Owl Creek Asset Management, L.p. - Net Worth and Insider Trading

Owl Creek Asset Management, L.p. Net Worth

The estimated net worth of Owl Creek Asset Management, L.p. is at least $196 Million dollars as of 2024-05-21. Owl Creek Asset Management, L.p. is the 10% Owner of Anterix Inc and owns about 5,411,738 shares of Anterix Inc (ATEX) stock worth over $178 Million. Owl Creek Asset Management, L.p. is the 10% Owner of Kernel Group Holdings Inc and owns about 677,500 shares of Kernel Group Holdings Inc (KRNL) stock worth over $7 Million. Owl Creek Asset Management, L.p. is also the 10% Owner of 26 Capital Acquisition Corp and owns about 302,300 shares of 26 Capital Acquisition Corp (ADER) stock worth over $3 Million. Besides these, Owl Creek Asset Management, L.p. also holds Constellation Acquisition Corp I (CSTAF) , Mountain Crest Acquisition Corp III (MCAE) , OCA Acquisition Corp (OCAX) , Oxbridge Acquisition Corp (OXAC) , Perception Capital Corp II (PCCT) , Yellow Corp (YELLQ) , Kingswood Acquisition Corp (KWAC) , Leo Holdings Corp II (LHC) , Catcha Investment Corp (CHAA) , WinVest Acquisition Corp (WINV) , Kairous Acquisition Corp Ltd (KACL) . Details can be seen in Owl Creek Asset Management, L.p.'s Latest Holdings Summary section.

Disclaimer: The insider information is derived from SEC filings. The estimated net worth is based on the assumption that Owl Creek Asset Management, L.p. has not made any transactions after 2023-12-21 and currently still holds the listed stock(s).

Transaction Summary of Owl Creek Asset Management, L.p.

Owl Creek Asset Management, L.p. Insider Ownership Reports

Based on ownership reports from SEC filings, as the reporting owner, Owl Creek Asset Management, L.p. owns 42 companies in total, including Velodyne Lidar Inc (VLDR) , Anterix Inc (ATEX) , and Industrea Acquisition Corp (INDUU) among others .

Click here to see the complete history of Owl Creek Asset Management, L.p.’s form 4 insider trades.

Insider Ownership Summary of Owl Creek Asset Management, L.p.

