The fight against climate change requires a drastic reduction of emissions of CO2 and other greenhouse gases. This means using less fossil fuels to produce electricity; fossil fuels must gradually be replaced with cleaner sources of energy. Many major operators in the energy sector are trying to develop technology solutions to produce clean energy, since there is a significant growth opportunity in this market.

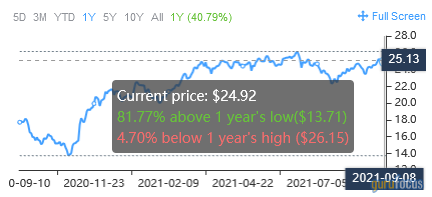

Important news on this front has recently come from Italian multinational oil and gas operator Eni SpA (E, Financial). The company, which trades at $24.92 per share as of the writing of this article, announced on Sept. 8 that it has successfully conducted the first test of a High-Temperature Superconductor (HTS) magnet for use in a fusion power plant to produce energy for the electricity grid. The test was conducted by Commonwealth Fusion Systems, a spin-out company of the Plasma Science and Fusion Center of the Massachusetts Institute of Technology, of which Eni is the largest shareholder.

The next Eni power plant will look like a sort of donut composed of 18 HTS magnets that will generate a magnetic field of such intensity and stability that it will allow the release of a high quantity of energy. This approach to generate thermonuclear fusion power is called magnetic confinement fusion. This innovative theoretical technology, which no one has ever applied or tested before on an industrial scale, aims to reproduce the same phenomenon that occurs in the sun and other stars. If this technology is successfully developed and implemented, it will be capable of providing fusion energy to the power grid.

In a comment to the news release, Eni's CEO Claudio Descalzi said that magnetic confinement fusion will allow humanity to access large quantities of safe, clean and unlimited energy, causing zero emissions into the atmosphere. The construction of the first experimental reactor is expected by 2025, while the company estimates it should be able to provide this type of energy to the power grid within the next decade if everything goes well.

A look at the financial data from the company's most recent quarter reveals that total revenues increased nearly 100% to approximately $19.43 billion, despite an 8% year-over-year drop in hydrocarbon production to nearly 1.6 million barrels of oil equivalent per day in the second quarter of 2021. The adjusted EPS was almost $0.29, switching from the net loss of approximately $0.22 per share endured in the same quarter of 2020.

Looking ahead to full fiscal 2021, Eni projects total operating cash flow to grow more than 75% from $6.54 billion in 2020, on an expected hydrocarbon production level of 1.7 million barrels of oil equivalent per day.

Eni holds a total of 6.905 billion barrels of oil equivalent in net proved mineral reserves and power plants with an (installed) operational capacity of 4.6 gigawatts.

The stock has a market capitalization of $44.51 billion, a 52-week range of $13.36 to $26.18 and a price-book ratio of 0.93 versus the industry median of 1.21. Also, the enterprise value-to-Ebitda ratio is 3.86 versus the industry median of 8.42 and the enterprise-value-to-revenue ratio is 1.02 versus the industry median of 2.24.

On June 10, the company paid a semi-annual dividend of $0.583 per common share, a 107.5% hike from the previous payment, which determines a trailing and forward dividend yield of 3.47% as of the writing of this article.

Disclosure: I have no positions in any securities mentioned.