The Matthews China Fund (Trades, Portfolio) disclosed this week its first-quarter portfolio, revealing that its top five trades included a new position in Industrial And Commercial Bank of China Ltd. (HKSE:01398, Financial), boosts to its holdings of China Construction Bank Corp. (HKSE:00939, Financial) and China International Capital Corp. Ltd. (HKSE:03908, Financial), a reduction in its stake in New Oriental Education & Technology Corp. (EDU, Financial) and the closure of its position in AVID Jonhon Optronic Technology Co. Ltd. (SZSE:002179, Financial).

Overseen by Andrew Mattock and Winnie Chwang, the fund seeks long-term capital appreciation primarily through investments in the common stock of companies located in China and Hong Kong. The fund examines several characteristics of sustainable growth, including the size and stability of cash flows.

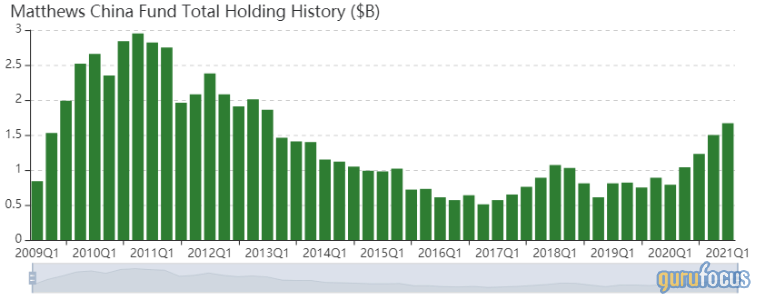

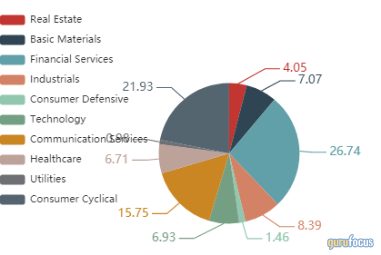

For the quarter ended March 31, the fund returned 2.56%, outperforming the MSCI China Index benchmark return of -0.43%. The fund contains 54 positions as of quarter end, with 10 new holdings and a turnover ratio of 27%. The top three sectors in terms of weight are financial services, consumer cyclical and communication services, representing 26.74%, 21.93% and 15.75% of the equity portfolio.

Industrial And Commercial Bank of China

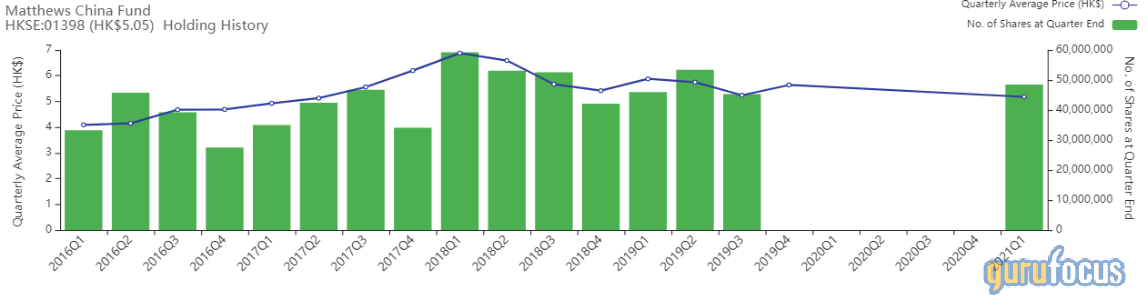

The fund purchased 48,503,000 shares of Industrial And Commercial Bank of China (HKSE:01398, Financial), giving the position 2.08% weight in the equity portfolio. Shares averaged 5.18 Hong Kong dollars (67 cents) during the first quarter; the stock is modestly undervalued based on Friday's price-to-GF Value ratio of 0.86.