| Ticker | Comapny | Transaction Date | Type of Owner |

|---|---|---|---|

| VLDR | Velodyne Lidar Inc | 2019-10-23 | 10 percent owner |

| ATEX | Anterix Inc | 2021-02-24 | 10 percent owner |

| INDUU | Industrea Acquisition Corp | 2019-01-14 | 10 percent owner |

| 2013-05-09 | 10 percent owner | ||

| 2018-12-20 | 10 percent owner | ||

| 2022-10-24 | 10 percent owner | ||

| 2022-11-29 | 10 percent owner | ||

| 2022-09-30 | 10 percent owner | ||

| 2022-12-02 | 10 percent owner | ||

| 2022-12-06 | 10 percent owner | ||

| 2023-02-02 | 10 percent owner | ||

| 2023-09-15 | 10 percent owner | ||

| 2022-12-05 | 10 percent owner | ||

| 2023-07-27 | 10 percent owner | ||

| 2023-08-18 | 10 percent owner | ||

| 2023-01-05 | 10 percent owner | ||

| 2022-12-12 | 10 percent owner | ||

| 2023-09-22 | 10 percent owner | ||

| 2022-12-22 | 10 percent owner | ||

| 2022-12-20 | 10 percent owner | ||

| 2023-09-15 | 10 percent owner | ||

| 2023-02-06 | 10 percent owner | ||

| 2023-10-06 | 10 percent owner | ||

| 2023-01-19 | 10 percent owner | ||

| 2023-01-13 | 10 percent owner | ||

| 2023-06-28 | 10 percent owner | ||

| 2023-02-01 | 10 percent owner | ||

| 2023-09-22 | 10 percent owner | ||

| 2023-02-06 | 10 percent owner | ||

| 2022-11-02 | 10 percent owner | ||

| 2023-02-17 | 10 percent owner | ||

| 2023-01-19 | 10 percent owner | ||

| 2023-08-17 | 10 percent owner | ||

| 2022-11-15 | 10 percent owner | ||

| 2023-01-20 | 10 percent owner | ||

| 2022-11-29 | 10 percent owner | ||

| 2023-05-23 | 10 percent owner | ||

| 2023-05-01 | 10 percent owner | ||

| 2022-11-14 | 10 percent owner | ||

| 2023-08-14 | 10 percent owner | ||

| 2023-04-27 | 10 percent owner | ||

| 2022-12-22 | 10 percent owner |

Owl Creek Asset Management, L.p. Latest Holdings Summary

Owl Creek Asset Management, L.p. currently owns a total of 14 stocks. Among these stocks, Owl Creek Asset Management, L.p. owns 5,411,738 shares of Anterix Inc (ATEX) as of February 24, 2021, with a value of $178 Million and a weighting of 90.6%. Owl Creek Asset Management, L.p. owns 677,500 shares of Kernel Group Holdings Inc (KRNL) as of June 28, 2023, with a value of $7 Million and a weighting of 3.8%. Owl Creek Asset Management, L.p. also owns 302,300 shares of 26 Capital Acquisition Corp (ADER) as of August 18, 2023, with a value of $3 Million and a weighting of 1.71%. The other 11 stocks Constellation Acquisition Corp I (CSTAF) , Mountain Crest Acquisition Corp III (MCAE) , OCA Acquisition Corp (OCAX) , Oxbridge Acquisition Corp (OXAC) , Perception Capital Corp II (PCCT) , Yellow Corp (YELLQ) , Kingswood Acquisition Corp (KWAC) , Leo Holdings Corp II (LHC) , Catcha Investment Corp (CHAA) , WinVest Acquisition Corp (WINV) , Kairous Acquisition Corp Ltd (KACL) have a combined weighting of 3.89% among all his current holdings.

Latest Holdings of Owl Creek Asset Management, L.p.

| Ticker | Comapny | Latest Transaction Date | Shares Owned | Current Price ($) | Current Value ($) |

|---|---|---|---|---|---|

| ATEX | Anterix Inc | 2021-02-24 | 5,411,738 | 32.80 | 177,505,006 |

| KRNL | Kernel Group Holdings Inc | 2023-06-28 | 677,500 | 11.00 | 7,452,500 |

| ADER | 26 Capital Acquisition Corp | 2023-08-18 | 302,300 | 11.08 | 3,349,484 |

| CSTAF | Constellation Acquisition Corp I | 2023-10-06 | 250,000 | 11.29 | 2,822,500 |

| MCAE | Mountain Crest Acquisition Corp III | 2023-02-02 | 522,165 | 4.97 | 2,595,160 |

| OCAX | OCA Acquisition Corp | 2023-12-21 | 104,691 | 10.96 | 1,147,413 |

| OXAC | Oxbridge Acquisition Corp | 2023-07-27 | 65,000 | 8.60 | 559,000 |

| PCCT | Perception Capital Corp II | 2023-08-17 | 79,323 | 6.26 | 496,562 |

| YELLQ | Yellow Corp | 2013-05-09 | 0 | 6.50 | 0 |

| KWAC | Kingswood Acquisition Corp | 2023-08-14 | 0 | 13.30 | 0 |

| LHC | Leo Holdings Corp II | 2023-09-15 | 0 | 11.87 | 0 |

| CHAA | Catcha Investment Corp | 2023-09-22 | 0 | 11.54 | 0 |

| WINV | WinVest Acquisition Corp | 2023-09-15 | 0 | 11.22 | 0 |

| KACL | Kairous Acquisition Corp Ltd | 2023-09-22 | 0 | 11.88 | 0 |

Holding Weightings of Owl Creek Asset Management, L.p.

Owl Creek Asset Management, L.p. Form 4 Trading Tracker

According to the SEC Form 4 filings, Owl Creek Asset Management, L.p. has made a total of 24 transactions in Anterix Inc (ATEX) over the past 5 years, including 24 buys and 0 sells. The most-recent trade in Anterix Inc is the acquisition of 9,606 shares on February 24, 2021, which cost Owl Creek Asset Management, L.p. around $407,967.

