GuruFocus had the pleasure of hosting a presentation with Ian Lapey, portfolio manager of the Gabelli Global Financial Services Fund and co-portfolio manager of the Gabelli ESG Fund.

Lapey joined GAMCO in 2018 and is the portfolio manager of the Gabelli Global Financial Services Fund and co-portfolio manager of the Gabelli ESG Fund. Prior to joining the firm, he was a research analyst and partner at Moerus Capital Management LLC and before that was a partner, research analyst and portfolio manager at Third Avenue Management (Trades, Portfolio), where in 2009 he was appointed co-manager of the flagship Third Avenue Value Fund (Trades, Portfolio) alongside legendary value investor Marty Whitman. Lapey was subsequently named sole portfolio manager of that fund in 2012.

Previously he held equity research analyst positions at Credit Suisse First Boston and Salomon Brothers. He began his career as a staff accountant for Ernst & Young as a CPA (inactive).

Lapey holds a BA economics from Williams College, an MBA in finance and statistics from the Stern School of Business at New York University and an MS in accounting from Northeastern University.

Watch the full stream here:

Key takeaways

Lapey kicked off his presentation with an overview of GAMCO and its strategy, as well as shared a bit about his own career, which has been influenced by Mario Gabelli (Trades, Portfolio) as well as Third Avenue Management (Trades, Portfolio)’s founder, the late Marty Whitman.

He emphasized that the firm uses a bottom-up, fundamental analysis approach to identify attractive businesses with mispriced valuations. The fund’s analysis mostly focuses on the balance sheet and seeks to minimize investment risk.

Lapey then transitioned to discuss some of the portfolio’s financial holdings.

Stocks

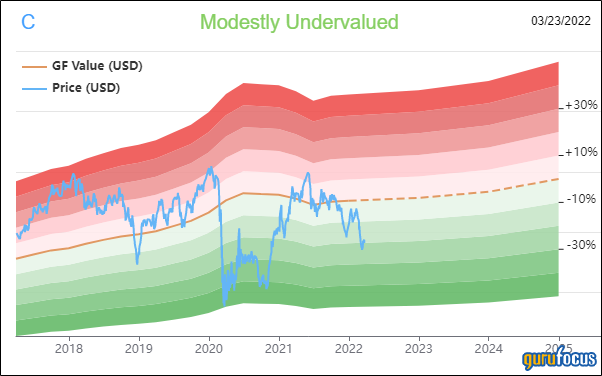

Some of the U.S. stocks Lapey highlighted within the context of the balance sheet strength, valuations and catalysts were Citigroup Inc. (C, Financial) and Capital One Financial Corp. (COF, Financial).

Capital One, he noted, showed resiliency during the Covid-19 pandemic, which hit within a year and a half of the fund being launched.

Questions

A lot of questions Lapey answered were related to his strategy. In particular, several people asked about the differences between Whitman and Gabelli’s investment philosophies and how they have influenced him. He responded that Whitman’s Third Avenue is more focused on net asset value, while GAMCO looks at private market value, which he noted is often based on a multiple of Ebitda, with a catalyst.

Lapey also noted that both are long-term value focused as opposed to the near term.

As the portfolio has several European and Asian holdings, another audience member asked if he had any exposure to Chinese stocks in particular. He responded that he has indirect exposure to China through investments in Dah Sing Banking (HKSE:02356, Financial) and Dah Sing Financial (HKSE:00440, Financial).