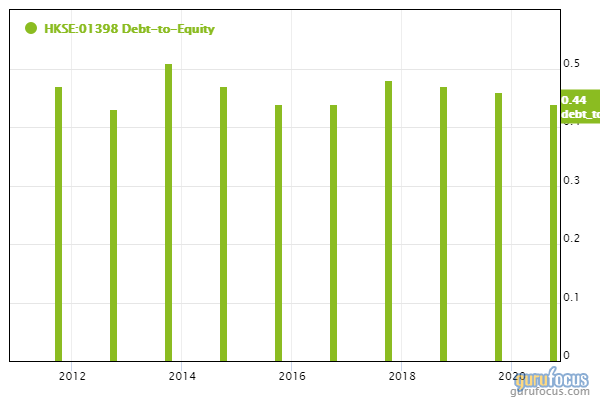

Headquartered in Beijing, ICBC operates a wide network of bank outlets that offer corporate banking, retail banking and wholesale banking. According to GuruFocus, ICBC's equity-to-asset and debt-to-equity ratios are close to the industry median ratios, suggesting fair financial strength.

According to the letter, the fund sees attractive valuations in financials, mentioning that the sector "has been an overlooked sector in China's equity markets despite maintaining a consistent pace of growth."

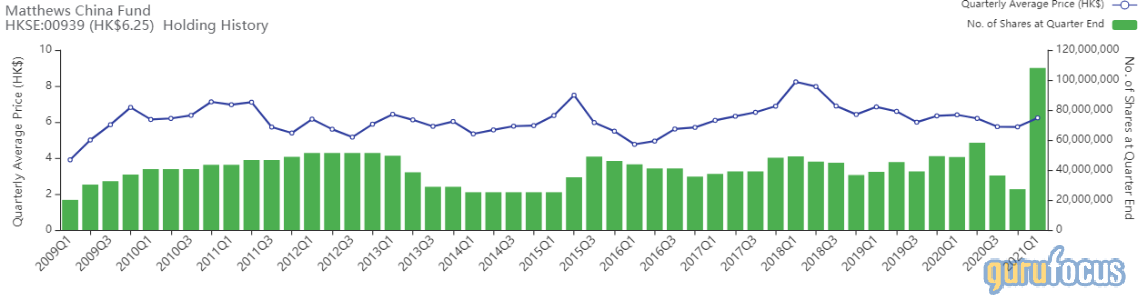

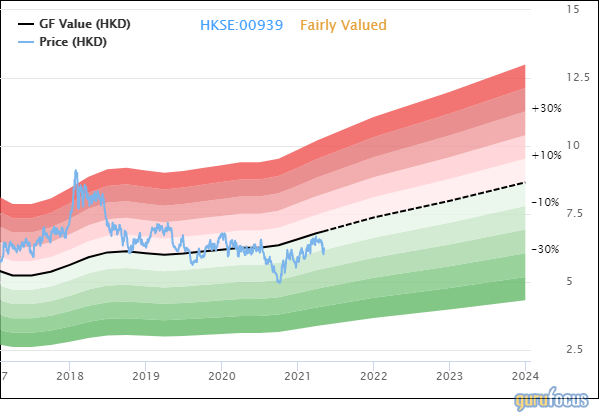

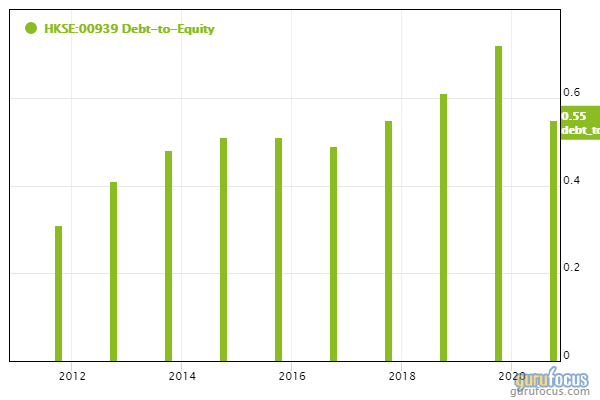

China Construction Bank

The fund purchased 80,885,000 shares of China Construction Bank (HKSE:00939, Financial), expanding the position 297.25% and the equity portfolio 4.07%. Shares averaged HK$6.23 during the first quarter; the stock is slightly undervalued based on Friday's price-to-GF Value ratio of 0.89.