According to the SEC Form 4 filings, Owl Creek Asset Management, L.p. has made a total of 2 transactions in Kernel Group Holdings Inc (KRNL) over the past 5 years, including 0 buys and 2 sells. The most-recent trade in Kernel Group Holdings Inc is the sale of 85,000 shares on June 28, 2023, which brought Owl Creek Asset Management, L.p. around $891,650.

According to the SEC Form 4 filings, Owl Creek Asset Management, L.p. has made a total of 2 transactions in 26 Capital Acquisition Corp (ADER) over the past 5 years, including 0 buys and 2 sells. The most-recent trade in 26 Capital Acquisition Corp is the sale of 152,060 shares on August 18, 2023, which brought Owl Creek Asset Management, L.p. around $2 Million.

More details on Owl Creek Asset Management, L.p.'s insider transactions can be found in the Insider Trading History of Owl Creek Asset Management, L.p. table.Insider Trading History of Owl Creek Asset Management, L.p.

- 1

Owl Creek Asset Management, L.p. Trading Performance

GuruFocus tracks the stock performance after each of Owl Creek Asset Management, L.p.'s buying transactions within different timeframes. To be detailed, the average return of stocks after 3 months bought by Owl Creek Asset Management, L.p. is 9.62%. GuruFocus also compares Owl Creek Asset Management, L.p.'s trading performance to market benchmark return within the same time period. The performance of stocks bought by Owl Creek Asset Management, L.p. within 3 months outperforms 30 times out of 54 transactions in total compared to the return of S&P 500 within the same period.

You can select different timeframes to see how Owl Creek Asset Management, L.p.'s insider trading performs compared to the benchmark.

Performance of Owl Creek Asset Management, L.p.

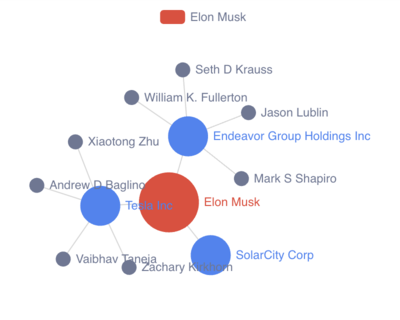

Owl Creek Asset Management, L.p. Ownership Network

Owl Creek Asset Management, L.p. Owned Company Details

What does Velodyne Lidar Inc do?

Who are the key executives at Velodyne Lidar Inc?

Owl Creek Asset Management, L.p. is the 10 percent owner of Velodyne Lidar Inc. Other key executives at Velodyne Lidar Inc include Vice President of Sales & NA Laura Tarman , director & Chief Executive Officer Tewksbury Ted L Iii , and Chief People Officer Kathryn Mcbeath .

Velodyne Lidar Inc (VLDR) Insider Trades Summary

Over the past 18 months, Owl Creek Asset Management, L.p. made no insider transaction in Velodyne Lidar Inc (VLDR). Other recent insider transactions involving Velodyne Lidar Inc (VLDR) include a net sale of 25,448 shares made by Mathew Rekow , a net sale of 4,795 shares made by Kathryn Mcbeath , and a net sale of 3,433 shares made by Laura Tarman .

In summary, during the past 3 months, insiders sold 0 shares of Velodyne Lidar Inc (VLDR) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 210,613 shares of Velodyne Lidar Inc (VLDR) were sold and 30,000 shares were bought by its insiders, resulting in a net sale of 180,613 shares.

Velodyne Lidar Inc (VLDR)'s detailed insider trading history can be found in Insider Trading Tracker table.

Velodyne Lidar Inc Insider Transactions

Owl Creek Asset Management, L.p. Mailing Address

Above is the net worth, insider trading, and ownership report for Owl Creek Asset Management, L.p.. You might contact Owl Creek Asset Management, L.p. via mailing address: 640 Fifth Avenue, 20th Floor, New York Ny 10019.