In this high-inflation, rising rate environment, dividend stocks may seem like a safe haven to protect your money, since you know you will at least be getting some sort of return. They may also sport higher-than-usual yields due to recent price declines.

However, not all dividends are created equal, and at a time when we are at risk of a worsening macroeconomic situation, a solid-looking dividend could easily turn into a dud.

So how do we go about finding which yields are safe and avoiding dividend traps? Some may claim there are specific ratios you need to keep an eye on, but just like anything in investing, leaning too much on shortcuts is dangerous.

Instead, I would argue there are five main qualities investors need to look for when assessing dividend stocks: fundamentals, payout ratios, history, management and comparison with industry peers.

Fundamentals

One of the most important things to pay attention to with any stock is the company’s fundamentals, and that’s especially true for dividend stocks since these names often don’t have super-high growth numbers to buoy investor sentiment and provide capital gains.

Is the company profitable? Does it have a solid balance sheet? Even if it is not growing quickly, are profits at least stable with decent margins?

No matter how high a company’s dividend yield is, if its business is in permanent decline, then it may be better to look for other options. For example, tobacco company Altria Group (MO, Financial) has a 6.56% dividend yield as of this writing, but it also has a three-year Ebitda per share growth rate of -19.4%, which does not bode well for future yields or the share price.

Regarding the balance sheet strength, investors should not limit themselves to just looking at whether the company has the cash to continue paying its dividend. Even if is payout ratio looks safe, that could change quickly if the company is in financial distress or, for example, makes an acquisition that it cannot handle. The GuruFocus All-in-One Screener identified 608 stocks with safe-looking payout ratios that nevertheless have distressed Altman Z-Scores, indicating the potential for bankruptcy within the next two years.

Payout ratios

While payout ratios may not be the sole indicator of dividend strength, they are still crucial to assess when trying to determine whether or not a company’s dividend is safe.

In general, a payout ratio in the range of 30% to 50% is considered healthy and sustainable. Lower than that could indicate the company is not very concerned about returning cash to shareholders, and higher than that could indicate a dividend decrease might be in the cards due to unsustainability.

There are certain types of companies that are exceptions, however. Real estate investment trusts, for example, are required to pay out 90% of taxable income to investors each year. Highly cyclical stocks, such as those operating in the shipping industry, may see their payout ratios shrink dramatically in an upswing, which is more indicative of being at the top of the cycle than anything regarding the dividend.

If the payout ratio rises substantially above 50% for more than a short period (or 90% for REITs), the dividend may be in danger of being cut or stalled in order to preserve cash for normal business operations and growth efforts.

One recent example of this is AT&T Inc. (T, Financial). With the difficult economic situation, capital-intensive business and high debt weighing on its operations and driving the payout ratio upwards of 0.65 over the past year, peaking at 2.48 for the June 2021 quarter, the telecommunications operator recently slashed its dividend, dropping the yield from 8.64% to 5.23%.

History

Both individual business and the stock market have their ups and downs. Many companies will have an unsustainable dividend at some point, but that does not necessarily mean they will reduce or eliminate the dividend, especially if the issues are just short term. In some cases, the payout ratio can even be artificially high due to non-cash items such as equity investment declines or goodwill impairments.

For hints as to how well a dividend will hold up in difficult times, we can analyze the company’s dividend payment history. Has it been increasing its dividends over the years? How did the dividend fare when an economic recession hit, or when the company when through a difficult time? At what payout ratios and growth rates has the company historically been able to pay and raise its dividend?

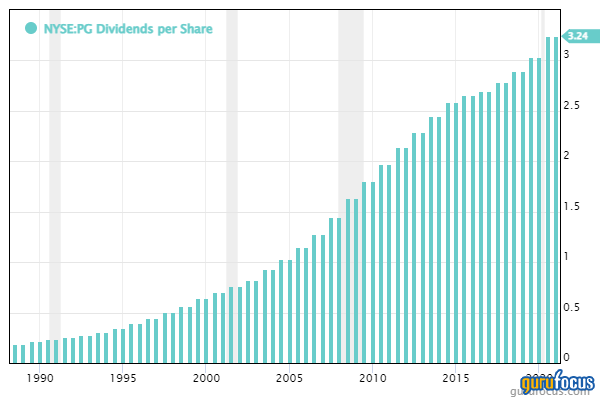

From a historical standpoint, certain types of companies tend to have more consistent dividend histories than others. Some of the most consistent dividend payers are consumer goods companies such as Procter & Gamble (PG, Financial), since they sell products that consumers do not typically cut their spending in even in difficult economic conditions.

Historic volatility is also worth considering; irregular price or earnings history can definitely impact dividends. Be on the lookout for earnings multiples that have risen considerably compared to history to see if fundamentals are deteriorating.

Management

Something that is all too often overlooked when assessing a company’s dividend is the attitude of the top management. Have figures such as the CEO or chief financial officer ever issued any statements about the dividend? Do they discuss the dividend in-depth when earnings season rolls around, or do they mostly remain silent on it?

Management will not always be in support of raising the dividend, even if the company has plenty of room to do so. Sometimes, this is because management believes the cash could be better spent on growth, but other times, it is so that they can do more share buybacks.

Whether dividends, buybacks or investments in growth are the best use of a company’s extra cash depends on its unique situation, but if management has a negative attitude towards dividends, then investors may not want to consider that stock as a dividend stock.

Comparison

In addition to its own history, another essential reference point in evaluating a stock’s dividend is how it compares to peers in the same industry. How do things like the yield, payout ratio, dividend growth, etc. stack up against similar companies?

For example, you might notice that a stock has a high payout ratio, only to see that it is lower than half of its industry peers, indicating that it might still be sustainable in the long term.

A stock with a much higher yield than others in its industry might be a red flag. If something seems too good be true, then that indeed might be the case. One example of this is Top Glove (TPGVF, Financial). The company continued hiking its dividend in a futile attempt to attract investors even as profits normalized in 2021 after a sharp increase due to the Covid-19 pandemic. Though the long-term outlook for the company remains the same, the trailing 12-month dividend yield of 12.18% is not likely to continue.

When the energy sector got slammed in 2020, the stocks of many oil and gas companies briefly saw their dividend yields artificially inflated into the double digits before their dividend cuts could take effect. This was a sector-wide issue. A few giants such as Exxon Mobil (XOM, Financial) managed to maintain their dividends, but the market quickly caught on to this and bought accordingly.