According to GuruFocus, the Beijing-based bank's cash-to-debt ratio of 3 outperforms 61.57% of global competitors. Despite this, equity-to-asset ratios underperform more than 60% of global banks while debt-to-equity ratios underperform approximately half of global banks.

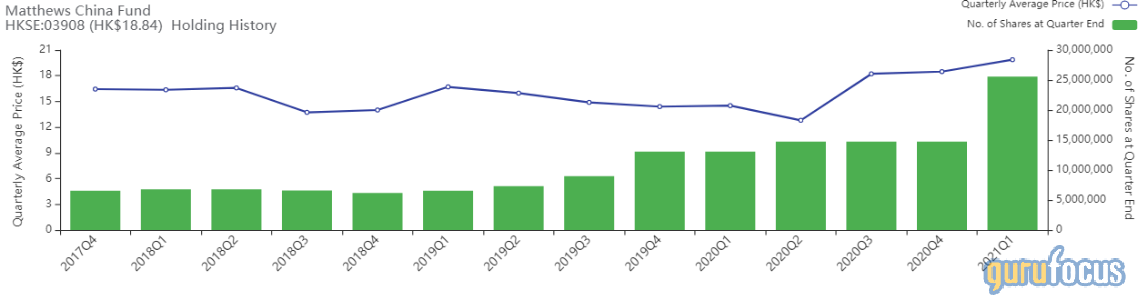

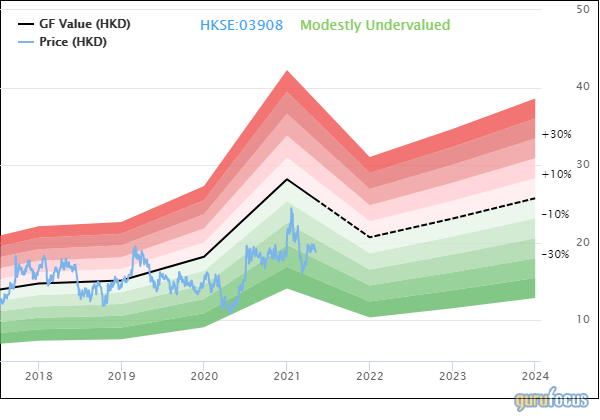

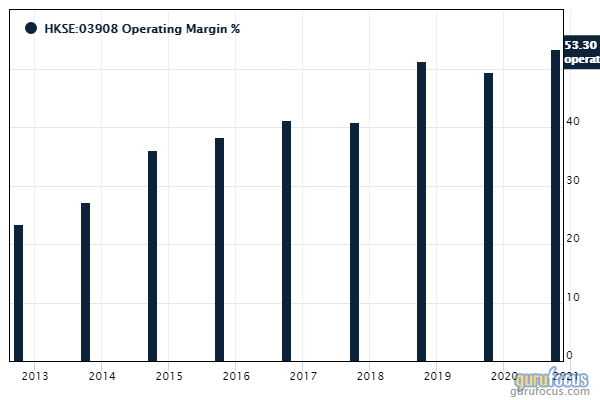

China International Capital

The fund purchased 10,800,800 shares of China International Capital (HKSE:03908, Financial), boosting the position 73.22% and the equity portfolio 1.57%. Shares averaged HK$19.87 during the first quarter; the stock is modestly undervalued based on Friday's price-to-GF Value ratio of 0.74.

GuruFocus ranks the capital market company's profitability 7 out of 10 on several positive investing signs, which include expanding operating margins and returns that outperform more than half of global competitors.

