As investors look ahead to Memorial Day weekend, five travel and leisure stocks with high guru ownership as of the first quarter are Booking Holdings Inc. (BKNG, Financial), Las Vegas Sands Corp. (LVS, Financial), Expedia Group Inc. (EXPE, Financial), Trip.com Group Ltd. (TCOM, Financial) and Hilton Worldwide Holdings Inc. (HLT, Financial) according to the Aggregated Portfolio of Gurus, a Premium feature of GuruFocus.

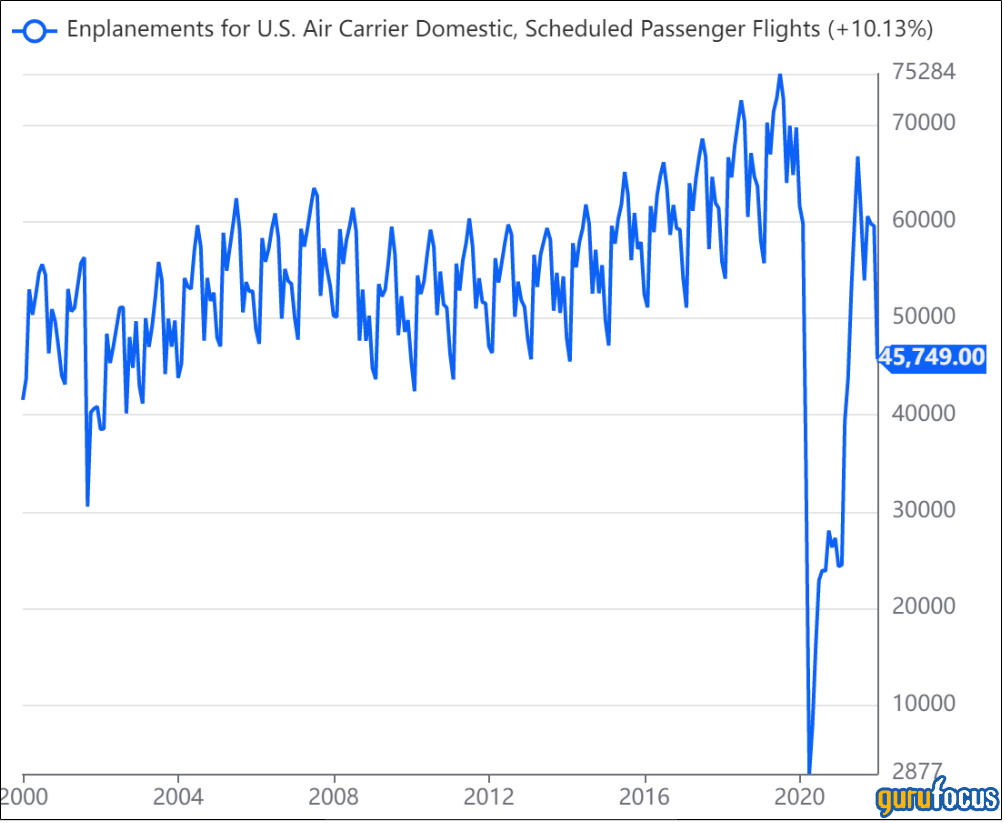

AAA Travel, a privately-held national member organization, said earlier this month that it predicts 39.2 million people will travel 50 miles or more from home during the Memorial Day weekend, up approximately 8.3% from the previous year and in line with the number of travelers during 2017. Air travel has also rebounded, up 25% from the previous year.

In light of the unofficial start of summer travel, GuruFocus’ Aggregated Portfolio listed several travel and leisure stocks with at least 11 gurus owning shares based on first-quarter 13F equity portfolio filings. Investors should be aware that 13F filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

Booking Holdings

Twenty-four gurus own shares of Booking Holdings (BKNG, Financial) with a combined weight of 29.47%.

Shares of Booking traded around $2,244.79, showing the stock is fairly valued based on Friday’s price-to-GF Value ratio of 0.93.

