Iconic firearm manufacturer Smith & Wesson Brands Inc. (SWBI, Financial) announced strong fourth-quarter and full-year 2021 earnings after the closing bell on Thursday, reporting its fourth straight quarter of record growth and annual sales reaching $1 billion for the first time in its long history.

The Springfield, Massachusetts-based company, which was founded in 1856, posted earnings of $1.70 per share for the three months ended April 30, topping Thomson Reuters’ estimates of $1.02. Net income was $89.2 million. Revenue grew 67.3% from the year-ago quarter to $322.9 million, beating projections of $259.8 million.

For the full year, the company recorded earnings of $4.40 per share on $1.1 billion in sales, which were up 100% from fiscal 2020. Net income was $243.6 million.

In a statement, President and CEO Mark Smith praised the company’s performance “in spite of the unthinkable challenges” posed by the Covid-19 pandemic over the past year.

“Our employees more than doubled the prior year sales, passed a milestone of $1 billion in revenue, and by every financial and operating metric, have delivered the most successful year in the 169-year history of the company,” he said.

Smith noted the gunmaker also saw strong market share growth throughout the year as demand for firearms accelerated.

“During the past fiscal year, the U.S. firearms market experienced record growth of 42%, meanwhile shipments from Smith & Wesson far surpassed the industry, growing by 70%,” he said. “Strong consumer preference for our products combined with our ability to rapidly react to the increased demand has placed us in a clear leadership position as we enter into our first full fiscal year as a standalone pure-play firearms company."

Known for its namesake pistols, revolvers and rifles as well as its M&P and Gemtech brands, Smith & Wesson spun off its outdoor products and accessories business last August. As such, its discontinued operations were not included in the performance comparison.

In addition to buying back 10% of its outstanding common stock throughout the year, Smith & Wesson also rewarded its shareholders by introducing a dividend for the first time in its history. Continuing with this capital allocation strategy, Executive Vice President and Chief Financial Officer Deana McPherson noted that the board of directors approved a new $50 million share repurchase program and increased the dividend by 60% to 8 cents per share.

"The hard work and dedication of all of our employees, combined with record-breaking demand for our high-quality products drove equally record-breaking financial results for the year, including record revenue, net income, earnings per share, and cash generation,” she said. “We began our first year as a pure-play firearm company with clear strategic priorities, and we have delivered on our strategy.”

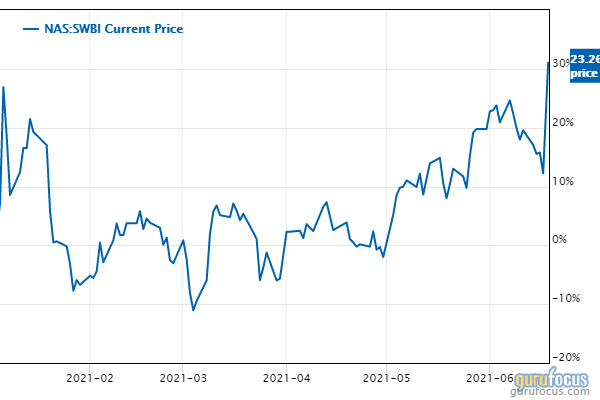

Shares of Smith & Wesson were up 17.27% on Friday afternoon at $23.36. GuruFocus estimates the stock has climbed over 30% year to date.

Of the gurus invested in Smith & Wesson, Jim Simons (Trades, Portfolio)’ Renaissance Technologies has the largest stake with 6.98% of outstanding shares. Joel Greenblatt (Trades, Portfolio), Paul Tudor Jones (Trades, Portfolio) and Caxton Associates (Trades, Portfolio) also have positions in the stock.