Norwegian Cruise Line Holdings Ltd (NCLH, Financial) has experienced a notable fluctuation in its stock price recently. With a current market capitalization of $7.66 billion and a stock price of $18, the company has seen a 2.03% decline over the past week. However, looking at a broader timeframe, NCLH has achieved a 10.86% gain over the past three months. Despite these gains, the GF Value, which stands at $58.88, suggests that the stock might be a possible value trap, a sentiment echoed in the past GF Value of $62.21. This valuation calls for investors to think twice before making an investment decision, as the current and past GF Valuations both indicate a possible value trap.

Exploring Norwegian Cruise Line Holdings Ltd

Norwegian Cruise Line Holdings Ltd, a prominent player in the Travel & Leisure industry, operates as the world's third-largest cruise company. With a fleet of 31 ships across three brands—Norwegian, Oceania, and Regent Seven Seas—the company offers a variety of cruising experiences from freestyle to luxury. As of May 2022, Norwegian had successfully redeployed its entire fleet and is now sailing to approximately 700 global destinations. With plans to expand its capacity through the addition of six passenger vessels by 2028, Norwegian Cruise Line is set to grow its berth count by 16,500, outpacing its industry peers in capacity growth.

Assessing Profitability

When it comes to profitability, Norwegian Cruise Line Holdings Ltd holds a Profitability Rank of 6/10 as of September 30, 2023. The company's operating margin is 6.50%, which is more competitive than 47.34% of 826 companies in the same industry. However, the ROE stands at a concerning -127.51%, albeit better than 3.02% of 796 companies. The ROA is also in negative territory at -1.12%, but still outperforms 29.23% of 845 companies. The ROIC of 2.50% is better than 47.14% of 840 companies. Over the past decade, Norwegian Cruise Line has managed to be profitable for 7 years, which is better than 61.39% of 777 companies in the industry.

Growth Prospects and Challenges

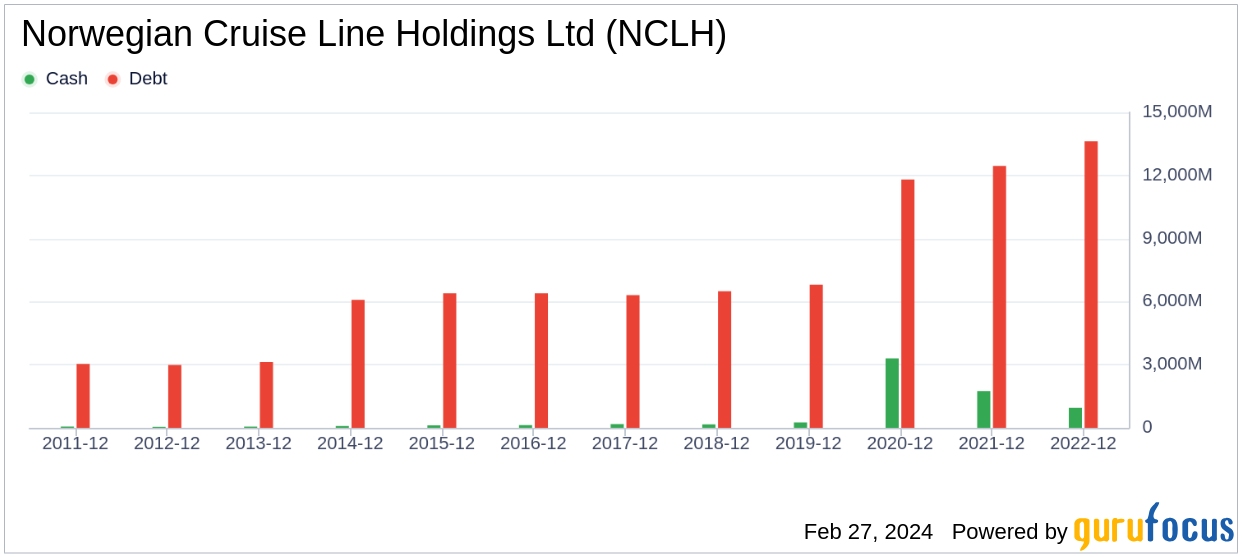

The Growth Rank for Norwegian Cruise Line is currently at 2/10. The company has faced significant challenges, with a 3-Year Revenue Growth Rate per Share of -27.20%, which is still better than 11.98% of 768 companies. The 5-Year Revenue Growth Rate per Share is even more concerning at -32.00%, yet this performance is better than 7.79% of 719 companies. These figures reflect the substantial impact that external factors, such as the global pandemic, have had on the travel and leisure industry, particularly the cruise sector.

Notable Shareholders

Among the notable holders of Norwegian Cruise Line stock, John Rogers (Trades, Portfolio) leads with 6,271,115 shares, representing 1.47% of the company. PRIMECAP Management (Trades, Portfolio) follows with 2,281,670 shares, accounting for 0.54%, and Paul Tudor Jones (Trades, Portfolio) holds 637,852 shares, or 0.15% of the company. These significant investments by well-known investors indicate a level of confidence in the company's potential for recovery and growth.

Competitive Landscape

In comparison to its competitors, Norwegian Cruise Line Holdings Ltd stands out with a market cap of $7.66 billion. Its closest competitors include MakeMyTrip Ltd (MMYT, Financial) with a market cap of $6.35 billion, Travel+Leisure Co (TNL, Financial) at $3.2 billion, and TripAdvisor Inc (TRIP, Financial) with a market cap of $3.74 billion. These companies represent the diverse and competitive nature of the travel and leisure industry, each with its own unique challenges and growth strategies.

Conclusion

In conclusion, Norwegian Cruise Line Holdings Ltd's stock performance has been a mixed bag, with recent losses overshadowed by gains over the past three months. The company's profitability metrics, while mixed, show resilience in a challenging industry. Growth remains a concern, with negative revenue growth rates over the past few years. However, the presence of significant shareholders and the company's competitive position in the travel and leisure industry suggest that there may be potential for recovery and growth in the long term. Investors should carefully consider the possible value trap indicated by the GF Value before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.