Glencore PLC (LSE:GLEN, Financial) held its annual investor update on Dec. 2 following the recent news that activist investor Bluebell Capital has sent management a letter to spin off its thermal coal division. Bluebell Capital is a small fund, but it still managed to push out respected Danone (XPAR:BN, Financial) CEO Emmanuel Faber earlier this year.

Calls for Glencore to divest thermal coal are nothing new. In fact, it is the last major mining company with thermal coal in its portfolio. Today’s investor presentation included a lot of detail on the miner’s progress on its Climate Action Transition Plan.

Glencore is often criticized by ESG-focused investors for its thermal coal portfolio. BHP Group (LSE:BHP, Financial) (BHP, Financial), Rio Tinto (LSE: RIO) (RIO, Financial) and, more recently, Anglo American (LSE:AAL, Financial) have all divested from thermal coal. BHP is in the process of spinning out its petroleum business, which means Glencore will be the only mining major with exposure to fossil fuels.

However, this basic criticism is unfair. Glencore is the only major miner committed to reducing scope 1, 2 and 3 emissions to net zero by 2050. Its plan is Paris aligned to 1.5c.

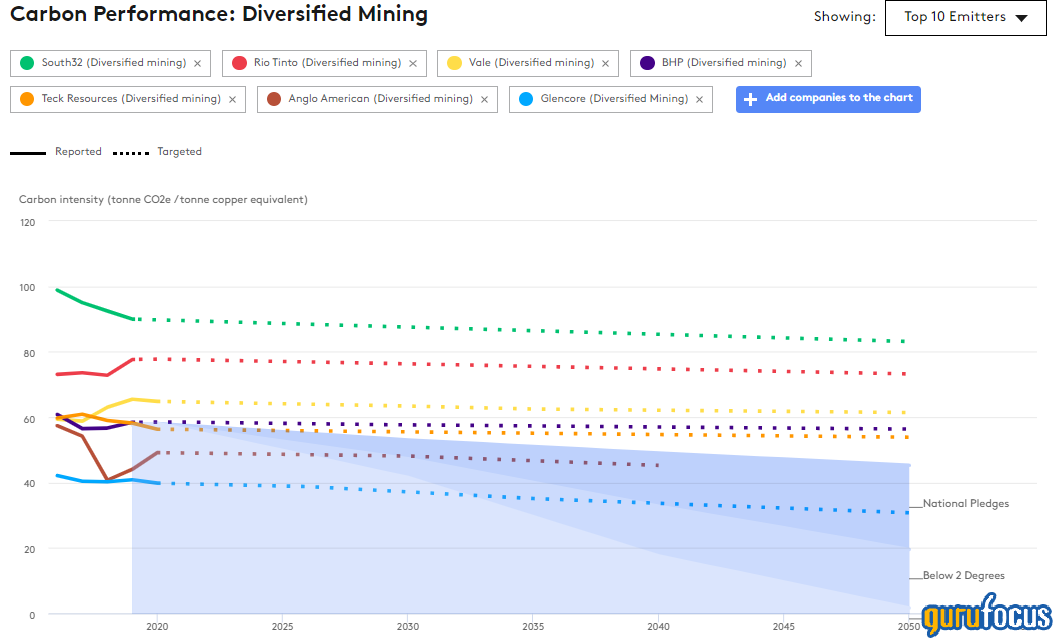

Indeed, using an interesting tool from the Transition Pathway Initiative, which is a global, asset-owner led initiative which assesses companies' preparedness for the transition to a low carbon economy and is rapidly becoming the go-to corporate climate action benchmark, we see that Glencore is actually the best positioned of the major miners. It has the lowest carbon intensity now, and the lowest carbon intensity projected for 2050 at current targets.

When pressed on the topic of a coal spin off, CEO Gary Nagle said management would listen to shareholders. Currently, management is committed to its strategy, which includes running down coal, and that 94% of shareholders backed this strategy at the last annual general meeting.

In addition to coal, Glencore is focused on four metals it calls green metals: copper, cobalt, nickel and zinc as they are heavily needed in the push for decarbonization in the energy transition. In the presentation, Glencore noted its product growth pipeline is prioritizing the transition metals of copper, nickel and zinc.

Glencore’s shares are up over 50% this year, comfortably outperforming iron ore specialists Rio Tinto and BHP. That is mostly thanks to soaring prices of its two main commodities – copper and coal.

In addition to its mining operations, Glencore is a famously well-run commodities trader. By trader, I mean arbitrageur or supply chain manager, and not speculator. At Glencore this business is called marketing, and its earnings are much less correlated to commodity prices. Some people are put off by the company’s higher-than-average debt, but you have to remember that its inventory is very liquid: stores of commodities which Glencore has the infrastructure and ability to offload quickly at fair value. Indeed, Glencore is famous for carefully managing its mining production to take advantage of trends in supply and demand for its various commodities.

This trading attitude – where BHP and Rio are more known to have an engineering culture – were seen clearly in the presentation. Glencore is a huge operation, with more than 150 operating sites within its 75 assets. Management is constantly optimizing the portfolio. It’s latest detailed portfolio review to identify the longer-life, lower-cost assets and sites that enable the group to produce, recycle and market the materials needed for the energy transition has resulted in seven disposals, 10 sale processes and a further 15 assets under assessment for future long-term fit and alignment with the group’s strategy. When pressed on what those assets might be, management declined to specify exactly, but noted the assets the company is shedding didn’t fit for a variety of reasons, including a disproportionate amount of management’s time required, ESG risks and lower returns on capital.

Meanwhile, its marketing division is growing, having come in at the top end of guidance for the last two years. Like at BP (LSE:BP., Financial) (BP, Financial), carbon offsetting is a strongly growing business within Glencore’s customer businesses where customers require carbon-free products, which it can structure and risk manage.

Another interesting point from the presentation was the notion of green premiums. Some carbon-intensive commodities, such as aluminium and to some extent copper, are being bifurcated, where production with a lower carbon footprint trades at a premium to carbon-heavy production. For Glencore’s large copper production in the Democratic Republic of Congo, it’s on the greener side as the energy needed is coming from hydropower.

Financials

Glencore’s stock falls into the value bucket according to Morningstar. Although its dividend yield is only about 2.4%, the company makes heavy use of share buybacks and has a clear capital returns policy. Net debt has been reduced also, giving the company more ability to make returns to shareholders.

The company seems to be a bit misunderstood, or perhaps it’s just too early in the climate transition for more sophisticated analysis to be done. If Glencore, under the watch of public markets, is closing coal mines responsibly, surely that’s better than coal going to non-public market miners would likely produce more coal from those same assets and operate them less responsibly. Glencore intends to leave coal reserves and resources in the ground in 2050. In the short term, the fossil fuel divestment argument has been causing supply-side problems, pushing up coal and oil prices, and Glencore has been the beneficiary of this. This extra cash enables it to invest more in future-facing commodities and realize full value for its coal. Some investors argued that Rio, BHP and Anglo, as “forced” sellers, sold their coal at below fair value because they prioritized actions that were in fashion.

Glencore seems to be prioritizing making money.

Guru David Herro (Trades, Portfolio) is a large and long-term holder of Glencore's stock. GuruFocus' insider ownership tool shows Glencore has relatively high ownership among its insiders at 9.7%.