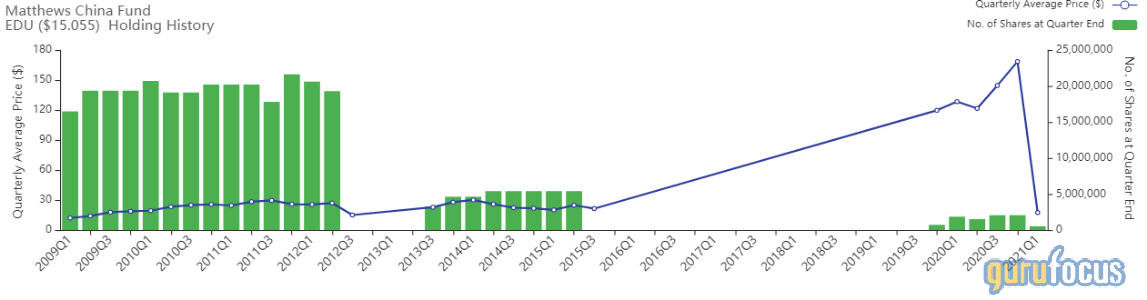

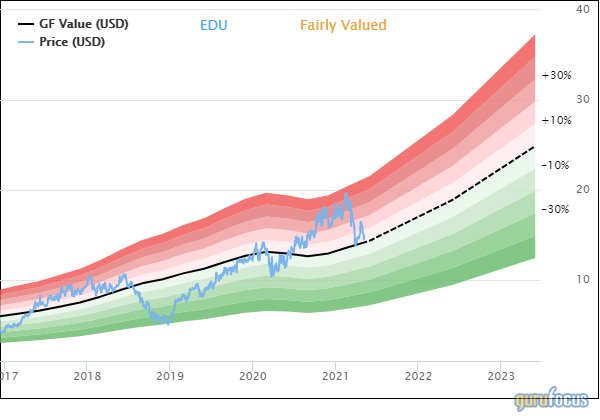

New Oriental Education & Technology

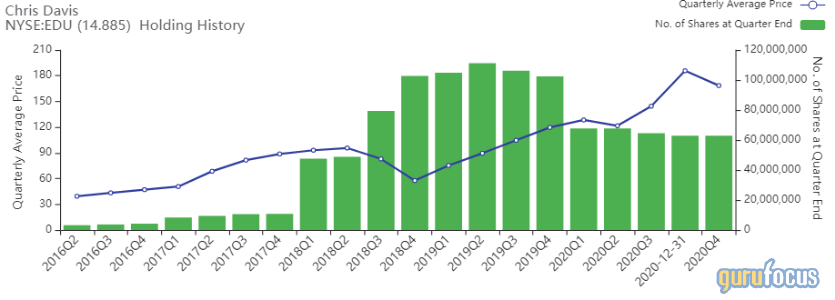

The fund sold 1,541,000 shares of New Oriental Education & Technology (EDU, Financial), slashing 74.77% of the holding and 1.91% of the equity portfolio. Shares averaged $17.50 during the first quarter; the stock is fairly valued based on Friday's price-to-GF Value ratio of 1.05.

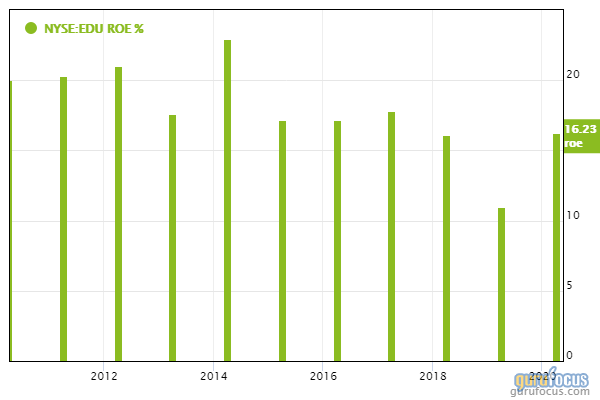

GuruFocus ranks the education company's profitability 9 out of 10 on several positive investing signs, which include a five-star business predictability rank and returns outperforming approximately 70% of global competitors.