The Norwalk, Connecticut-based online reservation giant has a GF Score of 79 out of 100: Even though the company’s growth ranks just 3 out of 10, Booking has a rank of 8 out of 10 for profitability and momentum and a rank between 6 and 7 for financial strength and GF Value.

Gurus with holdings in Booking include Dodge & Cox and Baillie Gifford (Trades, Portfolio).

Las Vegas Sands

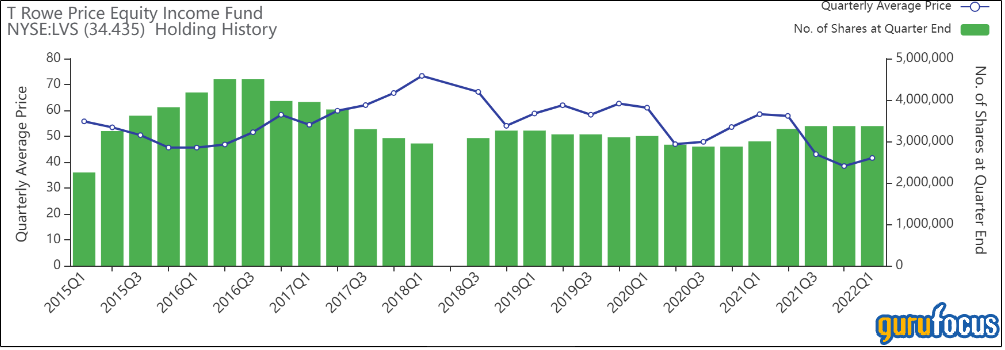

Fourteen gurus own shares of Las Vegas Sands (LVS, Financial) with a combined weight of 7.79%.

Shares of Las Vegas Sands traded around $34.45, showing the stock is fairly valued based on Friday’s price-to-GF Value ratio of approximately 1.

In February, Las Vegas Sands sold its Venetian and Palazzo properties on the Strip, moving its primary focus to its Asian properties. The company has a GF Score of 68 out of 100 based on a profitability rank of 7 out of 10, a GF Value rank of 6 out of 10, a momentum rank of 5 out of 10, a financial strength rank of 4 out of 10 and a growth rank of 1 out of 10.

Gurus with holdings in Las Vegas Sands include the T Rowe Price Equity Income Fund (Trades, Portfolio) and Sarah Ketterer (Trades, Portfolio)’s Causeway Capital Management.

Expedia

Twelve gurus own shares in Expedia (EXPE, Financial) with a combined weight of 2.06%.

Shares of Expedia traded around $130.59, showing the stock is fairly valued based on Friday’s price-to-GF Value ratio of 1.02.

The Seattle-based travel giant has a GF Score of 70 out of 100: Although the company has a momentum rank of 10 out of 10 and a rank of 6 out of 10 for profitability and GF Value, Expedia has a financial strength rank of 4 out of 10 and a growth rank of just 2 out of 10.

Trip.com Group

Twelve gurus own shares of Trip.com Group (TCOM, Financial) with a combined weight of 2.30%.

Shares of Trip.com Group traded around $21.42, showing the stock is modestly undervalued based on Friday’s price-to-GF Value ratio of 0.88.

The Shanghai-based travel company has a GF Score of 62 out of 100: While the company has a GF Value rank of 7 out of 10, Trip.com has a rank of 5 out of 10 for financial strength and profitability and a rank of just 2 out of 10 for growth and momentum.

Hilton

Eleven gurus own shares of Hilton (HLT, Financial) with a combined weight of 18.98%.

Shares of Hilton traded around $142.11, showing the stock is significantly overvalued based on Friday’s price-to-GF Value ratio of 1.49.

The McLean, Virginia-based hotel company has a GF Score of 63 out of 100: Although the company has a profitability rank of 7 out of 10 and a momentum rank of 6 out of 10, Hilton has a growth rank of just 1 out of 10 and a rank of 3 out of 10 for financial strength and GF Value.