 out of 10 rating. Even though the operating margin is in decline, returns outperform over half of its competitors. Mohawk also has a high Piotroski F-Score of 8 and a one-star predictability rank.

With a 2.35% stake, Richard Pzena (Trades, Portfolio) is Mohawk’s largest guru shareholder. Other gurus who are invested in the stock include John Rogers (Trades, Portfolio), Charles Brandes (Trades, Portfolio), Steven Cohen (Trades, Portfolio), Tom Gayner (Trades, Portfolio), Jeremy Grantham (Trades, Portfolio) and Ray Dalio (Trades, Portfolio).

Additional trades and portfolio performance

During the quarter, the Value Fund also added to its position in Bayerische Motoren Werke AG (XTER:BMW, Financial), reduced its stakes in Tidwater Inc. (TDW, Financial) and The Drilling Company of 1972 AS (OCSE:DRLCO, Financial) and sold out of Macerich Co. (MAC, Financial).

Around half of Third Avenue’s $574 million equity portfolio, which is composed of 30 stocks, is invested in the financial services and basic materials sectors. .

GuruFocus data indicates the fund returned 7.75% in 2020, underperforming the S&P 500’s 18.4% return.