Other gurus with holdings in New Orientation Education & Technology include Chris Davis (Trades, Portfolio)' Davis Select Advisors, Ken Fisher (Trades, Portfolio)'s Fisher Investments and Chase Coleman (Trades, Portfolio)'s Tiger Global Management.

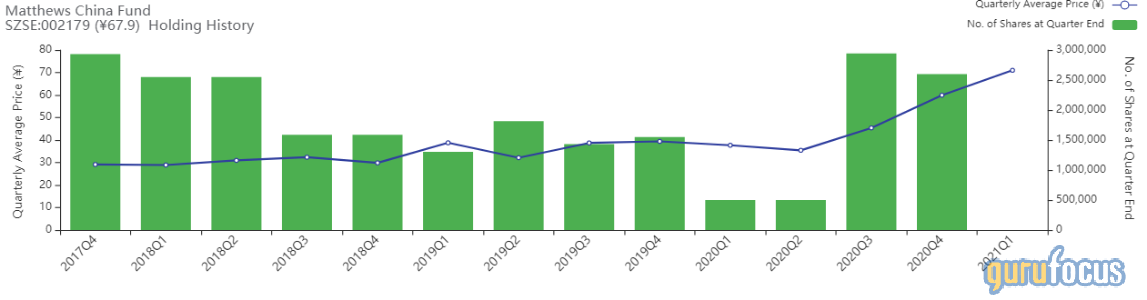

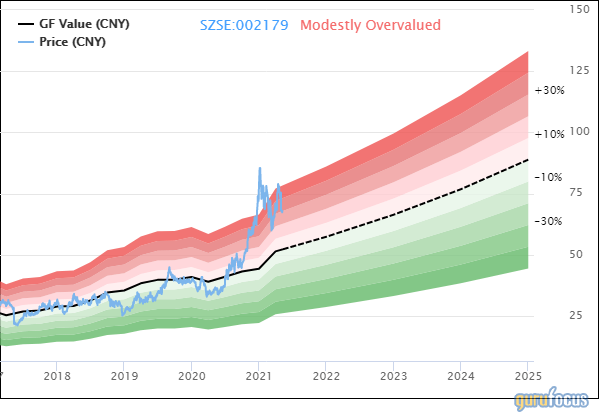

AVID Jonhon Optronic Technology

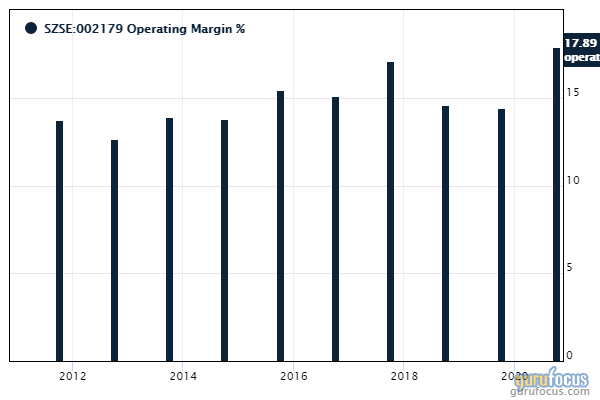

The fund sold 2,597,101 shares of AVID Jonhon Optronic Technology (SZSE:002179, Financial), trimming the equity portfolio 2.09%. Shares averaged 70.98 yuan ($11.03) during the first quarter; the stock is modestly overvalued based on Friday's price-to-GF Value ratio of 1.30.

GuruFocus ranks the Luoyang, Henan-based optical equipment company's profitability 9 out of 10 on several positive investing signs, which include a four-star business predictability rank, a high Piotroski F-score of 8 and an operating margin that has increased approximately 1.2% per year on average over the past five years and is outperforming more than 90% of global competitors.

Disclosure: No positions.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.