In its portfolio for the second quarter of 2021, which was released last week, the Fairholme Fund (Trades, Portfolio) disclosed it reduced its position in The St. Joe Co. (JOE, Financial).

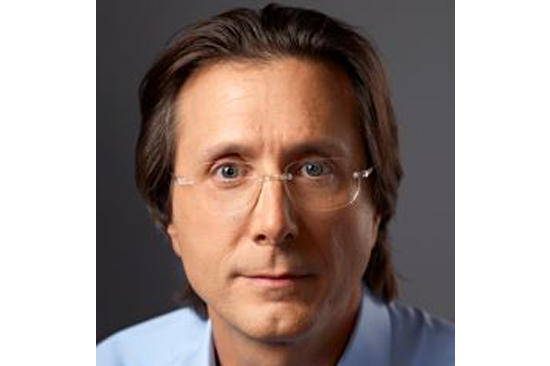

The fund is part of Bruce Berkowitz (Trades, Portfolio)’s Miami-based Fairholme Capital Management. As he believes that more diversified portfolios lead to more average returns, the guru invests in a handful of undervalued stocks whose underlying companies have good management teams and steady cash flow generation.

Based on these criteria, the fund trimmed its stake by 3.01% during the three months ended May 31. Fairholme sold 668,800 shares of the Florida-based real estate development and asset management company, impacting the equity portfolio by -2.71%. The stock traded for an average price of $45.35 per share during the quarter.

Despite the reduction, in his semi-annual 2021 letter, Berkowitz noted St. Joe has become the fund’s largest investment by far. It now holds 21.5 million shares, which account for 87.95% of the equity portfolio. GuruFocus estimates the fund has gained 59.42% on the investment over its lifetime.

St. Joe, which is one of Florida’s largest landowners, has a $2.68 billion market cap; its shares were trading around $45.48 on Monday with a price-earnings ratio of 53.51, a price-book ratio of 4.72 and a price-sales ratio of 12.21.

The GF Value Line suggests the stock is modestly overvalued based on its historical ratios, past performance and future earnings projections.

The valuation rank of 5 out of 10, however, is more supportive of it being fairly valued.

In addition to owning 171,000 acres of land in Northwest Florida, Berkowitz said in his semi-annual letter that the “company obtained what may be the largest residential entitlement in the United Sates, initiated the first of what I expect to be many billion-dollar growth plans on coastal lands held for decades, and repurchased 36.3% of its stock at an average price of $17.63 per share.”

Additionally, for the second quarter, St. Joe reported on July 28 its revenue increased 100% from the prior-year quarter to $72.2 million, while operating income grew 177% to $30.7 million.

The company also saw its cash before distributions and investments climb 127% to $1 per share over the first six months of the year.

As a result of these promising developments, Berkowitz commented that Charlie Munger (Trades, Portfolio) was correct when he said, “The big money is not in the buying or the selling, but in the waiting.”

GuruFocus rated St. Joe’s financial strength 5 out of 10. Although the company has issued approximately $124.7 million in new long-term debt over the past three years, it is at a manageable level due to an adequate level of interest coverage. The Altman Z-Score of 3.98 also indicates it is in good standing. The return on invested capital, however, has fallen below the weighted average cost of capital, suggesting the company struggles to create value while growing.

The company’s profitability scored a 6 out of 10 rating, driven by margins and returns on equity, assets and capital that outperform over half of its competitors. St. Joe also has a moderate Piotroski F-Score of 6 out of 9, which means its operations are stable. Despite recording a loss in operating income over the past three years, the company still has a predictability rank of one out of five stars. According to GuruFocus, companies with this rank return an average of 1.1% annually over a 10-year period.

On top of decent insider buying in recent months, St. Joe also has good guru ownership. In addition to Berkowitz’s Fairholme, which is its largest shareholder by a wide margin, Mario Gabelli (Trades, Portfolio), Chuck Royce (Trades, Portfolio), Jim Simons (Trades, Portfolio)’ Renaissance Technologies, Paul Tudor Jones (Trades, Portfolio) and Joel Greenblatt (Trades, Portfolio) also have positions in the stock.

Portfolio composition and performance

No other changes were made to the portfolio.

The real estate sector has the largest representation in Fairholme’s $1.15 billion equity portfolio, which is composed of four stocks, at 87.95%. The financial services and basic materials spaces have much smaller allocations.

The fund also has a position in Imperial Metals Corp. (TSX:III, Financial) as well as holds preferred shares of both Fannie Mae (FNMAS.PFD) and the Federal Home Loan Mortgage Corp. (FMCKJ.PFD), which is also known as Freddie Mac.

In his annual letter to shareholders, Berkowitz said the fund returned 46.9% in 2020, outperforming the S&P 500’s return of 18.4%.